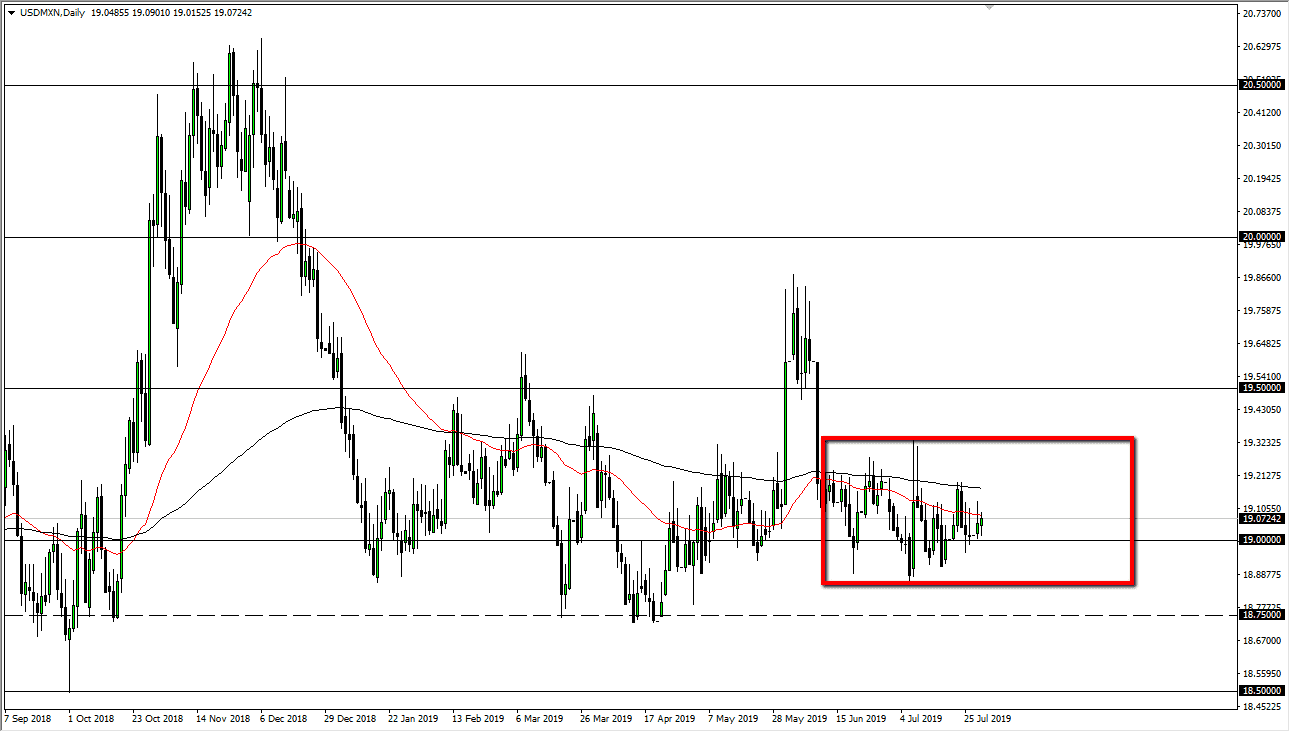

The US dollar has been grinding back and forth against the Mexican peso over the last several weeks, and as you can see the 19 pesos level has been a bit of a magnet for the USD/MXN pair. That being the case, it’s very likely that we could see a lot of volatility when we finally do break out, and the Federal Reserve interest rate meeting on Wednesday of course could be a catalyst for that to happen.

Keep in mind that this pair isn’t as liquid as many of the other pairs that you may typically trade, so if we get some type of move in the greenback, it will be far more pronounced against the Mexican peso that it would again say the Canadian dollar or the Euro. Ultimately, we continue to see a lot of resistance at the 19.25 pesos level, with the 18.9 pesos level offering plenty of support. At this point, the 50 day EMA and the 200 day EMA both look relatively flat, as there isn’t much in the way of a trend over the last several weeks.

That being said, we could very easily trade back and forth and chop around in this pair as I have been talking about for a few weeks though, but I do believe that this might be the catalyst to finally move. After all, the Federal Reserve taking a very dovish stance will more than likely set up the idea of future rate hikes, spreading the interest rate differential between these two currencies. If that’s the case, then I think we will probably break down below the 18.9 pesos level, perhaps reaching towards the 18.75 pesos level, and then the 18.50 pesos level. That could be the beginning of something rather important.

On the other side of this equation, if we get the Federal Reserve shock in the market by not cutting, that will more than likely send the US dollar straight up in the air, reaching towards the 19.50 pesos level, perhaps even the 20 pesos level after that. All things being equal, this is a market that has been too quiet for too long, and therefore I feel that a move is certainly coming. That Federal Reserve interest rate decision and statement of course will move this market to the upside. This should be rather important if we can get a daily close outside of this range.