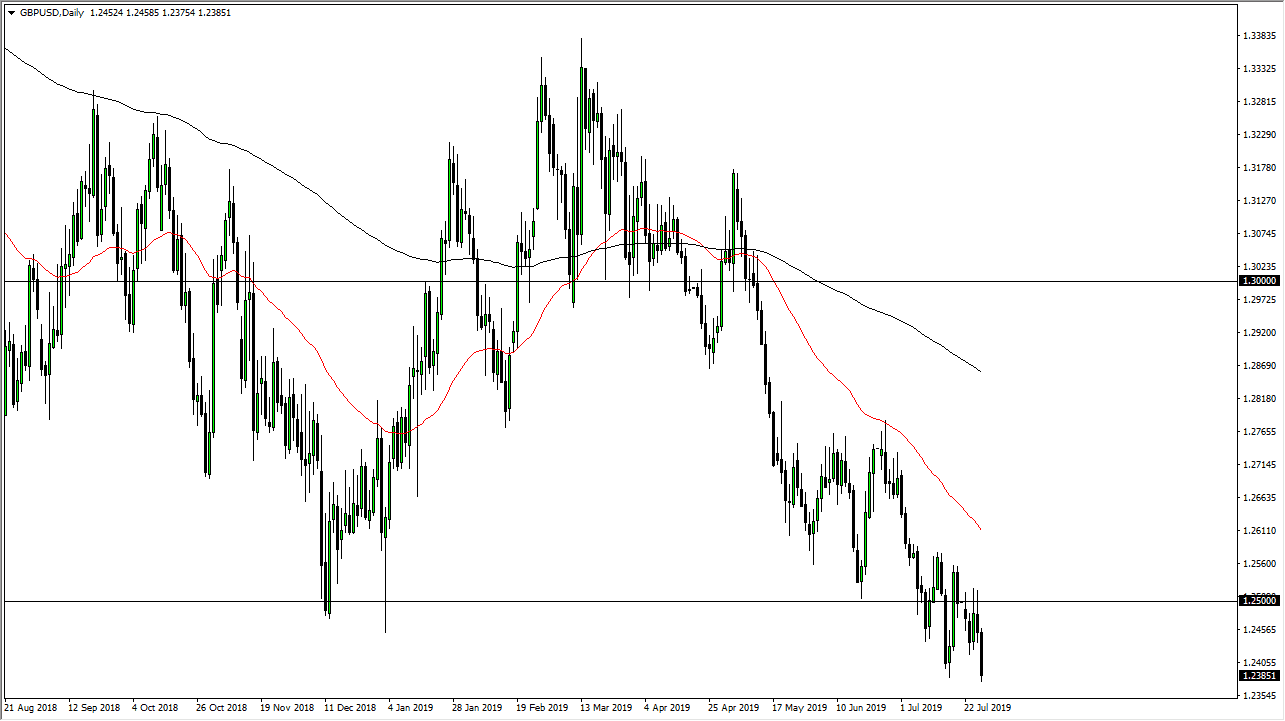

The British pound continued to fall during the trading session on Friday, reaching down below the 1.24 level. This is a market that continues to struggle in general, so I think at this point every time it rallies you need to be looking for a selling opportunity. Yes, the Federal Reserve is very likely to cut interest rates, and that should be in theory bad for the US dollar, but the reality is that the British pound is a completely different scenario than most other currencies.

With the Brexit going on, and the massive amounts of uncertainty around that, it makes sense that the British pound will continue to fall. Ultimately, I think rallies are to be sold as there is to simply a ton of resistance above and even more in the way of uncertainty. The 1.25 level above is going to be resistance, and I think that resistance extends to the 1.26 handle beyond that. Quite frankly, there is no reason to think that this market is going to suddenly turn around. Granted, we are getting closer to the Brexit than ever, but at this point it’s also very likely that it will be a “no deal Brexit.”

With all of that being said, if the Federal Reserve does cut interest rates and seem to be aggressively dovish, it’s likely that we will see this market rally, but it will be short-lived at best. I think at this point it’s very likely that the market continues to find plenty of reasons to fall, either headline or economic. We also have the concerns about geopolitical issues, which tends to drive the US dollar higher anyway.

Looking at this chart, it’s very likely that we break down towards the 1.2250 level, and then the 1.20 level after that. Overall, I think that rallies are to be sold at the first signs of exhaustion. The slope is very negative in this chart, and as we continue to see a lot of choppiness I think that will continue to spook people out of this market. I also believe that we will eventually get a “flush lower” based upon fear of the Brexit, but once things stabilize, this could be the trade of a lifetime. That being said, we are quite a ways from that, probably four or five months.