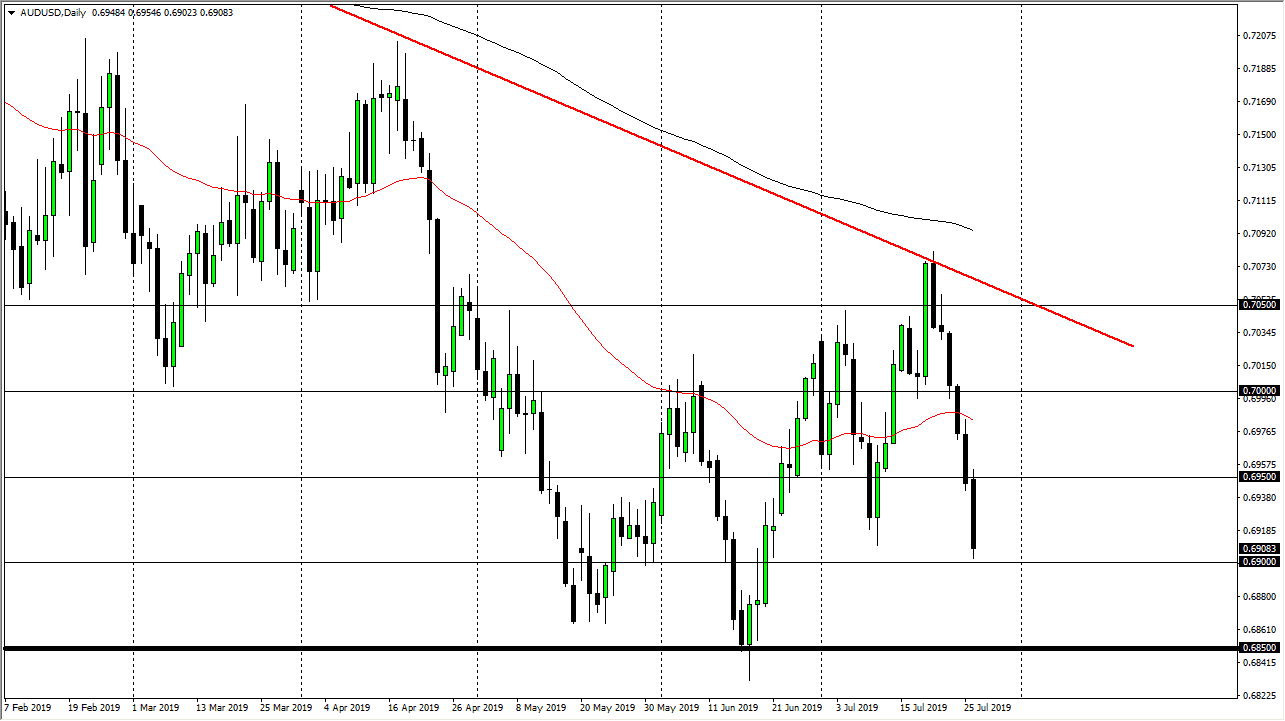

Well, it’s official. I’ve given up on the Australian dollar, at least in the short term. That being the case though, the market has broken below to form a “lower low”, and as a result it looks as if we will probably go towards much more meaningful support underneath. That means the 0.6850 level may come into play. Beyond that, we also have support at the 0.68 handle which should keep the market afloat. Quite frankly, if we were to break down below the 0.68 handle, that would be catastrophic for the Aussie as it would show a complete breakdown.

All things being equal though, the Federal Reserve is set to cut rates and now we will pay attention as to whether or not this statement after the rate cut is extraordinarily dovish. If it is, that could be reason enough to push this market higher but I think we certainly don’t look likely to do so in the short term. Overall, we need to break through that nasty red trend line that I have on the chart, and we have most clearly not done so. I’ll be the first to admit that I have lost a little bit of money on this pair recently. However, I think that it’s only a matter of time before we see markets rally, as we have gotten a bit oversold. That being said though, if we were to break down below the 0.68, the market could break down extraordinarily quick as it would be a “flush” in the overall strength of the Aussie.

The US/China trade relations will continue to be a major contributor to where the Australian dollar goes next, as the Australian economy is massively tied to the Chinese mainland construction strength and of course the export market that is so prevalent in that country. As Australia supplies a lot of the raw materials for that economy, if we can get some type of agreement between the Americans and the Chinese, that will send this pair into overdrive. It also has a certain amount of influence from the gold market, but that seems to be breaking down presently. Ultimately, I do believe there is a significant amount of support ready to come into play about 50 pips below, but I need to see this market prove itself before putting any more money into that market.