The British pound went back and forth during the trading session on Tuesday as we continue to see a lot of bearish pressure in the British pound. After all, we don’t know what’s going on with the Brexit, and with the prime minister question now being solved, as we have the Boris Johnson result, then we need to see whether or not we can come to some type of consensus in London to have a Brexit deal. At this point, it seems very unlikely to be the case and therefore I think we will continue to see a lot of negative pressure when it comes to this currency.

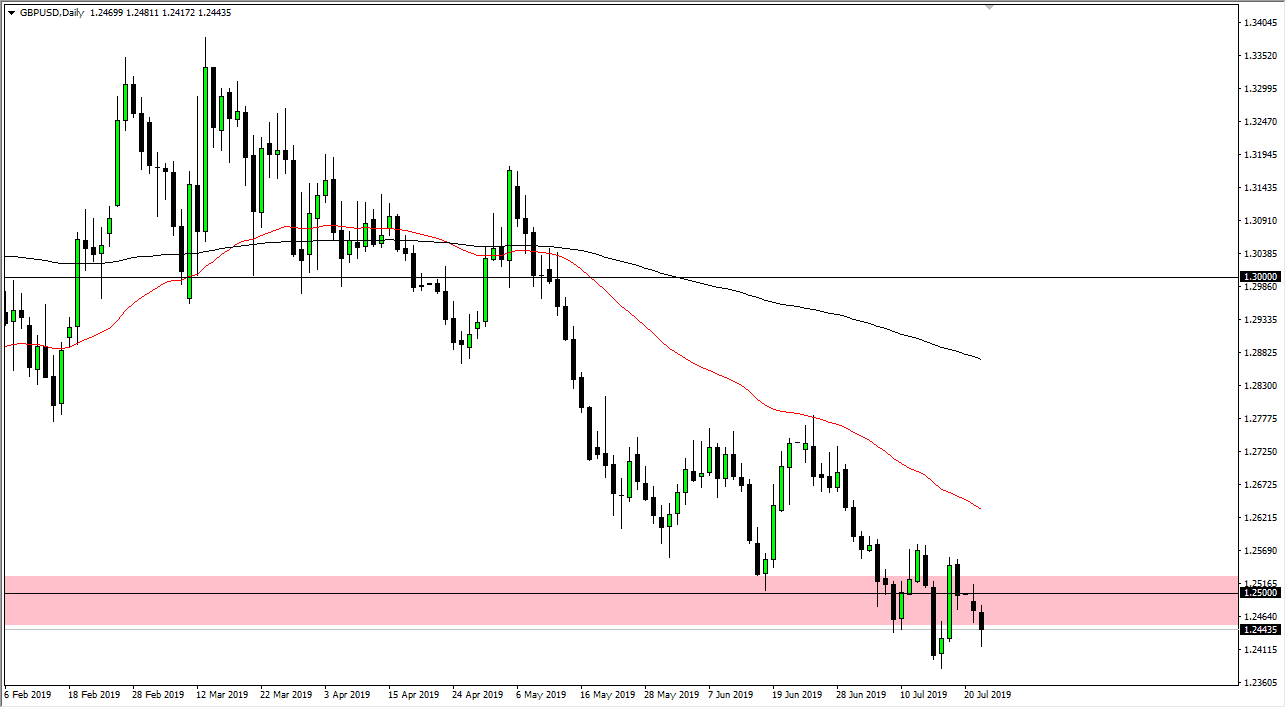

We have the Federal Reserve on the other side of the equation looking to cut interest rates, and that should put a bit of bearish pressure on the greenback. That could provide a lift in this market, but the reality is that we have not been able to show any significant bounce in this market knowing that ahead of time. That tells you just how bearish the British pound is currently. All things being equal, it’s very likely that we are going to see rallies faded, as we continue to see “lower highs” in this market. That being said, even if we did break above the resistance barriers near the 1.2575 handle, then I think the 50 day EMA is going to come into play, followed by the 1.2750 level.

To the downside, if we can make a fresh, new low I believe that this market then goes down to the 1.2250 level, and then possibly the 1.20 level. That doesn’t mean we have to get there tomorrow though, so at this point I think we will probably bounce around in the short term, followed by the potential move lower. Simple patience will be needed in order to take advantage of this particular move as there are a whole plethora of potential headlines out there that could throw this market around. All things being equal though, I do think that we go lower, as the British pound has been not only in a downtrend for some time, but it also has a lot of uncertainty around it, something that markets absolutely hate. With that, I look at rallies as an opportunity to pick up the greenback “on the cheap.”