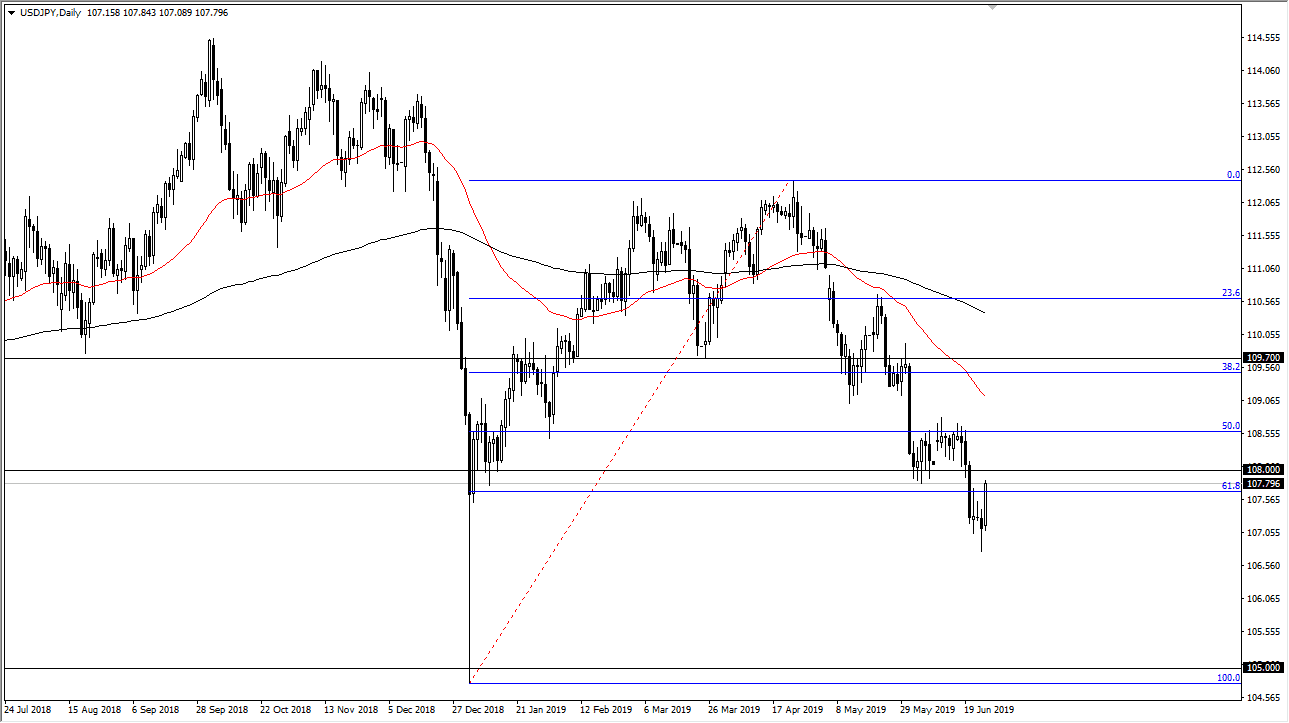

USD/JPY

The US dollar has rallied significantly during the trading session on Wednesday, reaching above the shooting star that had been formed a couple of days ago. That’s a very bullish sign, but obviously there is a lot of noise between here and several candles above. At this point, I think the market is probably going to continue to be very choppy and difficult, but I recognize that as we head towards the G 20 this weekend it’s likely that we are going to see a lot of volatility as traders are worried about the outcome of talks between the Americans and the Chinese. At this point, the market has a lot of noise above that it has to deal with so I don’t think it’s until we break above the ¥108.75 level that I can take a significant amount of risk to the upside. I anticipate that rallies will be sold off.

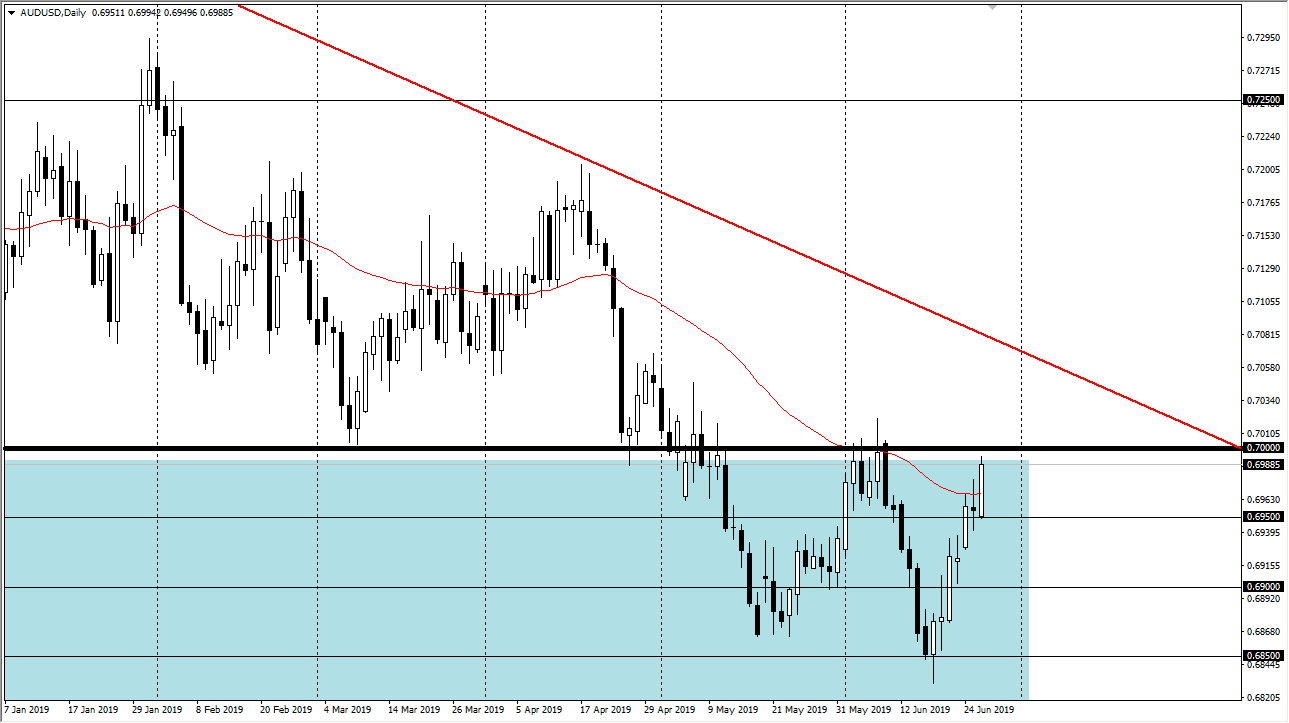

AUD/USD

The Australian dollar rallied significantly during the trading session on Wednesday, reaching towards the 0.70 level. There is a lot of resistance and that barrier, so I will be looking for some type of selling opportunity in this vicinity. That being the case though, I think you need to wait for some type of exhaustive candle to get involved. I do think it will appear, especially as we get closer to the weekend as we have a lot of potential for people looking to avoid that type of risk. I do think that the United States and China will probably disappoint traders around the world, and it’s very likely that we will see the Australian dollar get punished as a result. The market continues to bounce around in 50 pips increments.