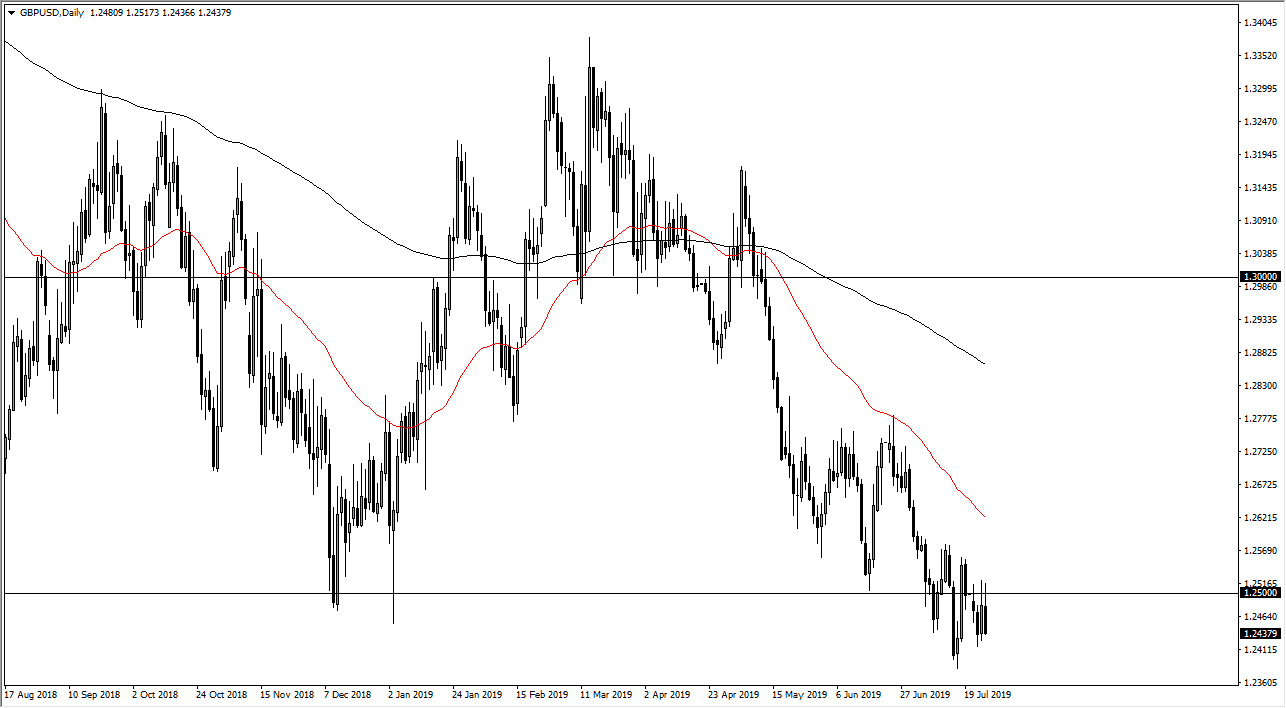

The British pound initially rallied during the trading session on Thursday to reach above the 1.25 level initially, but then broke down rather significantly. At this point, the market looks very likely to continue to favor the downside, and even though we have had the occasional attempt to reach higher, the fact is that we continue to sell off drastically. This is a market that is suffering at the hands of the lot of headlines coming out of the Brexit.

As we broke above the 1.25 handle, we started to see a lot of selling just as we had during the previous session. That being the case, the market is likely to continue to go much lower given enough time. The market sees a lot of pressure above 1.25 if that extends to the 1.26 handle. Beyond that, there is also the 50 day EMA starting to reach lower as well, so I think it’s only a matter of time before rallies will be punished. Yes, the Federal Reserve is going to cut rates, but I believe that even if the US dollar falls significantly, it’s going to take something pretty special for this pair to rally based upon all of the headlines and the negativity coming out of the Brexit negotiations, or perhaps I should say the lack of negotiations.

As we continue to bounce around, I think that eventually we will break lower, perhaps reaching to the 1.2250 level. That’s a level that will attract a lot of attention, as it has in the past. Beyond that though, I think that we go looking towards 1.20 level which is even more impressive as far support is concerned. This market still needs to break down from here, as we simply don’t have reasons to go long. In fact, the odds of a “no deal Brexit” continue to increase.