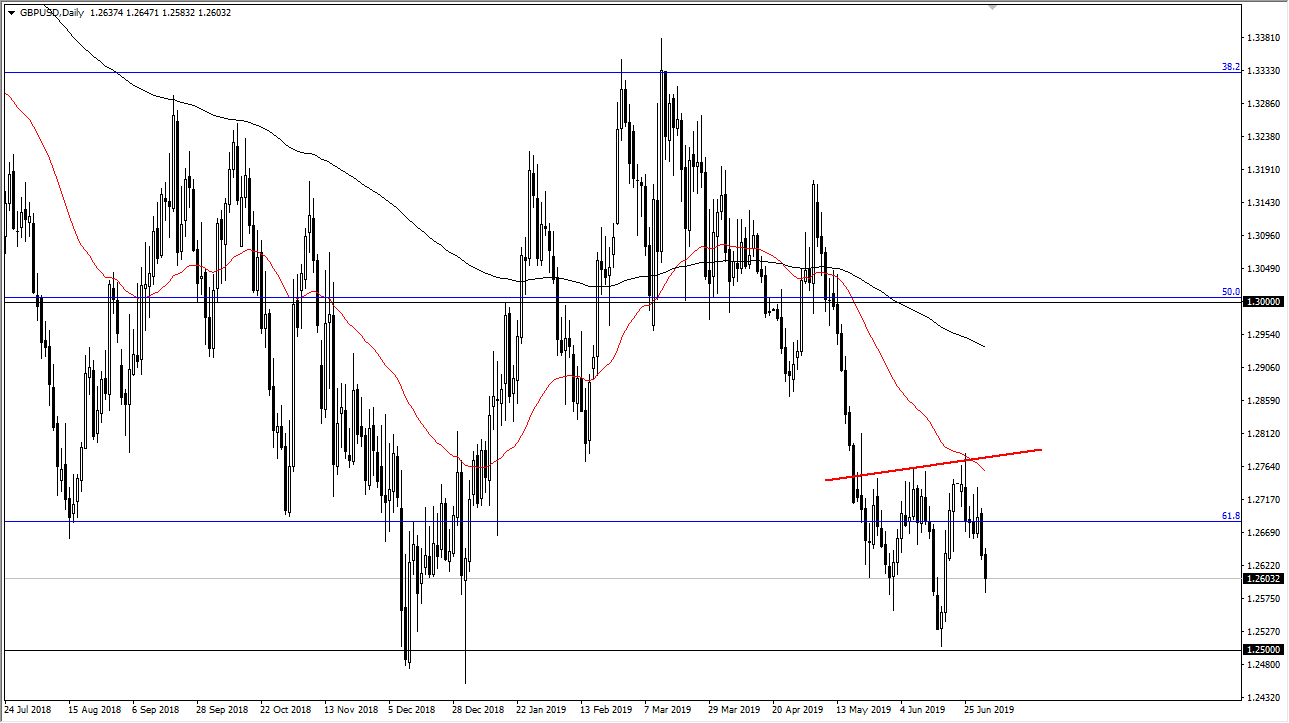

The British pound broke down significantly during the trading session as Mark Carney spoke. That being said, we have found a bit of support at the 1.26 level, and now we still are possibly trying to form an inverted head and shoulders and the next couple of days will be crucial. We obviously have a lot of problems trading this market due to the Brexit, which throws a lot of “what if’s” into the marketplace.

On the other side though, we have the Federal Reserve looks likely to cut interest rates, and therefore it’s very likely that it should put bearish pressure on the US dollar. The question now is whether or not that will be enough to lift the British pound, and I don’t think it is, at least not in relation to other currencies such as the Euro. Ultimately, it looks as if the market could be traded to the upside, but if we break down below the bottom of the candle stick for the Tuesday session, then it’s likely we go looking towards the 1.25 level which should be even more supportive.

If we can turn around and break above the 1.28 handle, then we break the neckline of the inverted head and shoulders and it opens up the door to a potential move all the way to the 1.30 level. That is an area that of course would attract a lot of attention due to the large, round, psychologically important figure, and of course the previous action that we have seen of the handle.

The next couple of days have a severe lack of liquidity in North America, and of course we have the jobs number coming out on Friday. If that is going to be the case, it’s going to be very noisy and we will continue to go back and forth in a very erratic manner. If you see this market rallying I suspect that you are probably going to be much better off trading the Euro as it tends to move in the same direction and it should be a bit healthier. On the other side of that equation, if the Euro starts to rally you may see the British pound try to play catch-up over here, so keep an eye on both charts and use them as secondary indicators of each other. After all, if it’s about the US dollar it’s likely that the pairs will move in the same direction.