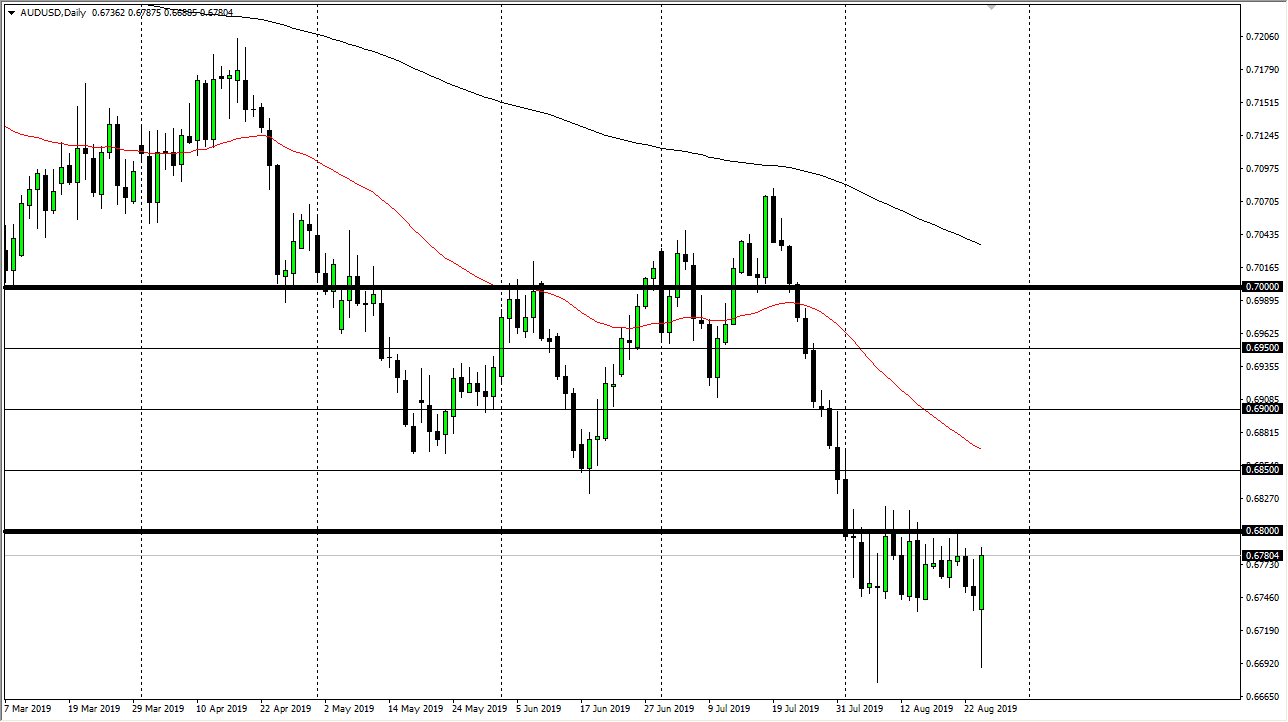

The Australian dollar initially fell hard during the trading session on Monday, as traders finally had an opportunity to react to the tariffs added by Donald Trump late on Friday. That being the case, there was a huge “risk off” move that faded away towards the Japanese yen. At this point, the market continues to see a lot of resistance just above, near the 0.68 level.

I believe that area offers a lot of resistance all the way up to the 0.6833 level, which is a “zone” of major selling. I think over the next 24 hours, we should get an opportunity to fade this market on short-term charts that show signs of exhaustion. After all, the Australian dollar is a proxy for the Chinese economy, and as the US/China situation continues to get worse, that should continue to work against the Aussie itself. The US dollar is getting a bit of a boost due to the fact that bonds have been in huge demand.

I don’t think it’s very likely that this market will be able to rally significantly from here, at least not until we get some type of agreement between the Americans and the Chinese, and as a result even if we do break out I think that the 50 day EMA, pictured in red on the chart, should continue to offer resistance as well. All things being equal though, I think we are ready to go much lower, perhaps down to the 0.65 handle based upon the longer-term charts. Obviously, if the situation gets better between the Americans and Chinese, we could see a massive move to the upside, and perhaps an explosive move at that, as it would probably be the beginning of the trend change. All things being equal though, I think we are simply looking for an opportunity to pick up the US dollar “on the cheap.”