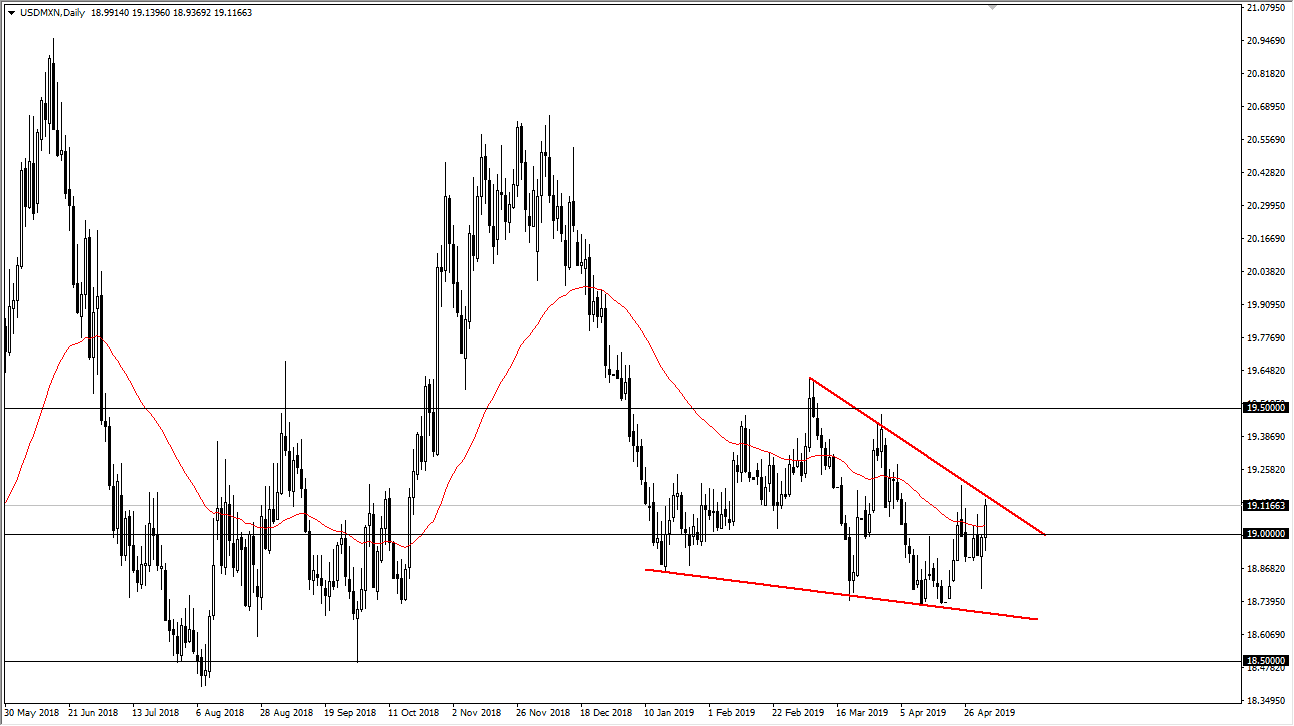

The US dollar initially pulled back against the Mexican peso on Thursday, but then turned around to break higher and towards the downtrend line above. At this point, it’s a bit premature to say this, but it does look like we are trying to form a bit of a falling wedge. If that’s the case, we could see a turnaround and a move higher.

Based upon the falling wedge, on a breakout we would go looking towards the highs of the wedge which is roughly 19.60 pesos. We have seen a lot of bullish pressure over the last couple of days, and the 19 pesos level seems to be offering support. We also have the 50 day EMA slicing through the candlestick, so it looks very likely that we are going to see a lot of technical trading.

With Friday being the jobs number in the United States, it’s very likely that the US dollar will be very volatile. The greenback will of course react to that, but it also will react to the crude oil markets when it comes to the Mexican peso. Remember, Mexico is a proxy for not only Latin America but also petroleum at points.

To the downside, we could we go reaching towards the 18.75 pesos level underneath which would be a continuation of what we have seen. Overall, the jobs number at 8:30 AM New York time, will slam this market in both directions before finally deciding on which direction we are going to take off in. Between now and the jobs number, the Mexican peso will probably be very quiet, mainly because most of the action is found during the north American session anyway, and then with the jobs number coming it will be especially quiet ahead of time.