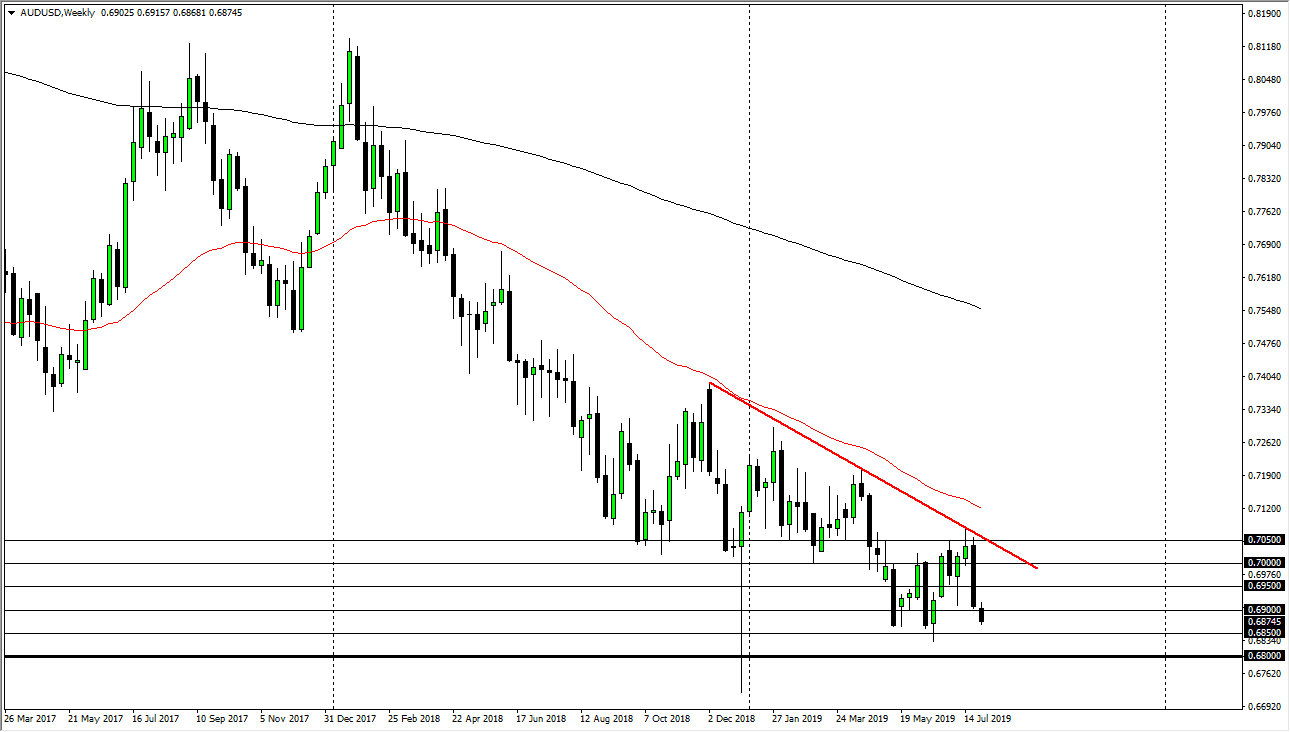

The Australian dollar has had a couple of rough weeks late in the month of July, and that could continue as we are in a strong downtrend. However, as I write this article we are approaching a major support level in the form of the 0.68 level underneath. That is a market level that we have seen tested more than once in the past and hold as being significant. Looking at this chart, it’s obvious that there is a lot of bearish pressure out there and why would there be? We have a lot of trouble between the United States and China, and the trade negotiations don’t seem to be getting any better. However, there is the possibility that we get a bit of a bounce early in the month.

Ultimately, the Federal Reserve is likely to cut rates, and that of course will give a little bit of a boost to currencies against the greenback, but now the next question of course is what with their statement sound like? I suspect it will be extraordinarily dovish, and it’s very likely that we could bounce a bit from here. The downtrend line above could cause quite a bit of resistance though, so I think it’s going to be difficult to break through. If we did, that would probably be the beginning of a major turnaround and a trend change.

If we do break down below the 0.68 level, that is a major problem for this market, it could send the Aussie dollar down to the 0.65 level quite rapidly. I suspect this would either be due to some type of problem between the Americans and the Chinese, or perhaps even a surprise by the Federal Reserve showing signs of hawkish in this, or maybe not being dovish enough. Either way, if we were to break down below that level it really doesn’t matter the reason, it would suggest a lot of trouble. Otherwise, if we break above that downtrend line, it’s more of a “buy-and-hold” scenario for the Aussie as we will have reached the bottom again.