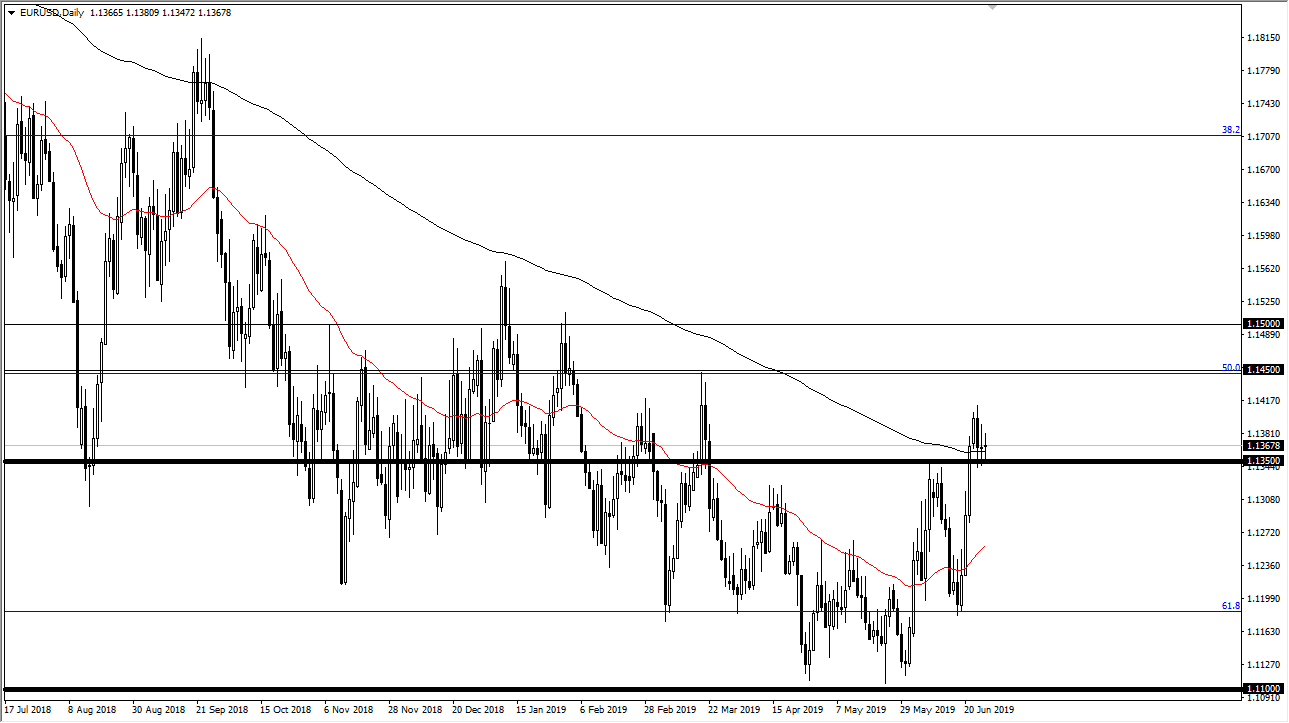

EUR/USD

The Euro went back and forth during the trading session on Thursday as we continue to bounce around the 200 day EMA. At this point, I think the market is simply looking for some type of reason to move, but that won’t be until we get to the G 20 meeting, and some type of statement coming out of either the United States or China. At this point, I think a lot of people are wondering whether or not the trade wars going to get worse, but at this point I think the thing that will be the biggest driver of this market is the Federal Reserve as well. After all, they are starting to talk about interest rate cuts, something that is a huge about-face as to where they had previously been. With that being the case, it’s very likely that we will continue to see choppiness, but I do believe that there is an upward proclivity eventually.

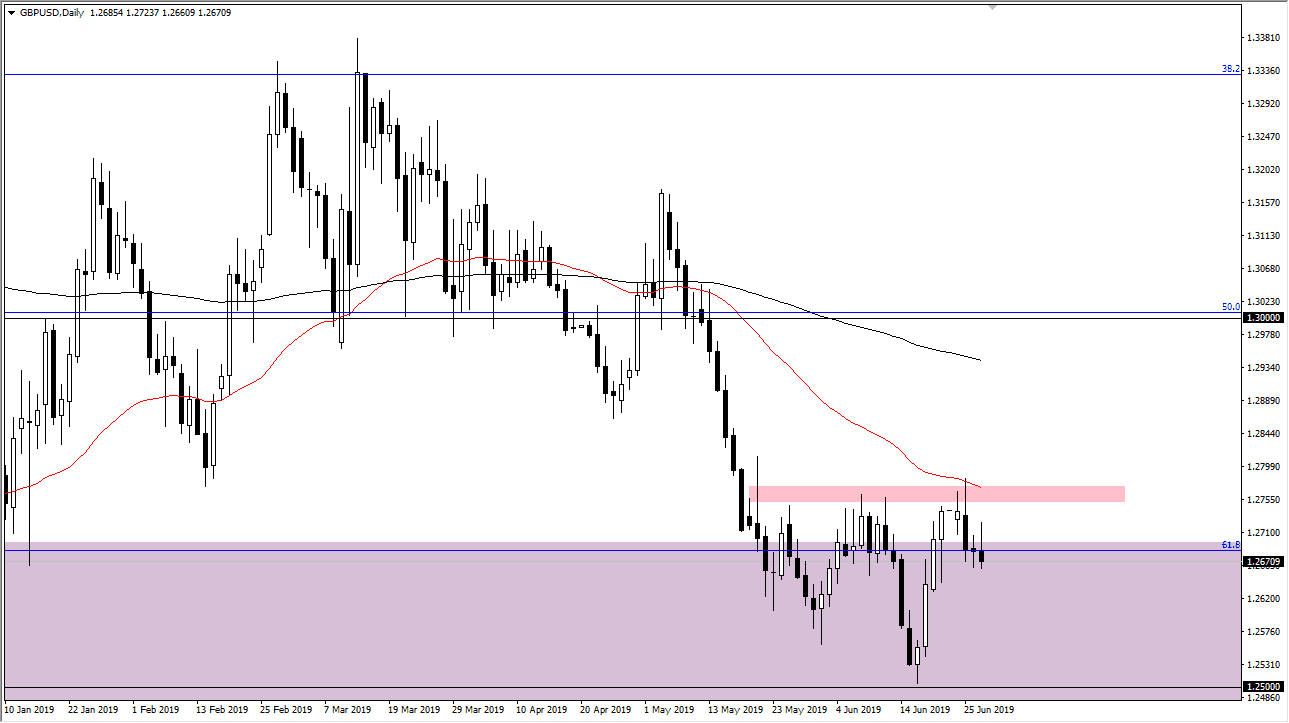

GBP/USD

The British pound initially tried to rally during the trading session but gave back quite a bit of the gains to form a less than impressive candlestick. With that in mind it’s very likely that we continue to see selling pressure, as the Brexit continues to weigh upon this pair, and of course the overall global geopolitical situation doesn’t favor a lot of risk-taking either. However, on the other side of the equation you have the Federal Reserve looking to cut interest rates down the road, so I do think there is a little bit of a floor underneath. However, if the US dollar starts to break down against currencies, the British pound may underperform due to the break away from the European Union causing so many issues.