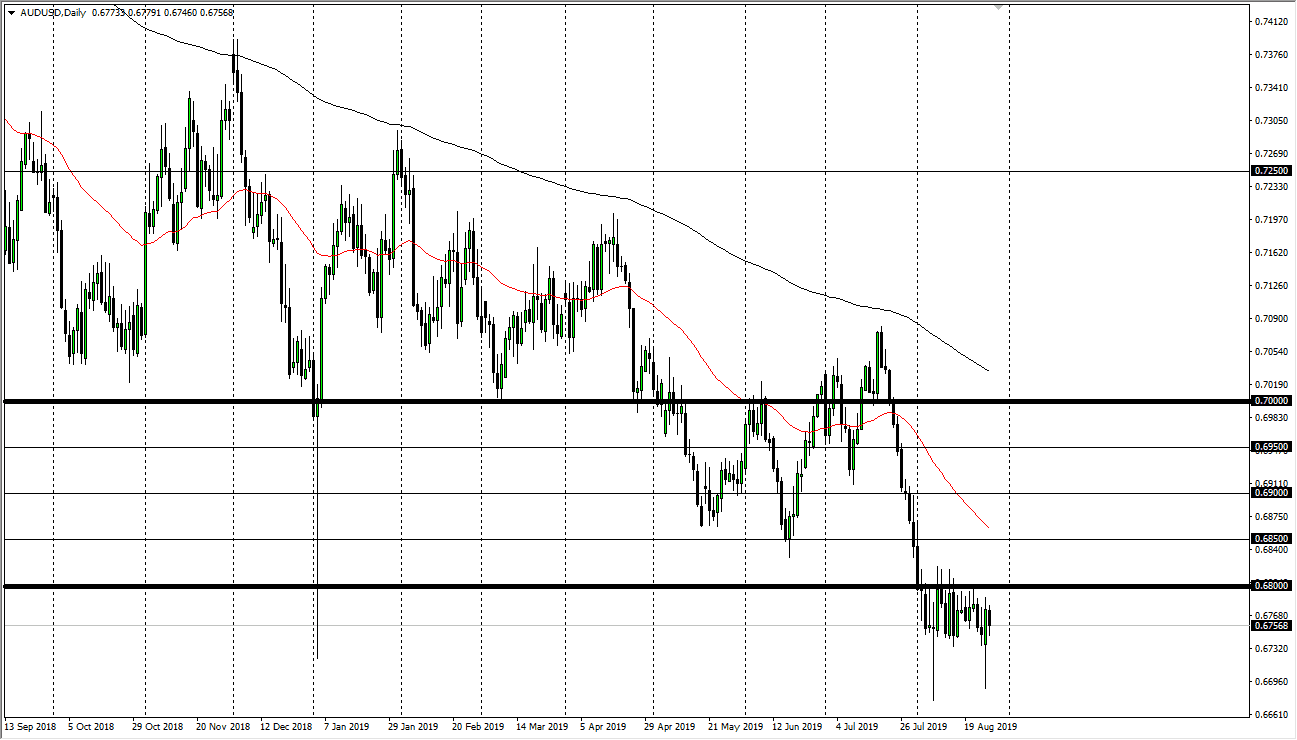

The Australian dollar has done almost nothing during the last couple of weeks, and of course Tuesday was no different. We continue to dance around the 0.68 level and the 0.6750 level. At this point, the market seems very unlikely to break out in the short term, but I would say that the question now is whether or not we just formed some type of bottoming pattern, or are we getting ready to break through the bottom?

Keep in mind that the Australian dollar is highly levered to the Chinese economy and therefore the US/China trade talks. In other words, it is going to be moved by headlines coming out of Beijing in Washington DC, and not Brisbane or Sydney. As long as the Australians are so highly levered to the Chinese mainland economy, they will be in the same boat as China itself. If there is a slowdown globally for demand of products, then Australia becomes a second derivative of the global supply chain.

Beyond that we have US dollar strength due to fear, and then of course the fact that the interest rate differential favors the US dollar against quite a few of the large economies. That doesn’t necessarily mean Australia, but what it does mean is that there is an overall rise in the demand of the greenback. Looking at this chart though, you can see that there are 50 pips increments marked out above, because this pair does tend to react every 50 pips. We also have the 50 day EMA reaching down towards the 0.6850 level, so I think that it’s only a matter of time before longer-term traders continue to push to the downside.

If we were to break down below the couple of hammers over the last couple of weeks, we could very well go down to the 0.65 handle. This is a market that has recognized the 0.65 level as crucial on longer-term charts, so I do think that the large portion of the selling of Australian dollars has already been done. I do think that we continue lower longer term, but in the short term it’s simply a matter of going back and forth in a roughly 50 pip range as we have seen of the last couple of weeks. I have no interest in buying, I’m simply looking for opportunities to short this market but recognize that the room to move is probably somewhat limited.