The US dollar initially rallied against the South African Rand during the trading session on Friday, but then rolled over rather significantly. This flies in the face of the “risk off” situation that we had seen in the markets, but the South African Rand has a bit of built in safety mechanism in the form of gold. Remember, there is a lot of gold that comes out of that country, so it makes sense that the South African Rand would have rallied on Friday as gold broke out rather significantly.

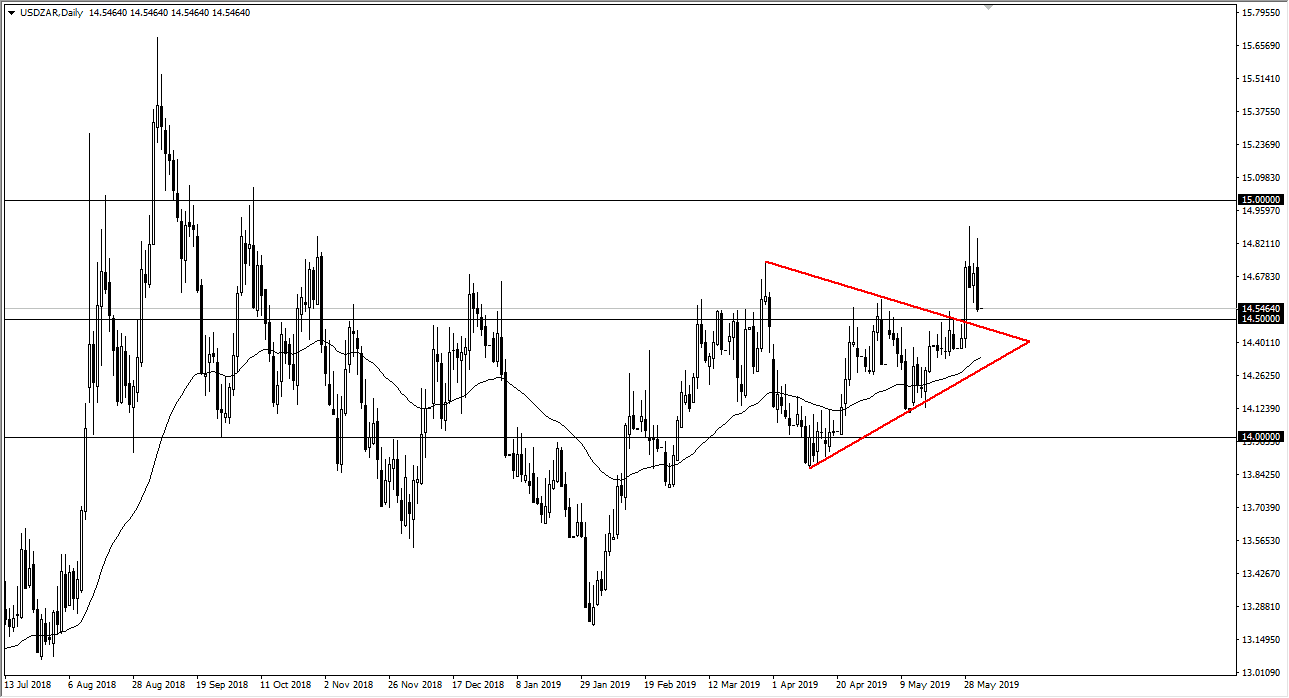

While the US dollar has also benefited in this “risk off” environment, but not necessarily against this particular currency. However, there is a technical pattern that I am watching that could lead to a bigger move. After all, we had recently broken above the downtrend line of a symmetrical triangle and reached towards the 14.90 Rand level. A pullback from there makes a lot of sense, and now it looks like we are going to test the top of that symmetrical triangle to see if it holds as support.

I suspect it probably will, because not only is that the previous downtrend line, but also the fact that the 14.50 Rand level has been important in the past and of course it will attract a certain amount of attention being a large number. Ultimately, this pullback looks as if it could be a buying opportunity and therefore paying attention to the short-term charts might be the best way to go. To the upside, the 15 Rand level would be a target for the longer-term move, and it seems as if we can get a little bit of support in this area, it’s likely that we go higher. I suspect the beginning of the day will be rather negative, but later on in the day I would anticipate a turnaround.