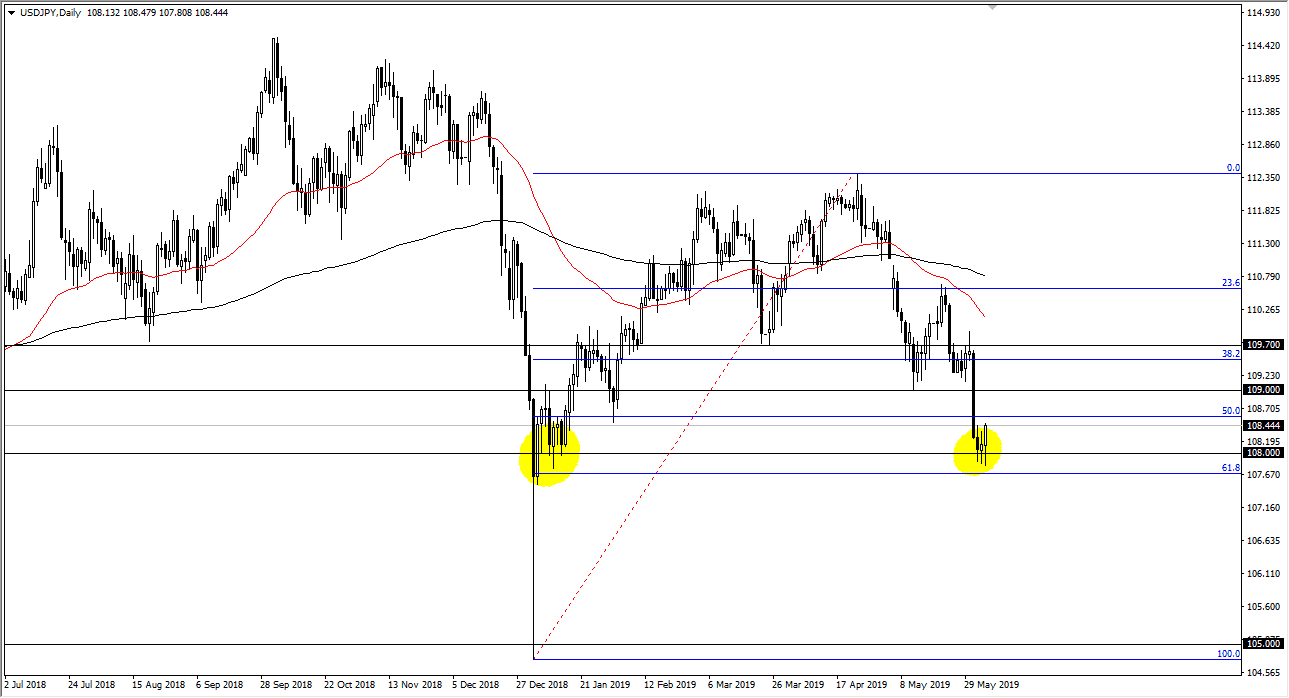

USD/JPY

The US dollar initially fell against the Japanese yen, breaking below the ¥109 level. The fact that we did so wasn’t a huge surprise, considering that the last couple of days has seen a lot of volatility. Looking at this chart, the 61.8% Fibonacci retracement level sits below there as well. Because of this, and the fact that we have had a bullish move during the trading session on Wednesday, I believe that we will probably break to the upside and go looking towards the ¥109 level. That’s an area that I think it extends to the ¥109.70 level for resistance, so it isn’t going to be easy to go higher. Remember, this pair tends to move with risk appetite so you can pay attention to stock markets in America and Asia to see where this may end up going. The alternate scenario as that we get some type of negativity in financial markets overall, and that could send this pair below the 61.8% Fibonacci retracement level, opening the door to the ¥105 level.

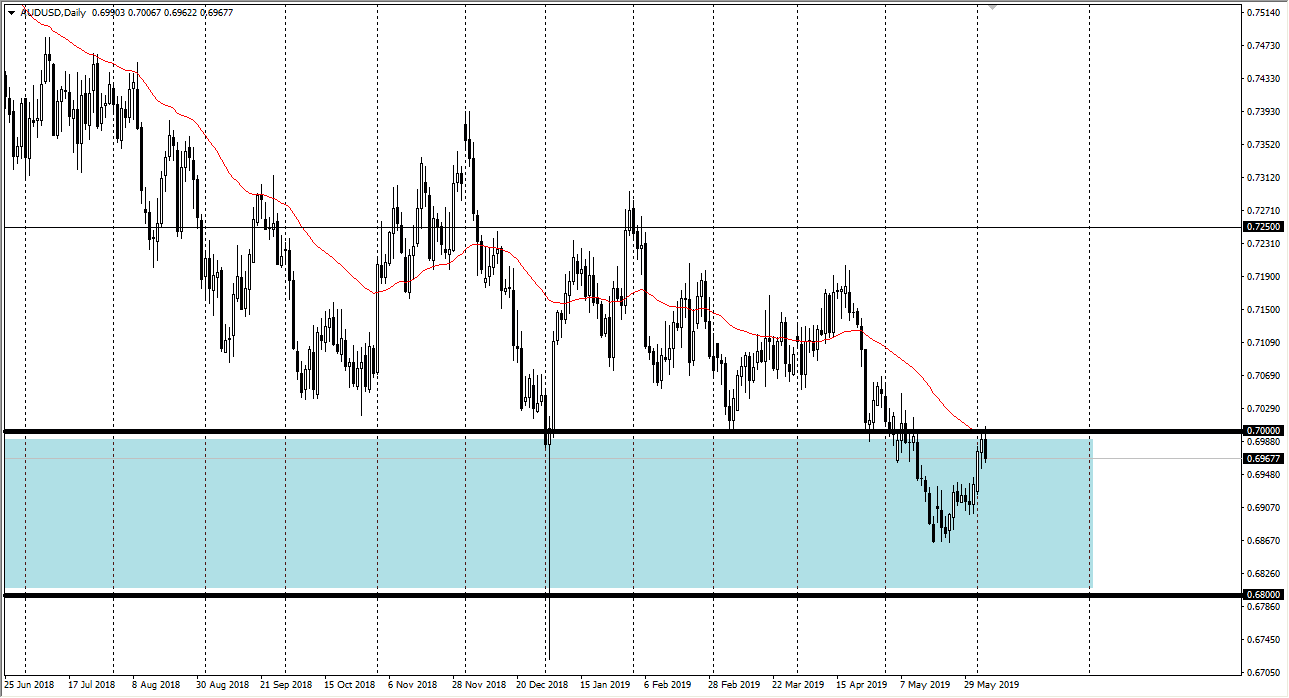

AUD/USD

The Australian dollar initially tried to break above the significant 0.70 level of resistance. However, we have turned around from there and it now looks as if we are ready to go lower. If we do, it’s likely that we could go down to the 0.69 handle. This is a pair that of course is sensitive to the US/China trade situation so pay attention to that. If we get more negativity, this pair should fall.

The alternate scenario is that we finally break above the 0.7050 level, and then we could go much higher, perhaps reaching towards the 0.72 level above. That would probably have something to do with good relations between the Americans and the Chinese.