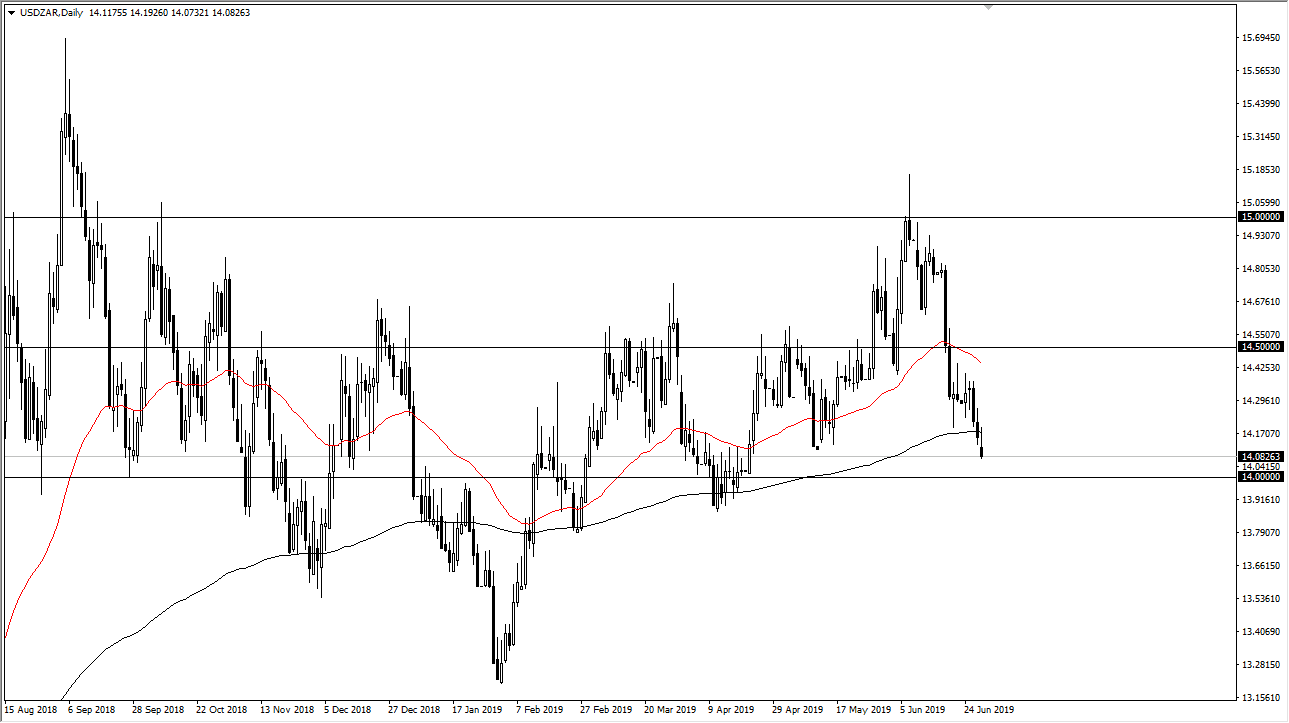

The US dollar initially tried to rally against the South African Rand but gave back the gains as we are now definitively below the 200 day EMA. That being the case it looks as if the market is ready to continue going lower, I suspect down to the 14 Rand level. Short-term rallies at this point are probably going to be selling opportunities, as the market has certainly broken down significantly.

If we were to break down below the 14 Rand level, the market could go much lower. Underneath that level there should be a significant amount of support but I do think it’s only a matter of time before we break through that as well if we get down that low. Ultimately, I think that the US dollar is going to continue to get hit due to the Federal Reserve cutting interest rates later this year and of course the South African Rand offering a significant interest rate differential.

That being said, if we get some type of “risk off” type of shock, it’s very likely that the pair will turn right back around and head towards the 14.50 Rand level. All things being equal, I think that we have seen enough bearish pressure and the break of the 200 day EMA certainly suggests that the US dollar is about to get hit. For what it’s worth, we are also dancing around the 200 day EMA against the Euro, which is one of the best ways to measure overall US dollar strength. As long as nothing major happens, I suspect that the downward pressure will continue in this pair, and rallies are to be sold until something changes drastically as far as risk appetite is concerned. You should also keep in mind that the South African Rand is highly levered to gold.