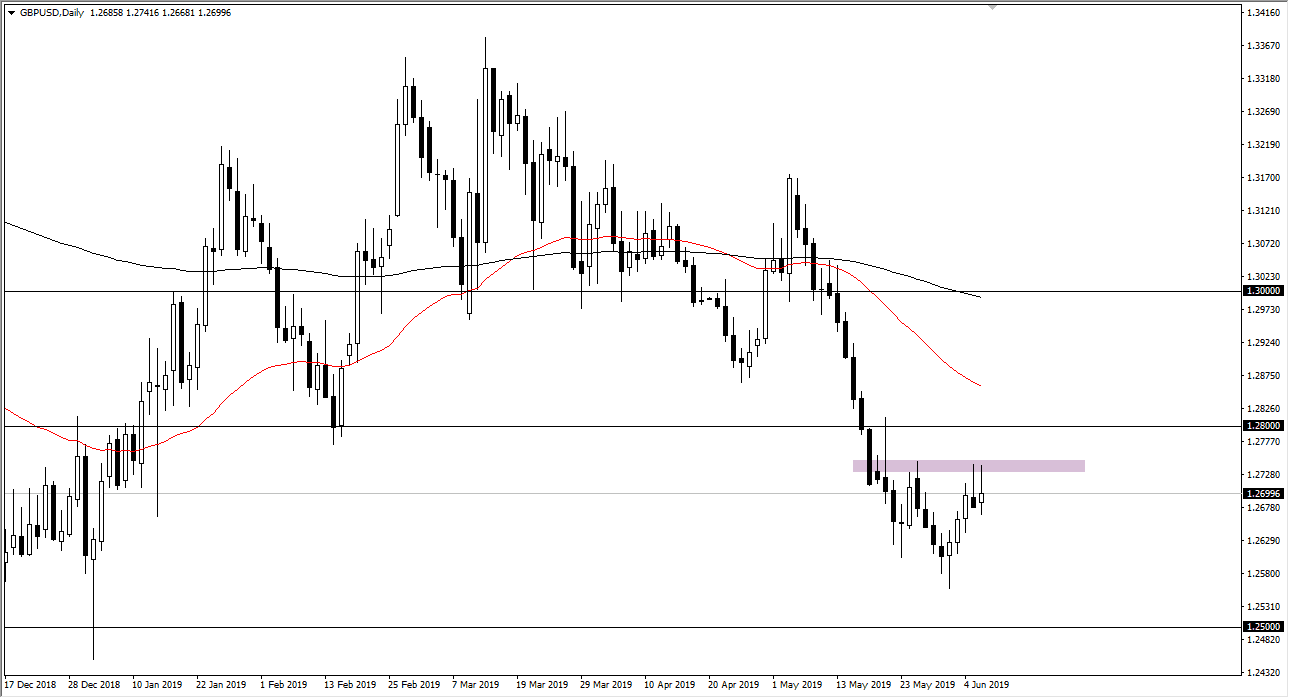

EUR/USD

The Euro initially fell during the trading session on Thursday but found enough support at the 1.12 level to continue the upward momentum and bounce significantly. Now that we have done that, we cleared the 1.1250 level and then reached towards the 1.1320 level again. However, sellers came back in late in the day and it tells us that we are simply going back and forth, but with more of an upward tilt as of late. If we can break above the 1.1325 handle, then we will test the 1.1350 level. A move above there opens up the door towards the 1.1450 level.

On the other hand, if we break down below the 1.12 level, we will probably go looking towards the 1.1150 level and then possibly even the 1.11 handle. Ultimately, this is a market that looks as if it is trying to build a longer-term support area, perhaps trying to change the overall trend. That being said, it’s going to be very noisy and messy.

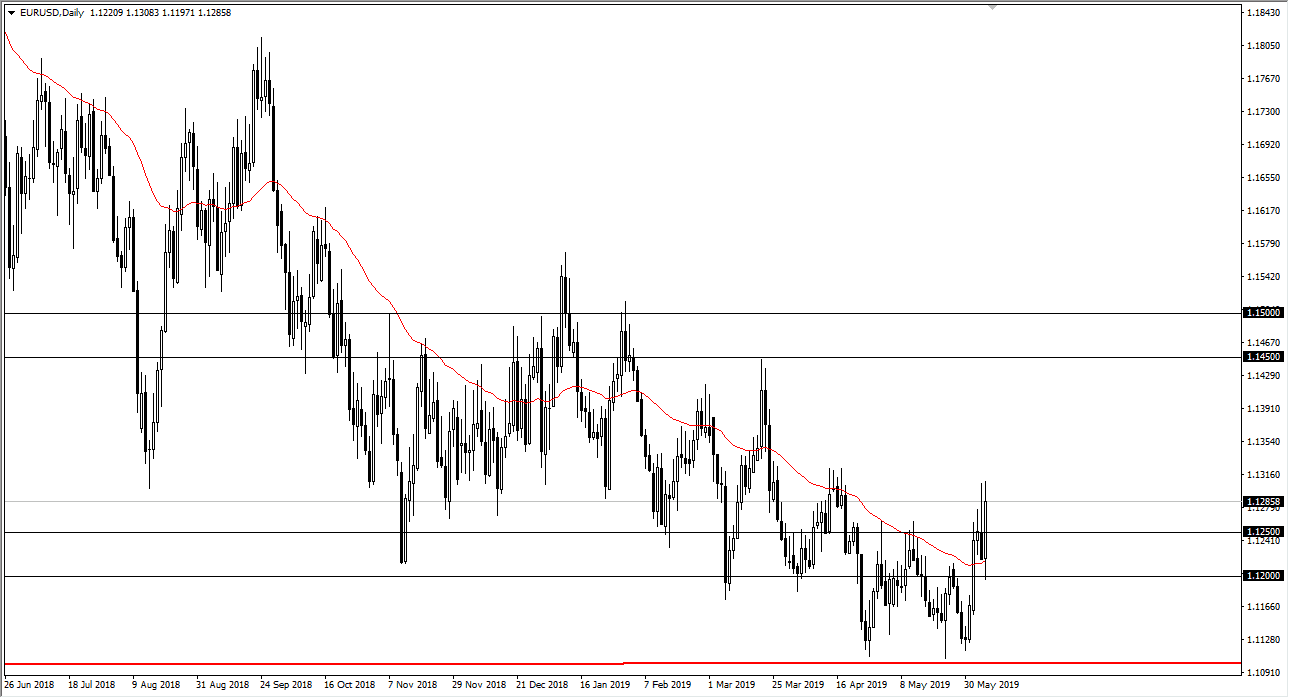

GBP/USD

The British pound initially fell during trading on Thursday and then shot straight up to test the same area we did during the previous session. At that, we started to see sellers yet again where I have the lavender box sitting. Now that we have formed a couple of shooting stars, I believe it’s only a matter time before the British pound sells off, perhaps reaching down towards the 1.26 handle. A break down below there fulfills the move down to the 1.25 handle which of course is massive support on longer-term charts in the meantime, and of course has a certain amount of psychological importance attached to it. The alternate scenario of course is that we break above a couple of shooting stars, and then go looking towards the 1.28 handle.