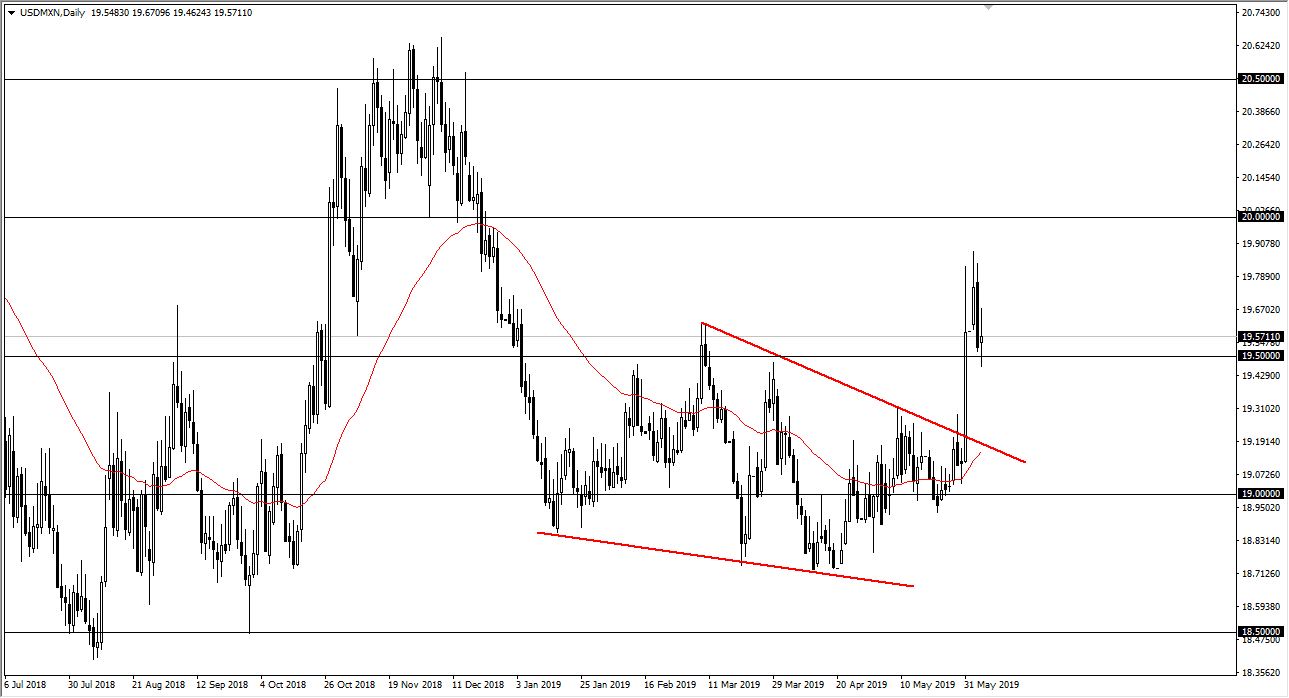

The US dollar went back and forth during the trading session on Wednesday, testing the range that we have been in over the last couple of days rather violently. This makes a lot of sense as the United States and Mexico enter talks and a lot of noise has gone back and forth via Twitter. Looking at this chart, the market seems to have quite a bit of support underneath at the 19.50 pesos level, which of course is an area that has been important more than once. By bouncing from there, it looks like we still have plenty of buyers for the US dollar. If the talks between America and Mexico don’t go well, this pair will start shooting towards the 20 pesos level without any hesitation at all.

The alternate scenario is that we break down below the bottom of the candle stick for the trading session on Wednesday, and then go looking towards the 19.20 pesos level, which coincides with the downtrend line that I have marked on the chart. This is a market that is not going to be trading on fundamentals but rather the occasional comments coming out of President Donald Trump, or perhaps other American officials. Beyond that, the Mexican delegation will have its own part to play in this, as it will produce headlines for domestic consumption. In other words, this is a market that is very noisy, so I think at this point you need to pay attention to the levels that I have mentioned, and trade it accordingly.

Looking at the chart, it’s likely that we will continue to see elevated volatility, but if the Americans and the Mexicans can come together, it’s possible that we may finally get a relaxed market that can be traded with more of a longer-term outlook. At that point, I would expect to see this market drop quite a bit.