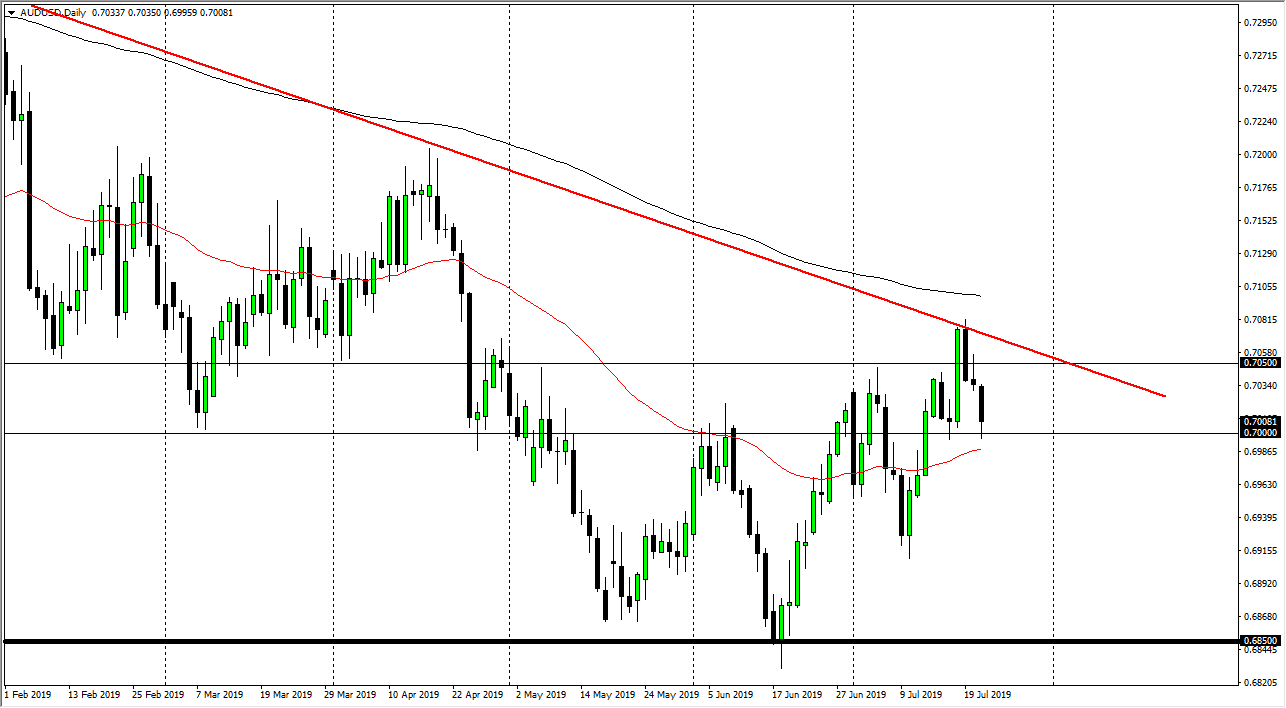

The Australian dollar has fallen during the trading session on Tuesday, reaching down to the 0.70 level underneath, and at this point it’s likely that the round figure makes quite a bit of sense. That being the case, round of figures typically offer a lot of attention. The 50 day EMA is just below, and that of course will quite often attract a lot of buying or selling pressure. I think at this point it’s likely that we could get a bit of a bounce and reach towards the 0.7050 level. However, if we break down below the 50 day EMA, we could then pull back a bit but I still think the one thing that you need to pay attention to is that we continue to make “higher lows”, as well as “higher highs.”

Looking at the shape of the candle stick for the day on Tuesday it is a bit negative, but ultimately we need to look at the totality of the move, and it looks as if the buyers are likely to come in and pick this market up. Beyond that, we also have a major downtrend line just above, and that will of course be something that people pay attention to. If we can finally break above there, then the market is ready to go much higher, perhaps changing the overall trend.

The US dollar will drop in value due to the Federal Reserve cutting interest rates, and that can bring money into this pair as we continue to see lots of quantitative easing being a major issue. Ultimately, I think that the market is likely to continue to grind a bit higher. Beyond that, the 200 day EMA is just above the downtrend line, so obviously if that clears, then it’s a longer-term “buy-and-hold” signal for a lot of trend traders. Ultimately though, if we were to break down below the 0.69 level that does cause quite a bit of trouble for the uptrend and could send this market down to the 0.6850 level next. I think this market continues to rally based upon the Federal Reserve and more importantly the gold market, as the Aussie is so highly influenced by gold, and of course the gold market is influenced by the US dollar and the Federal Reserve. All things being equal, I do think it’s only a matter of time before break out but timing of course is the most important thing.