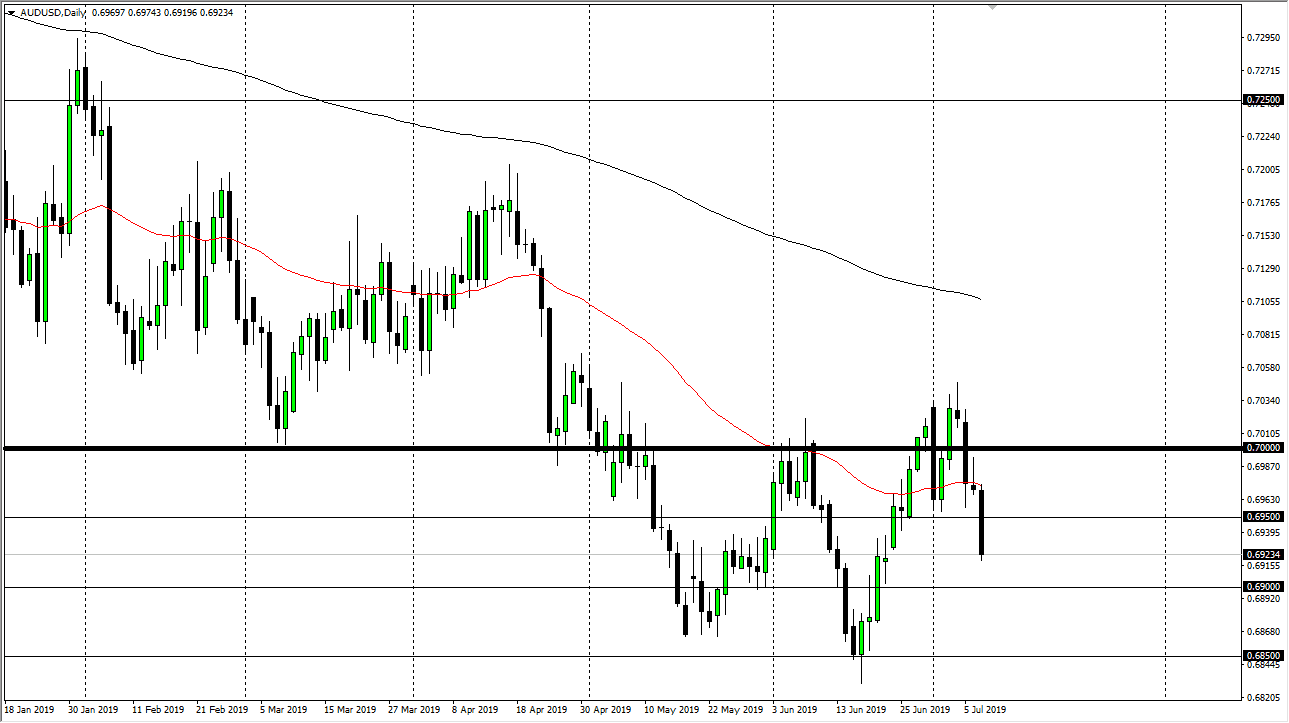

The Australian dollar broke down during the day on Tuesday, slicing through the bottom of the inverted hammer from the Monday session. That of course is a negative sign but more importantly to traders is that we broke down below the 0.6950 handle, an area that has been important support over the last couple of weeks. The fact that we broke down there is of course a very negative sign, and we have now fallen to fill a minor gap. I don’t put too much credence into the gap, but what I do pay attention to is the macro situation as well as the various support and resistance levels that I have marked on the chart.

The Australian dollar has traded in 50 pips increments as of late, showing support and resistance every time we hit one of those mid-century figures. At this point, I suspect that the 0.69 level will be massive support, and we could get a bounce from there. What could cause this? Jerome Powell. After all, he gives testimony in front of Congress during the trading session on Wednesday, and that could put bearish pressure on the greenback.

Another thing that has been driving this market has been the US/China trade tensions, which of course have started to calm down a little bit, and that should help the Australian dollar longer-term. That doesn’t mean that it will pull back like we have seen, but quite frankly I think that eventually we will find a buying opportunity. One signal would be is if we can wipe out the candle stick from the Tuesday session and break above it. That would not only clear the selling pressure of the day but it would also clear the 50 day EMA.

Another possibility is that we drop down to the 0.69 level, and then start to bounce again. If we get some type of supportive candle such as a hammer, that would also be a buying opportunity. I suspect that Jerome Powell will talk about how easy the money policy in the Federal Reserve is going to be, so I suspect that this down leg is somewhat limited in the pair. All things being equal I think that the markets will eventually rally but we are in the midst of building a base. That generally takes quite a bit of time, which is something that we are seeing right now.