The Australian dollar went back and forth during the trading session on Friday, as the Chinese levied retaliatory tariffs against the Americans again. With this being the case it’s likely that the US-China trade war will continue to accelerate, not slow down, although it should be pointed out that they at least only matched what the Americans were doing, not outdid them. If that’s the situation though, it’s very likely that we are going to continue to see negative pressure overall, so I do like selling rallies as they occur.

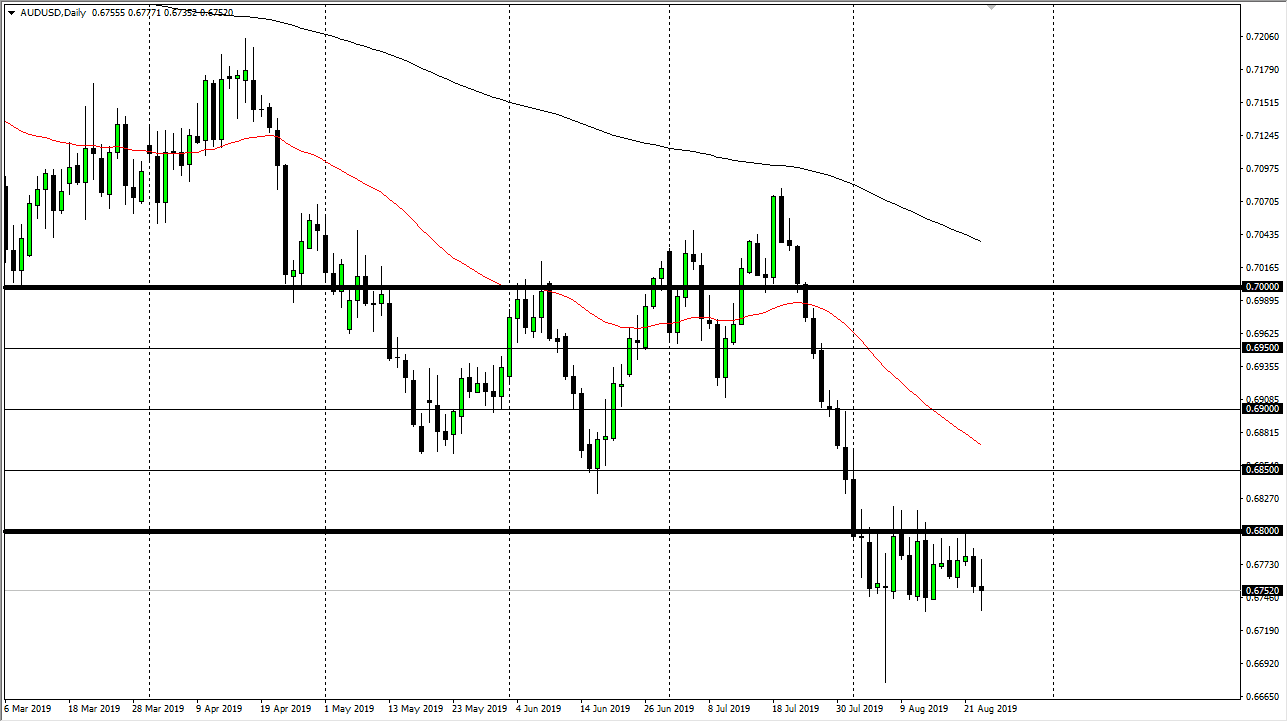

The candle stick for the Friday session of course showed a lot of volatility and choppiness, and I have to wonder whether or not the fact that we were heading into the weekend was the main reason that we may have stopped falling. I think if we break down below the lows of the Friday session we should then go looking towards the bottom of the hammer from a couple of weeks ago which was the most recent low. At this point, I think we also break down below there and we are looking towards the 0.65 handle.

To the upside, the 0.68 level has offered significant resistance, and therefore I think there is a lot of selling pressure in that area and I would be more than willing to short this market if it does bounce towards that region. There is a “zone” of resistance that extends about 35 pips above there, so at this point I think it’s only a matter time before you can fade that move. Beyond that, we have the 50 day EMA which is just below the 0.69 level that should continue to push this market lower as well.

I like fading rallies, and I don’t have any interest in trying to go long of this market. Ultimately, this is a market that I think will continue to see plenty of volatility due to the US-China trade relations as Australia’s so highly levered to the Chinese situation. Ultimately, this is a market that I think continues to be very sensitive to tweets, headlines coming out of Beijing, and of course Washington. In other words, it should continue to be significantly noisy, and therefore I think you should look for opportunities to buy the US dollar, and to short this market, every time at rallies.