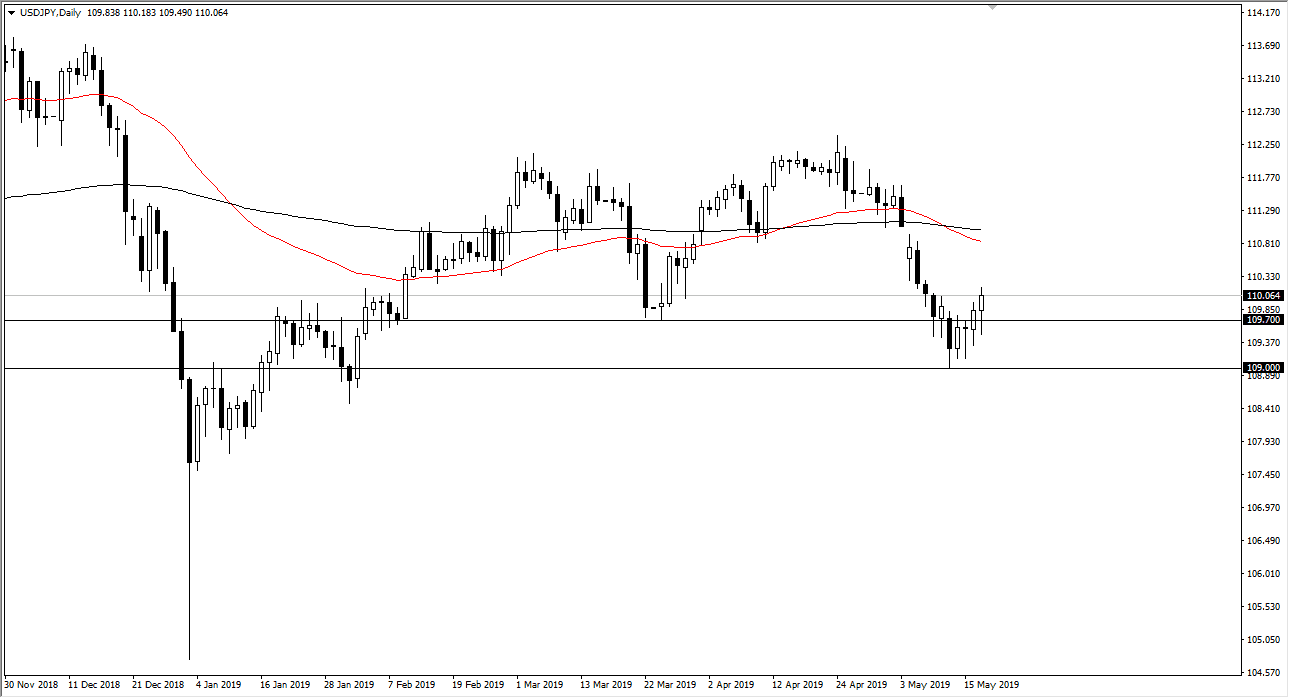

USD/JPY

The US dollar initially fell during the trading session again on Friday, but just as we have seen over the last several sessions, buyers come back in to turn around and rally again. At this point in time, it looks as if the buyers are willing to come in and pick up dips, taking advantage of the overall supportive area below. The ¥109 level is massive as far support is concerned, so it’s very likely that it will be difficult to break down through there. If we do, that would be an extraordinarily negative situation. If that happens, I anticipate that will go looking towards the ¥108 level, but more likely than not there should be plenty of buyers willing to get involved, especially if we continue to see the stock markets recover somewhat. The ¥111 level above is a major gap that needs to be filled, and it looks like we will try to do that.

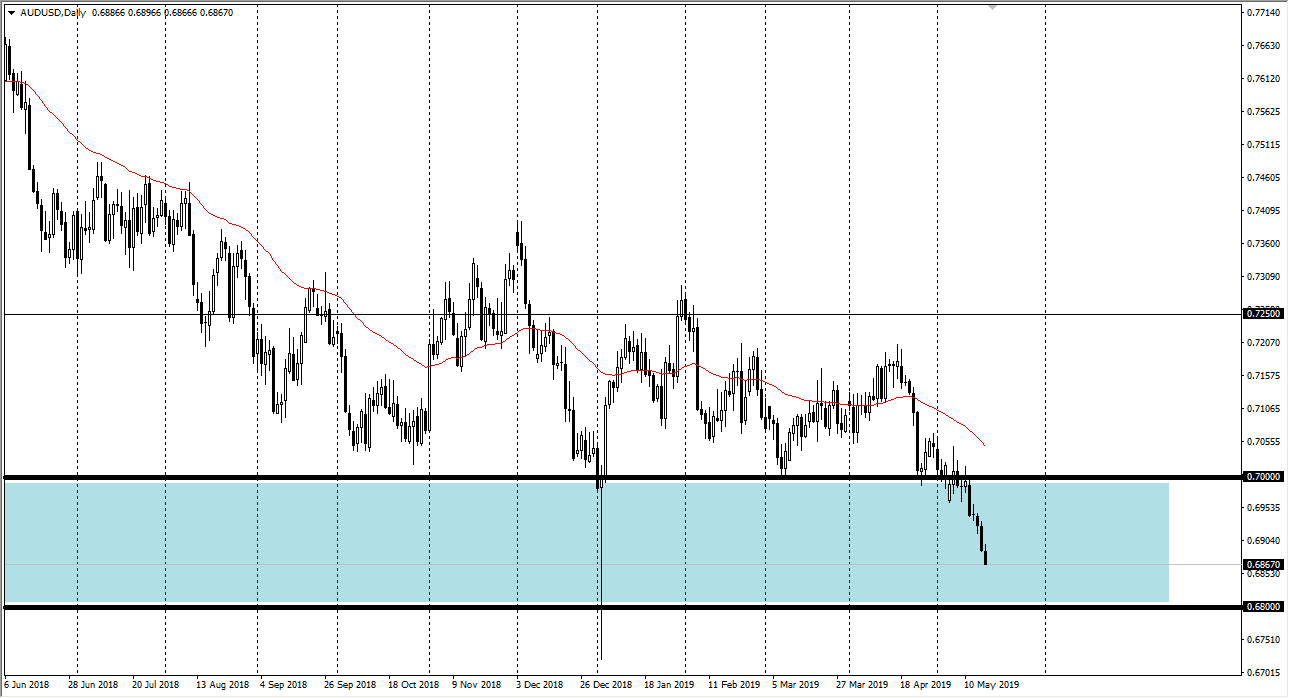

AUD/USD

The Australian dollar initially tried to rally during the day on Friday, but then fell significantly. At this point in time it’s likely that we will continue to see a bit of pressure to the downside, perhaps reaching down to the 0.68 handle. That’s the bottom of an overall consolidation area that offers significant support that starts at the 0.70 level.

With the US/China trade relations souring, it makes sense that this pair would continue to struggle a bit, but I think it’s only a matter time before we do find buyers. That being said, if we break down below the 0.68 level, then this market really could unwind, perhaps reaching down to the 0.65 handle. If that happens, I would expect the selling to greatly accelerate. At this point I am simply sitting on my hands.