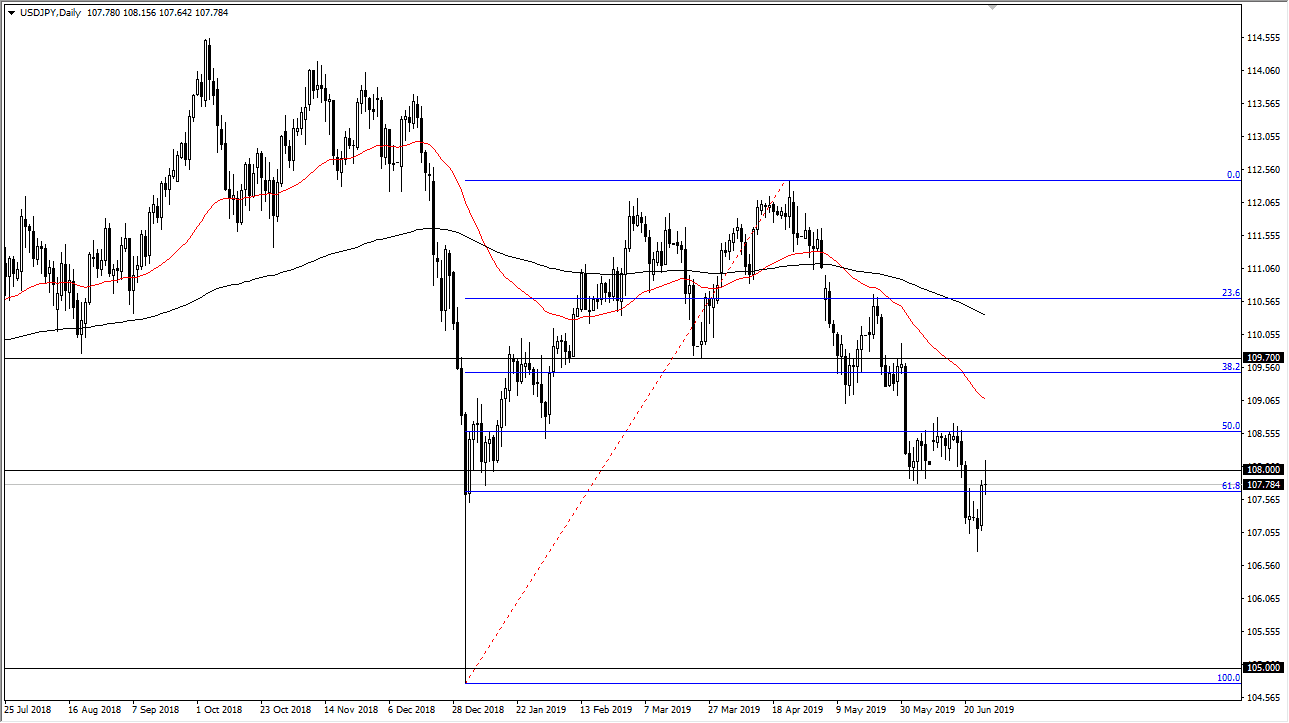

USD/JPY

The US dollar did try to rally during the trading session on Thursday but found enough resistance at the ¥108 level to turn things around and show signs of negativity again. This makes quite a bit of sense to happen, because we are heading into the G 20 this weekend. That being the case, it’s likely that a lot of “risk off” trading will come into play, attracting a lot of attention in general. That generally works out pretty good for the Japanese yen in general, so I believe that we will continue to see this market roll over. The fact that we formed a shooting star right at an area where I would expect to see resistance makes a lot of sense for sellers to come in and knock it down to the ¥107 level.

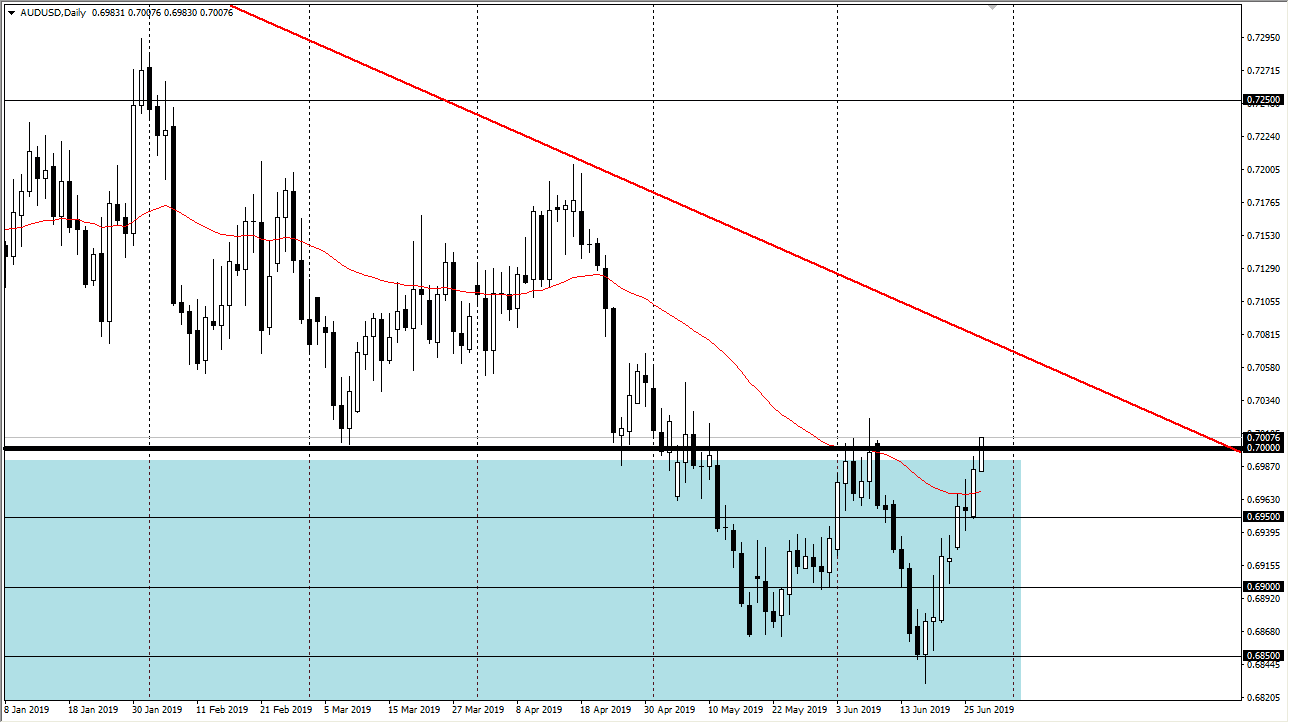

AUD/USD

The Australian dollar has rallied significantly during the trading session on Thursday as we continue to see the US dollar get hit a bit. However, there is a lot of noise just above and I think that we could see some exhaustion coming in and as we head towards the G 20. After all, the Americans and the Chinese talking each other has a direct effect on the trade war, and then trade war will have an influence on the Aussie dollar. Ultimately, I think that we are on the precipice of something big happening but we won’t know the full result until we get the results of the meeting between the Americans and the Chinese. I think there probably is going to be high possibility of disappointment, so I still believe that the sellers could come back into this market and punish the Aussie. However, if we were to break above the 0.7060 level, then we could break out a little bit more significantly. All things being equal though, I suspect it’s probably best to wait till Monday.