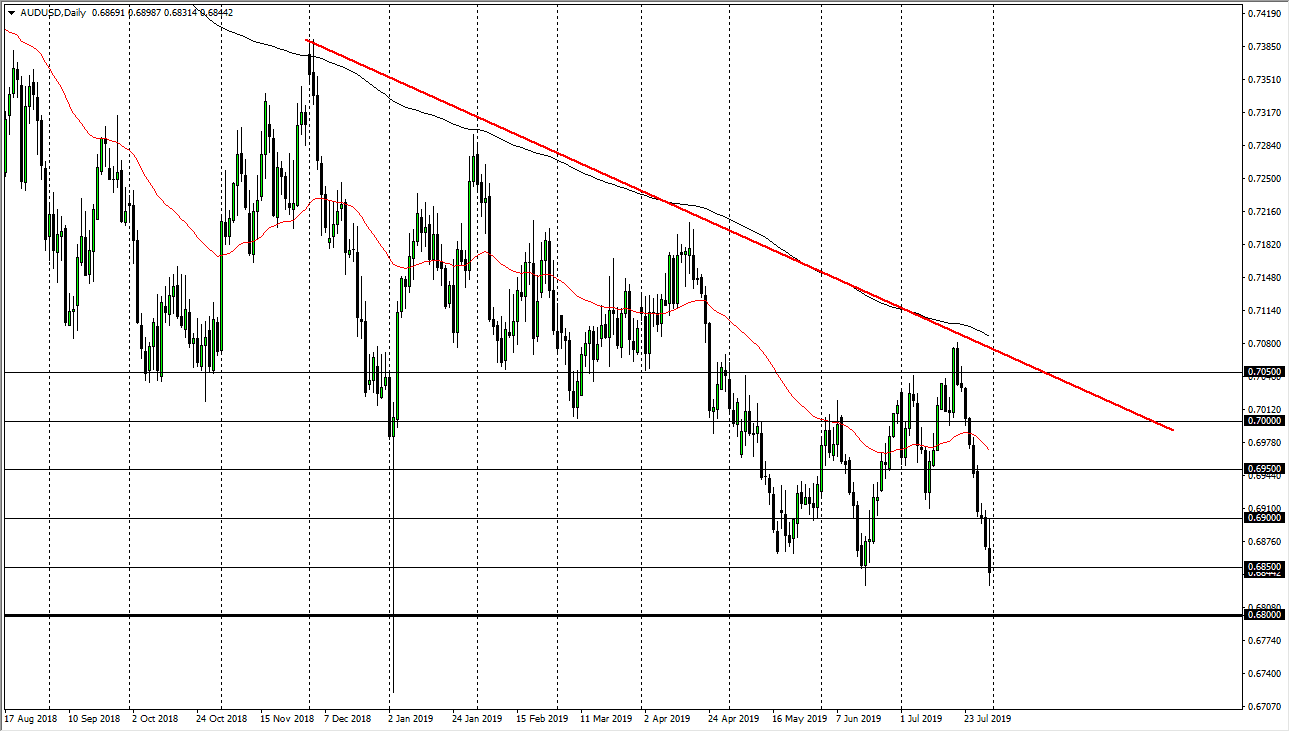

The Australian dollar initially tried to rally during the trading session against the US dollar, but the Federal Reserve wasn’t quite dovish enough to pick up currencies against the greenback. Because of this, the Australian dollar got hammered, as we are trying to reach down towards the 0.6800 level underneath. That is an area that is massive support, so if we were to break through there it would of course be a very negative turn of events for the Aussie.

At that point, I believe that the Australian dollar will probably go down to the 0.65 handle, an area that should attract a lot of attention due to the large, round, psychological significance of the number. That being said, we sought to get through the 0.6800 level, which is going to take a certain amount of momentum. We are oversold at just about any metric you measure this by, so I would not be surprised to see a bit of a bounce from here. We are essentially stuck at this point, because we have fallen too far to start shorting here and start “chasing the trade”, but at the same time there is absolutely nothing on this chart that tells me we should start buying at this point.

With that in mind I am going to stand on the sidelines and wait for some type of supportive weekly candle, or perhaps a breakthrough of major support underneath. I am a bit surprised that the Australian dollar has gotten hammered the way it has, but I think we are starting to see concerns about the housing market in Australia again, so it’s possible that we are starting to look at this market as a scenario where we need to find some type of longer-term signal to start following. We are most certainly at a major crossroads when it comes to the Australian dollar, and the failed breakout from a couple of weeks ago is a very negative sign indeed. All things being equal, this is a market that we need to wait a couple of days in order to get a signal that we can put some money towards. I’m a bit surprised that the Federal Reserve didn’t go all out on the dovish attitude, but they almost certainly will eventually. All things being equal, I’m on the sidelines but recognize that the 0.6800 level will be crucial.