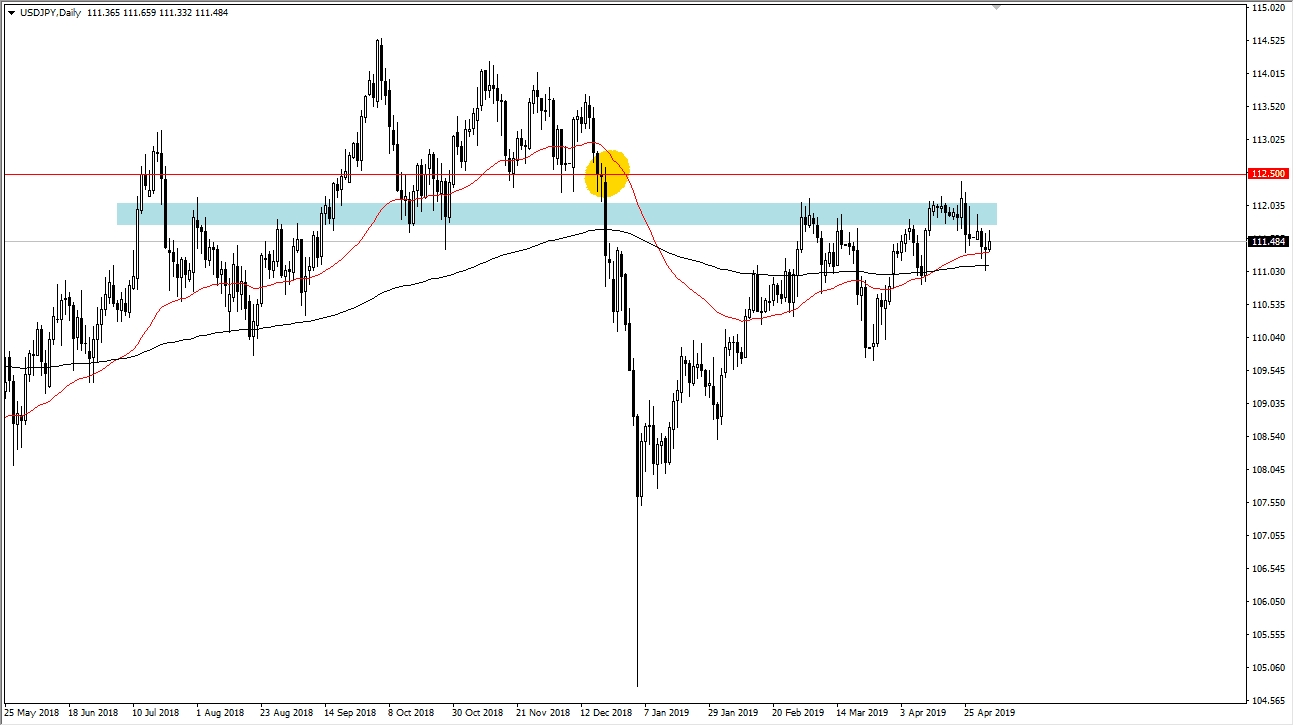

USD/JPY

The US dollar has rallied a bit during the trading session on Thursday but paired some of the gains towards the end of the day as we are simply hovering at the 50 day EMA. The 200 day EMA is just below there as well, hanging about the ¥111 level. That’s an area that will cause a certain amount of support, but if we break down below there the market probably goes down to the ¥110 level. That is an area that should attract a lot of attention as well. A breakdown below that really could start to unwind this market. However, the ¥112 level has been significant resistance, extending to the ¥112.50 level. If we break above there, then we could go to the ¥113.50 level. Ultimately, this is a market that is trying to grind to the upside and with the jobs number coming out on Friday, it’s very likely that this pair will be very volatile as it is highly sensitive to that announcement.

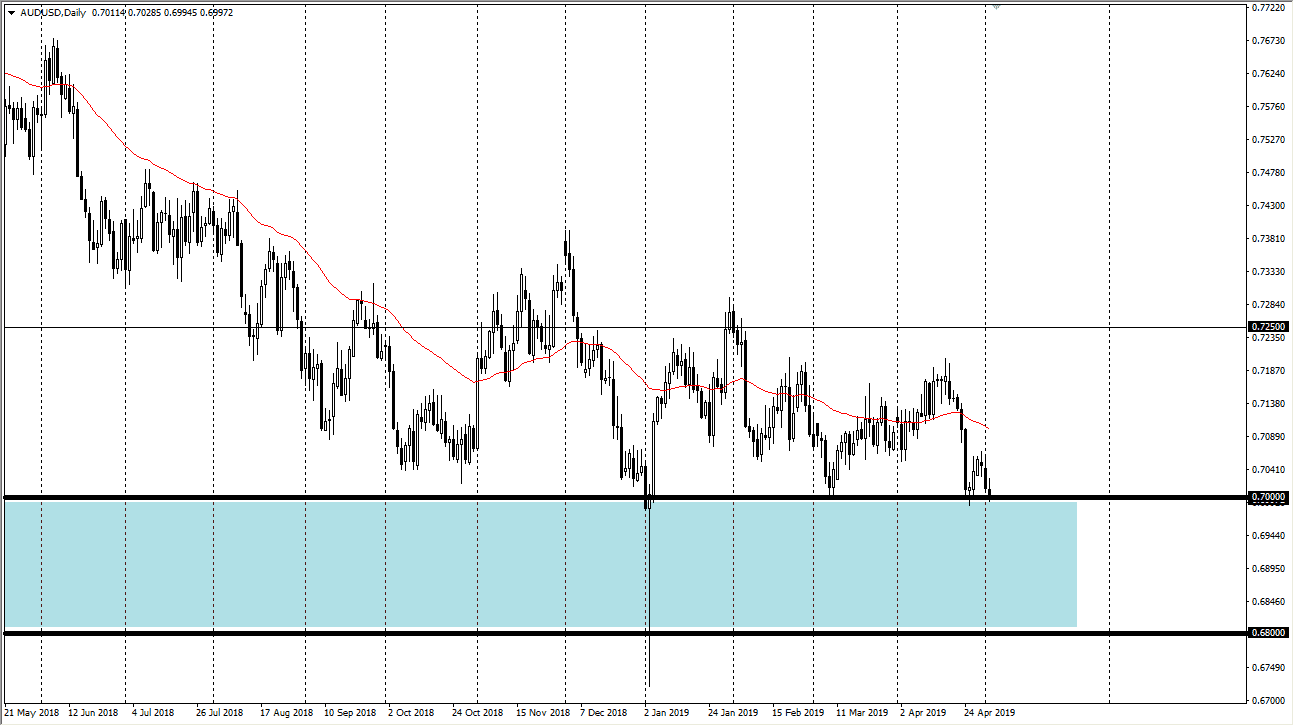

AUD/USD

The Australian dollar tried to rally in the very beginning of the session, but you can see has failed miserably. We continue to test major levels of support underneath, which for the most part I look at as the 0.70 handle. However, I recognize that support should extend down to the 0.68 level so I have no interest in shorting this market. It’s not that we can’t break down, it’s just that it’s going to take a lot of work. I much more comfortable buying some type of bounce and playing it from a long position, on longer-term charts. I think we’re trying to form some type of bottom, but right now we obviously have a lot of work ahead of us.