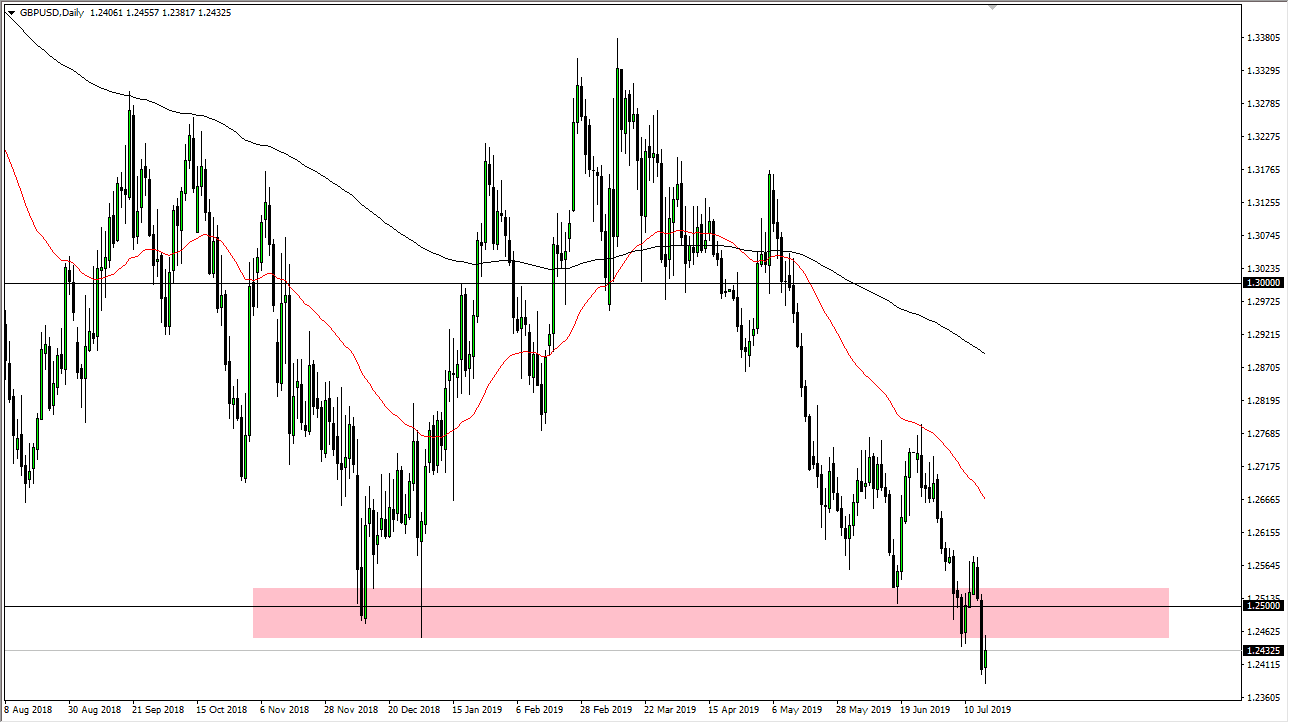

The British pound initially broke down during the trading session but then turned around to show signs of life. However, we have already started to pull back from the previous lows, which now could be the beginning of significant downward pressure. The Sterling simply cannot get out of its own way, and we are reaching extreme lows. At this point, it’s obvious that the sellers will come in and jump on this market every time it tries to rally, because there’s no reason for it to rally other than the Federal Reserve.

Speaking of which, the Federal Reserve is going to cut interest rates in July, and possibly again in September. If that’s going to be the case, that does weigh upon the greenback but I think that we are starting to come to terms with the idea that the British will be leaving the European Union without a deal. That probably causes the next great “flush” in this market, but when things get at the absolute worse, that’s probably when it’s time to start buying the British pound and holding on for the next decade. That being said, we are a bit ahead of ourselves.

This is a market that continues to show signs of negativity every time we try to rally, and now it looks like the 1.25 level will be resistance and a bit of a “ceiling” that extends to the 1.2550 level. Above there, the 1.2750 level is the next major barrier. At this point, I do not trust the British pound so I think simply selling on signs of exhaustion will be the best way to go. Beyond that, I would also pay attention to the US dollar and how it is doing against other currencies if we can glean some type of direction. For example, if you are seeing the US dollar strengthening against the Australian dollar, Euro, the Japanese yen, and many other currencies, then this pair is probably going to be falling apart. That being said, if the US dollar is getting hit hard against several other currencies, that doesn’t necessarily mean you should be buying this pair, rather you should be looking for areas above the start shorting. The British pound is not a currency you should be buying right now, because we have a couple of dangerous months ahead of us. By the end of the year though, we should finally have long-term clarity.