The British pound rallied significantly during the day on Friday, testing and breaking above the top of the shooting star from the Thursday session. This is a very bullish sign, as it shows the resistance giving way and perhaps a move higher. What’s even more telling is that people are willing to buy the British pound going into the weekend. That’s something that should be paid attention to, because there are a whole will of the potential problems that could come out of the Brexit at any moment.

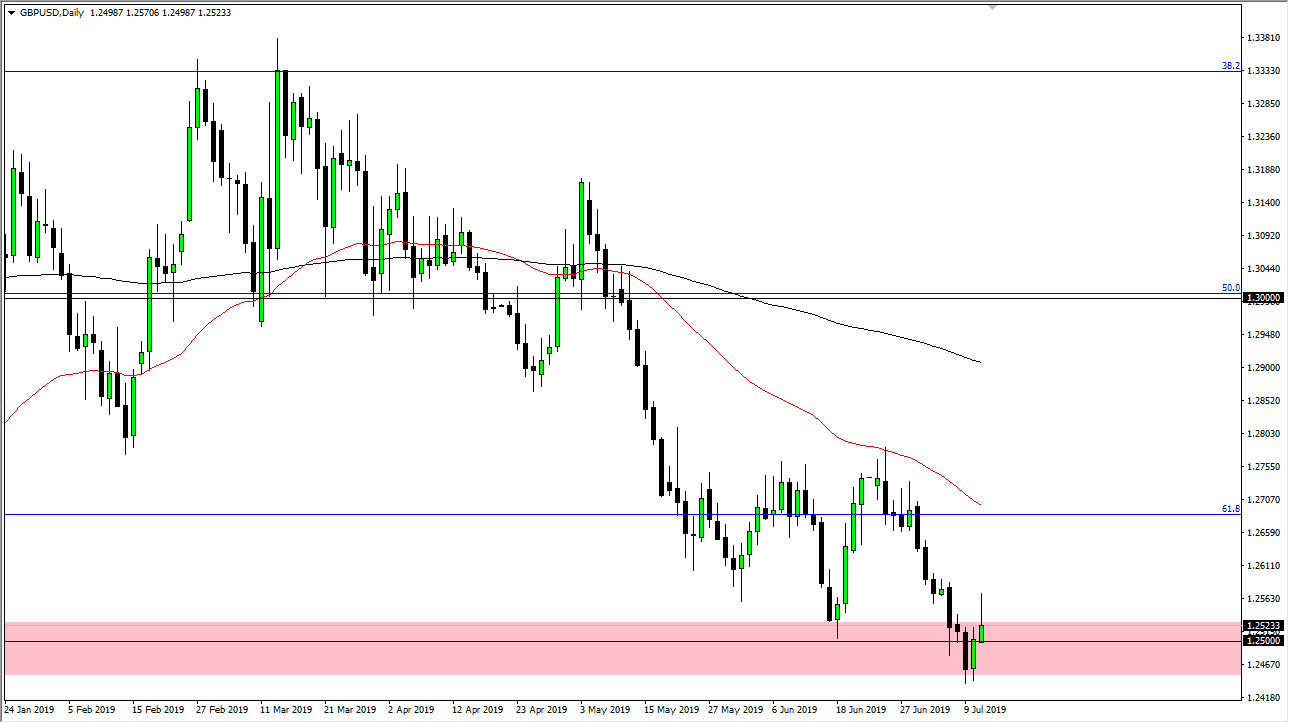

The Federal Reserve is of course looking to cut interest rates, and that will work against the value of the US dollar. Ultimately, this market does have a lot of resistance above, especially if the 50 day EMA which is pictured in red on the chart. Beyond that, there is the 1.27 level that extends to the 1.2750 level as far as resistance is concerned. This is a market that has bounced rather significantly and the fact that we have broken above the shooting star from the previous session is a very bullish sign.

All things being equal, I believe that this is a short-term rally that can be taken advantage of. However, there are much more stable currencies out there that you can buy against the US dollar, as the British pound has a whole wealth of potential negative headlines coming out of the Brexit. After all, there is a lot of uncertainty when it comes to that entire situation, not only whether or not there will be a deal, but quite frankly the British economy itself is starting to show signs of trouble.

The only thing keeping this market afloat is the Federal Reserve, so if they were for some reason to not cut interest rates, this pair will plummet through the floor. Looking for rallies that show signs of exhaustion will continue to be the best way to play this market, and therefore you will eventually get a nice shorting opportunity. Like I said though, if we continue to go higher here you may wish to play a different currency pair, perhaps the Australian dollar, the Canadian dollar, or something like that. The candle stick is very strong looking for Friday, but it’s much easier to short the US dollar against other currencies that don’t have all of the overall dark cloud that hangs above Sterling.