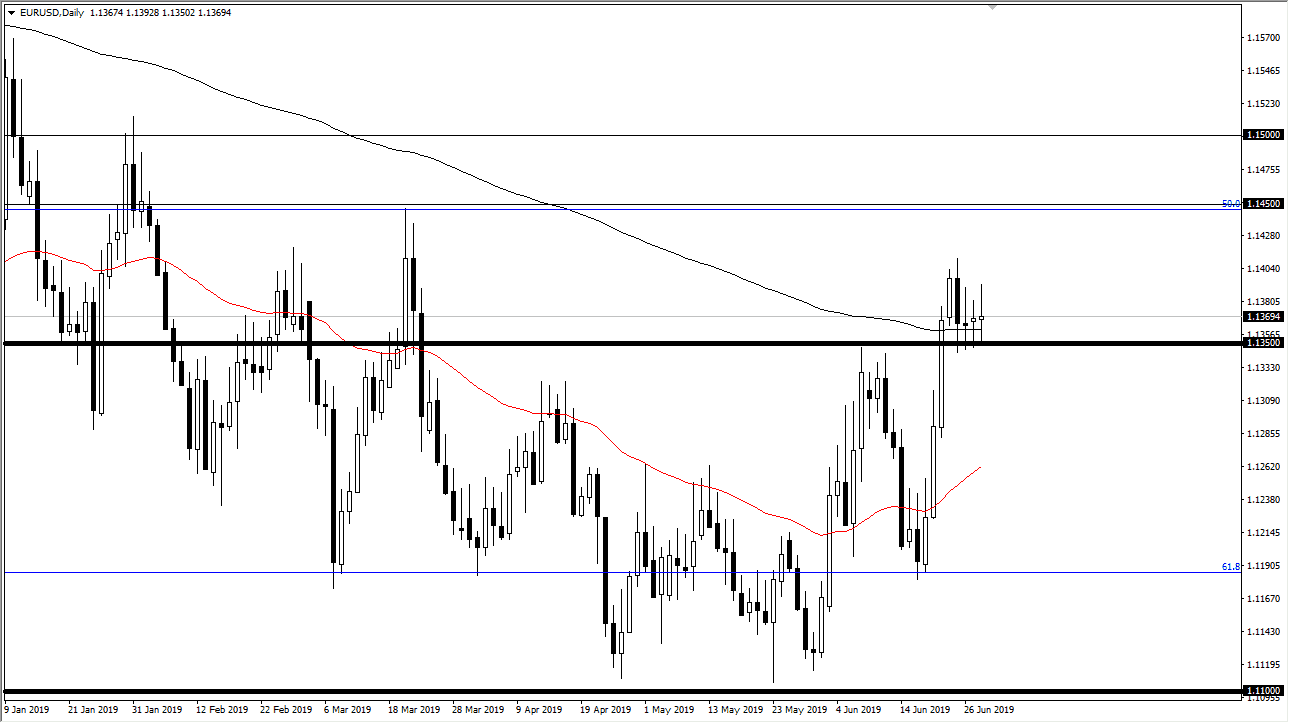

EUR/USD

The Euro went back and forth during the trading session on Friday as we continue to dance around the 200 day EMA. At this point, the 1.1350 level underneath is offering support as well, as it was previous resistance. At this point, it looks as if the market is going to continue to try to figure out where to go next, but the fact that we broke above the 200 day EMA is a very bullish sign. We could also make an argument for a longer-term bottoming pattern and what the Federal Reserve stepping on the sidelines and now looking likely to cut interest rates, it makes sense that the Euro would gain against the US dollar.

Ultimately, the 1.1450 level above would cause significant resistance, extending all the way to the 1.15 level. However, that’s going to take some time to get to, and I also believe that if we can break above there the market will turn a major trend change going forward.

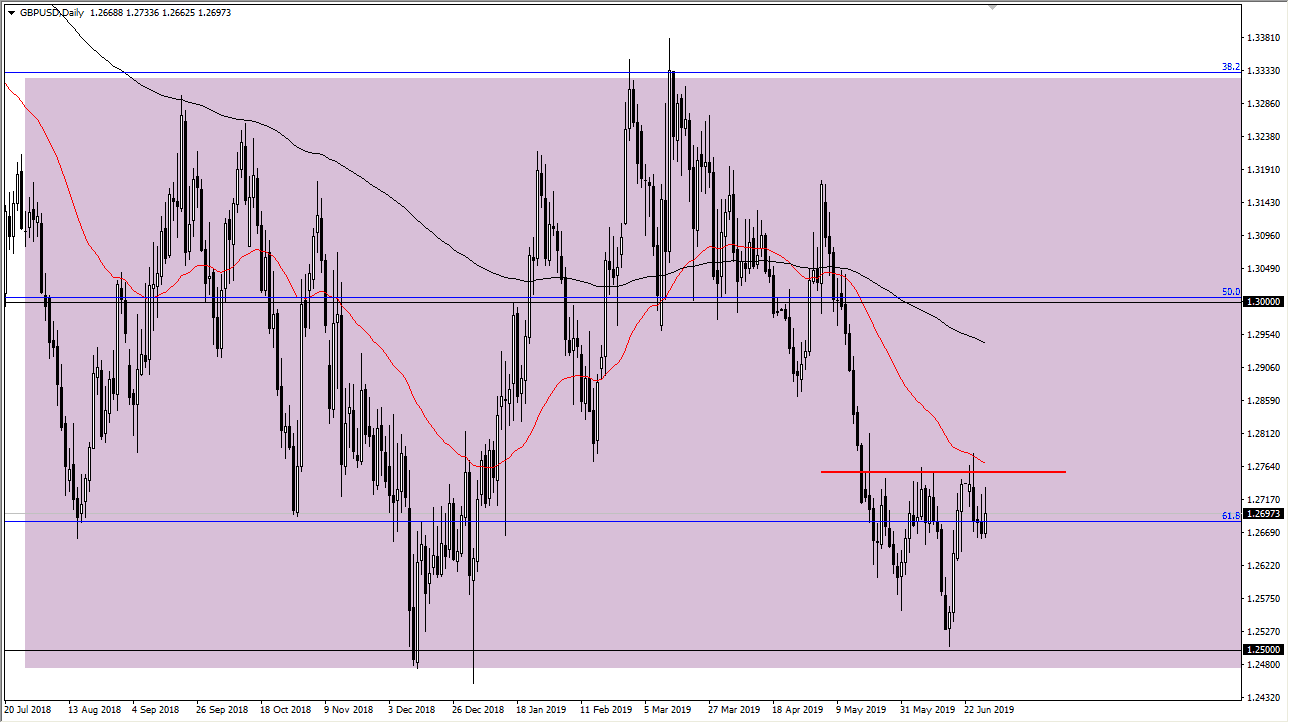

GBP/USD

The British pound initially tried to rally during the trading session but gave back quite a bit of the gains on Friday. At this point, it looks as if the 1.2750 level is significant resistance that extends to the 1.28 level. If we can break above there, then it’s likely that the market could go much higher. At this point, I think that we will continue to try to grind above there, but it’s going to take a bit of inertia to finally make that move. In the short term, expect small pullbacks but this pullback should be buying opportunities unless we break down below the 1.26 handle. If we break down below there it’s likely that we go looking towards the 1.25 level. With the Federal Reserve looking to cut interest rates, it’s likely that the British pound could be a beneficiary although it will more than likely lag behind the Euro.