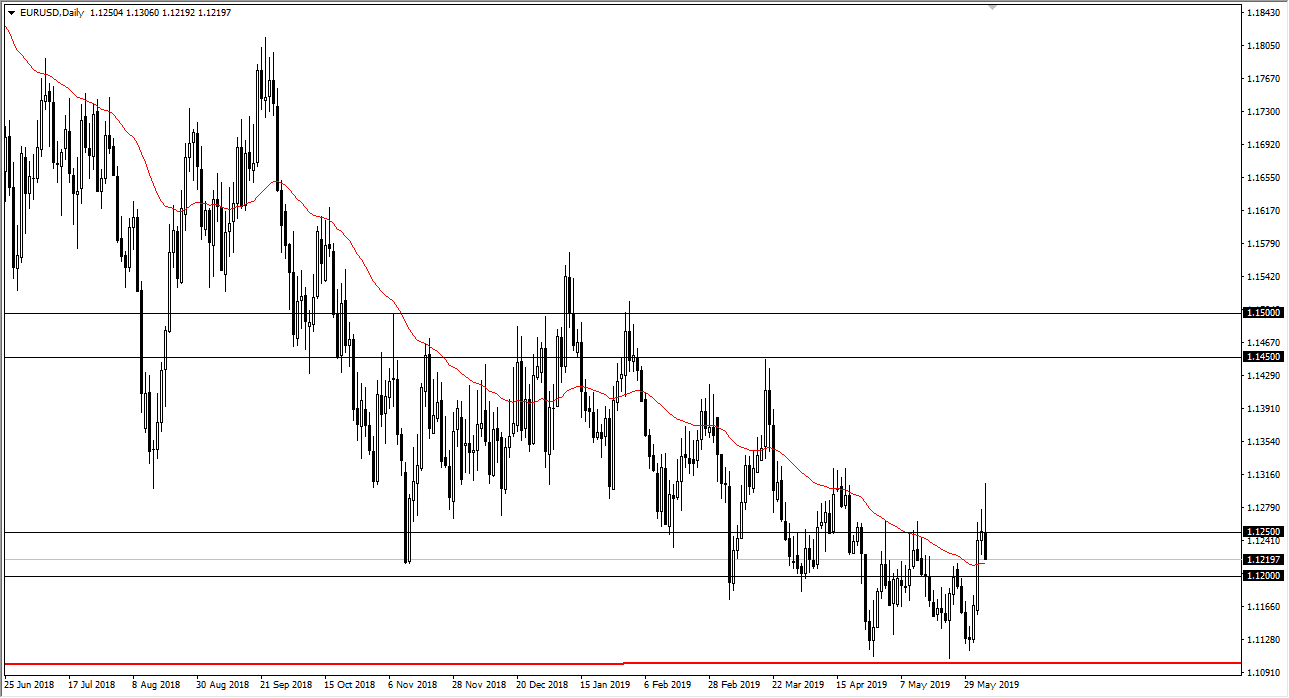

EUR/USD

The Euro initially shot higher during trading on Wednesday, reaching as high as 1.1320 or so, but then turned right back around to slice through the 1.1250 level. This move coincide quite nicely with the Gold markets rolling over, but we did park just above the 50 day EMA. The question now is whether or not we can bounce, or are we going to simply fall from here? I believe that the candlestick has shown just how resistant the 1.1250 level is going to be. The fact that we could not close above there tells me quite a bit, and therefore I think that the sellers are still very much interested in this market. If we break down below the 1.12 level, it’s very likely that we continue to go lower, perhaps down to the 1.1150 level, and then the 1.11 handle.

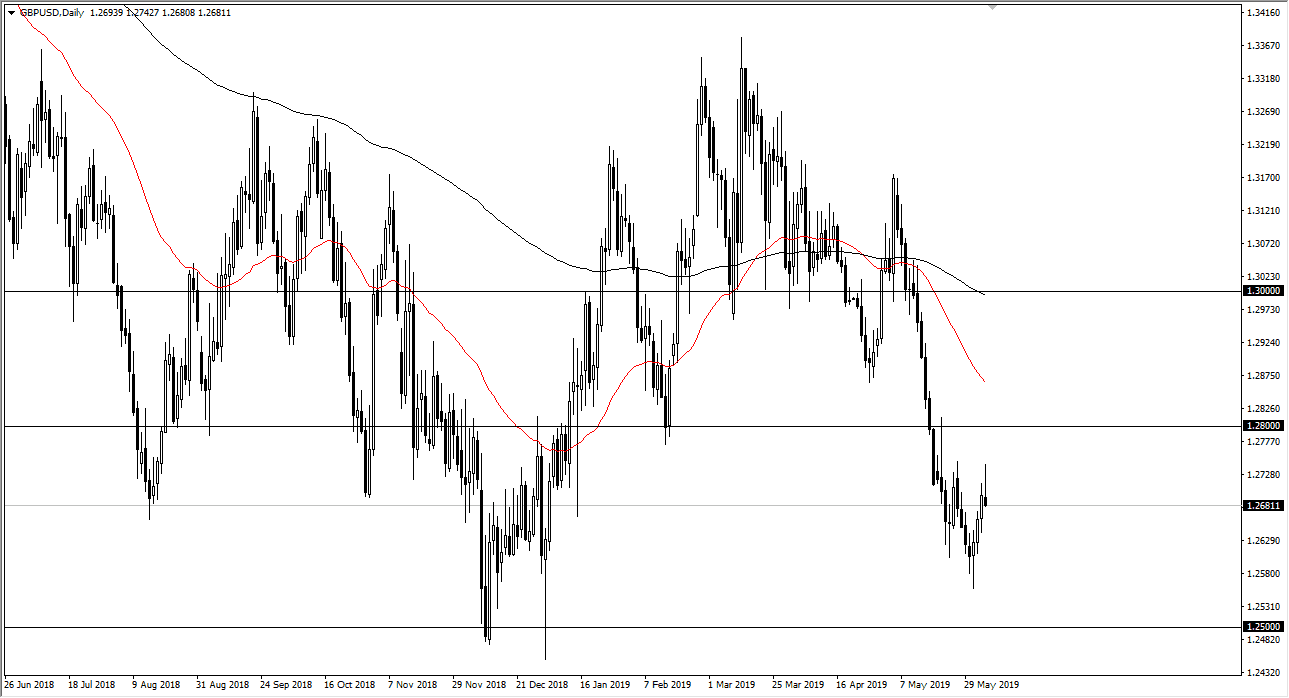

GBP/USD

The British pound initially tried to rally during the trading session on Wednesday as well but gave back the gains as we rolled over rather significantly. By forming a shooting star, it looks very likely that we are going to continue to drop from here. I believe that the market could go down towards the 1.26 level, and then eventually the 1.25 level as the level has been so important and of course the round figure will help as well. The alternate scenario of course is that we break above to the upside but I think that a break above the highs for the session on Wednesday has the market challenging the 1.28 level which I expect is even more resistive at that point. Too many Brexit headlines out there to keep this market going higher for any significant amount of time.