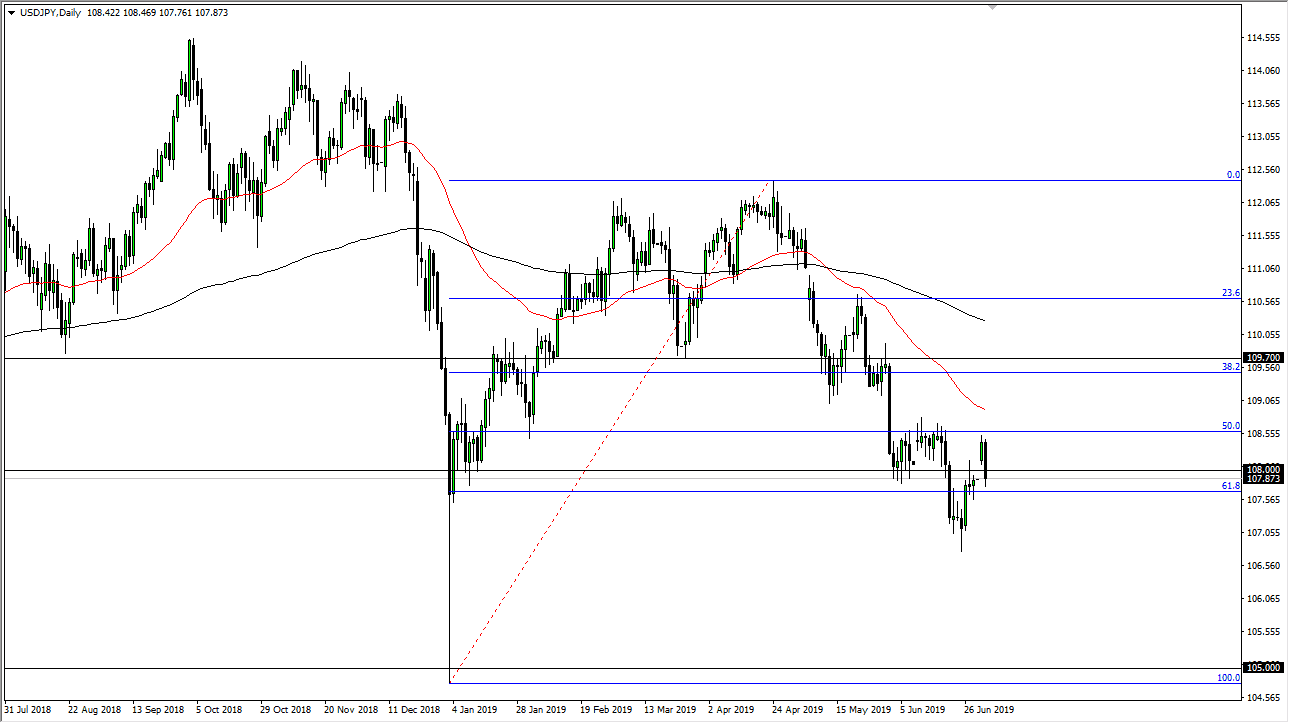

The US dollar fell rather hard during the trading session on Tuesday, filling the gap against the Japanese yen. At this point we now have to ask whether or not we can rally from here, which you would expect based upon the gap, but if it doesn’t work then it’s very likely that we will see a lot of negativity.

Looking at this chart, it does look like we need to make a decision rather soon, but the problem that we are going to run into is that we get a major holiday within the next 48 hours followed by the jobs number. Ultimately, the jobs number will probably break the stalemate, allowing the market to make up its mind. If we can break above the ¥108.70 level, that would be a very bullish sign and could send this market up about 100 pips. On the other hand, if we were to break down below the ¥107.50 level, I think we will lose 50 pips, and then perhaps even go lower than that.

Remember that this pair is highly sensitive to the stock markets and overall risk appetite, so pay attention to the S&P 500 as a bit of a proxy. Because of this, if we can continue to find buyers in that market is likely that we go higher. It also makes sense that this market might be a bit quiet in the next couple of days as the Americans will be focusing on holiday and barbecues more than trading. With one of the biggest drivers of this market being close, it makes sense that it might be a bit quiet. That being said, we have filled the gap and that was something that needed to be done from a technical analysis standpoint.

Bond yield differentials probably play a backseat to the stock market right now, but I do find that it’s interesting that we are starting to see a little bit of divergence between bonds, stocks, and this pair. It just seems to be whatever mood we are in for the day as to which one is lining up with the other. We do have the 50 day EMA above the ¥108.70 level, so one could make the argument that sellers are still in control. That being said I don’t like shortening until we break down below the hammer from the Friday session to consider that. To the upside I’d like to clear all of those wicks from a couple of weeks ago.