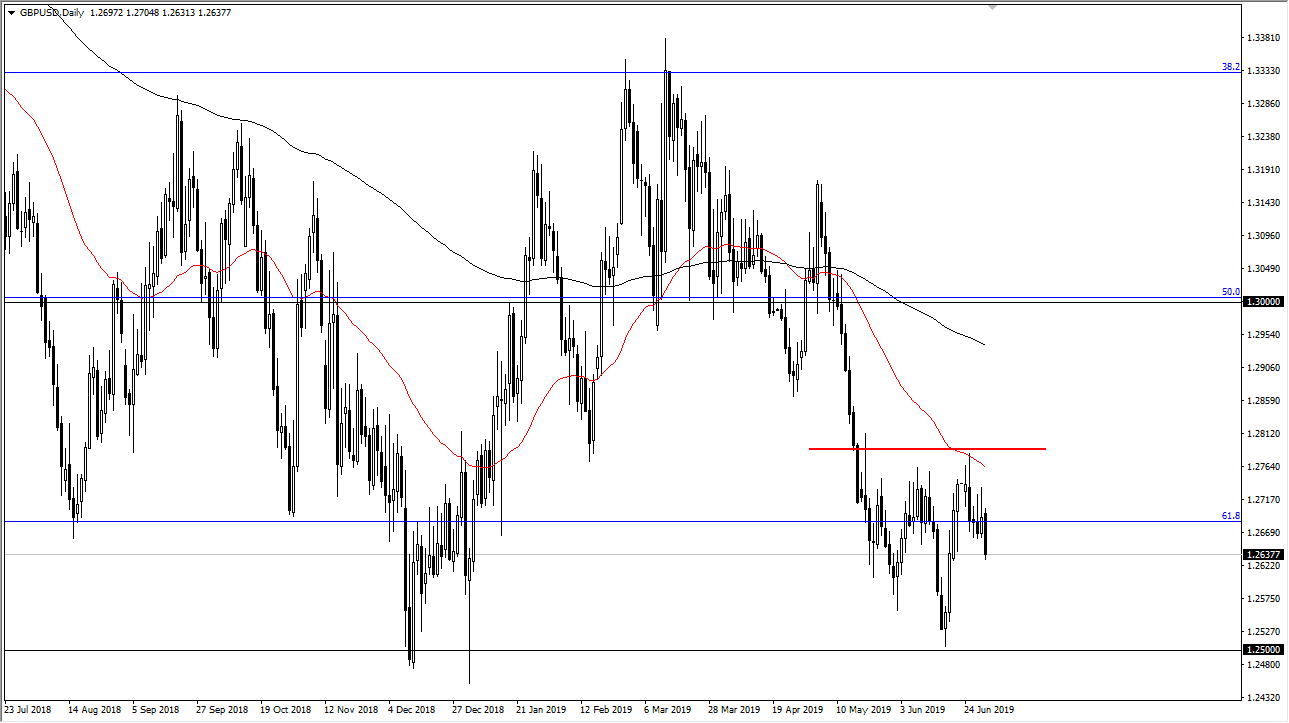

The British pound initially nudged slightly higher during the day on Monday but then turned around to break down significantly. We broke down through the bottom of three consecutive days, which of course is a very negative sign. However, as I look at this chart I recognize that we are approaching an area of potential support. In fact, it doesn’t take a whole lot of imagination to anticipate a potential inverted head and shoulders on this chart.

The first question of course is going to be “why would there be an inverted head and shoulders in the British pound of all currencies?” And that would be because of the Federal Reserve looking to cut interest rates. Remember, when it comes to central banks the Federal Reserve has the most sway when it comes to how currencies move so it makes sense that perhaps people will focus more on that then the British pound itself.

Yes, we have the Brexit and that continues to cause a lot of problems. Ultimately though, people will be more focused on the Greenback as it relates to currencies globally, not just the British pound. With the Brexit being a major issue though, you should keep in mind that if all currency start to rally against the greenback, the British pound might be a bit of a laggard as it at least has the dark cloud of the Brexit hanging over it. You should also keep in mind that if we get a lot of buying in the greenback, the British pound will probably fall quicker than many of the other currencies.

To the upside I see the 1.28 level as massive resistance that has just been crossed by the 50 day EMA. On a break above the 1.28 level that would confirm the inverted head and shoulders area, sending this market looking for somewhere closer to the 1.30 level, maybe the 1.3050 area. That would coincide with a lot of US dollar weakness in general. If we can get good news out of London, that would be like throwing gasoline on the fire. However, I think most traders have given up on any clarity coming out of the UK anytime soon, so this point I think that people are simply focusing on the Federal Reserve and trying to ignore as much about Brexit as they can. To the downside, if we break down below the 1.26 level, that probably opens the door to the 1.25 level which will be massive support breaking through there would in fact be very negative.