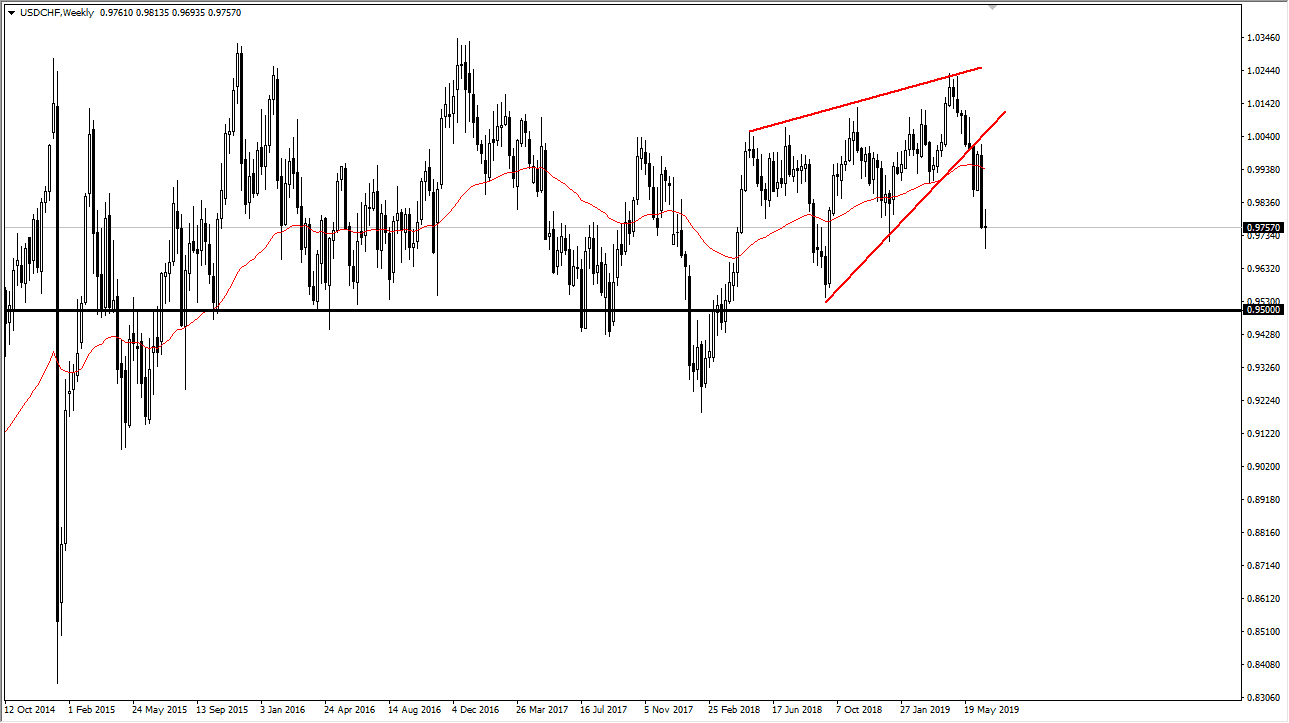

The US dollar has been relatively negative against the Swiss franc lately, as we spent most of the month falling from the rising wedge that had been formed previously. This is a market that of course represents safety and the strength or weakness of the US dollar. I find it very interesting that we have seen so much negativity as of late.

From the technical analysis standpoint, you can see that the week leading into the month of June was very soft as we formed an inverted hammer. After breaking below the bottom of that inverted hammer, the market looks very likely to continue the negativity which of course is exactly what happened. Now that we have broken through the rising wedge, the technical analysis dictates that you try to go towards the bottom of it. That has a target of 0.95 or so.

Granted, this doesn’t mean that we will get there immediately, but I do think that the occasional rally will probably be reason enough to sell the greenback. While the Swiss National Bank has been very loose and accommodative with its monetary policy, the Federal Reserve has recently changed its tune, talking about cuts later in the year. In other words, that means that the US dollar is overvalued.

At this point I would look for any rallies to be sold so a break above the weekly candle stick from this last week will probably have people looking to sell near the 0.99 level. However, if we break down below the bottom of the weekly candle stick closing out the month, then we probably go looking towards the 0.95 level much quicker. Selling rallies continues to be the way going forward through the month of July, and possibly even August.