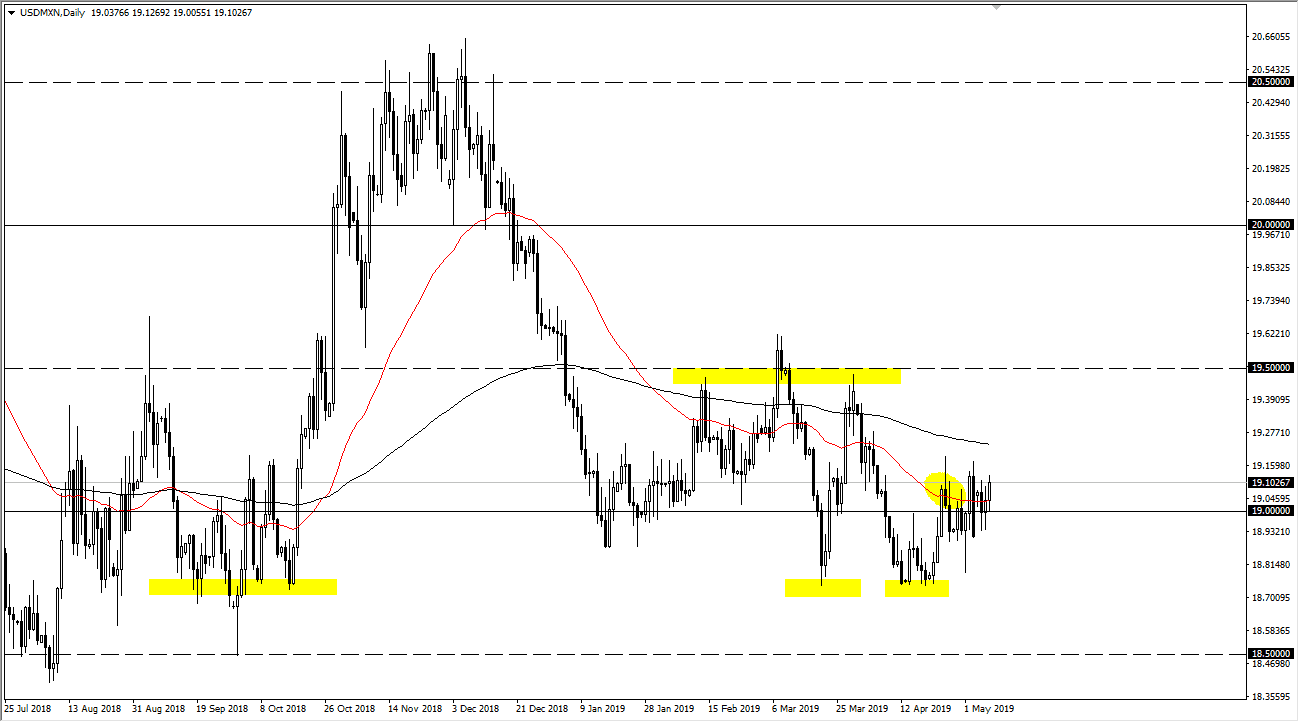

The US dollar initially pulled back against the Mexican peso during the trading session on Wednesday but has found enough support at the 19 pesos level to turn around and rally a bit. That of course is a good sign and could send this market much higher. After all, the US dollar has been strengthening for quite some time, and of course the Mexican peso is an exotic currency. This is a play on Latin America and of course emerging markets overall. With that in mind, one other thing that you should keep in mind that could come into play isn’t necessarily that it is a play on emerging markets rather than a play on US strength in general.

Just below the 19 pesos level I would expect a lot of support, but that support extends all the way down to the 18.90 pesos level. If we were to break down below that level, then we could unwind down to the 18.70 pesos level and below. All things being equal though, it does look like we are trying to rally a bit to try to reach towards the 19.50 pesos level again. After the last couple of weeks, we have seen a bit of a bottoming pattern and what my eye keeps being drawn towards is the massive hammer that formed last week underneath the 19 pesos level. That should continue to lift this market overall.

All that being said, the US/China trade relations will course throw monkey wrench into the Forex world in general, so we could see some issues pop-up. If that’s going to be the play going forward, it’s difficult to tell how that will affect this market. One would think it would be good for the US dollar against exotics, but the reality is that people will start to look for a riskier assets around the world, meaning they will be leaving the United States. It should be good for the peso if the trade deal gets worked on, although the reaction may be somewhat muted.