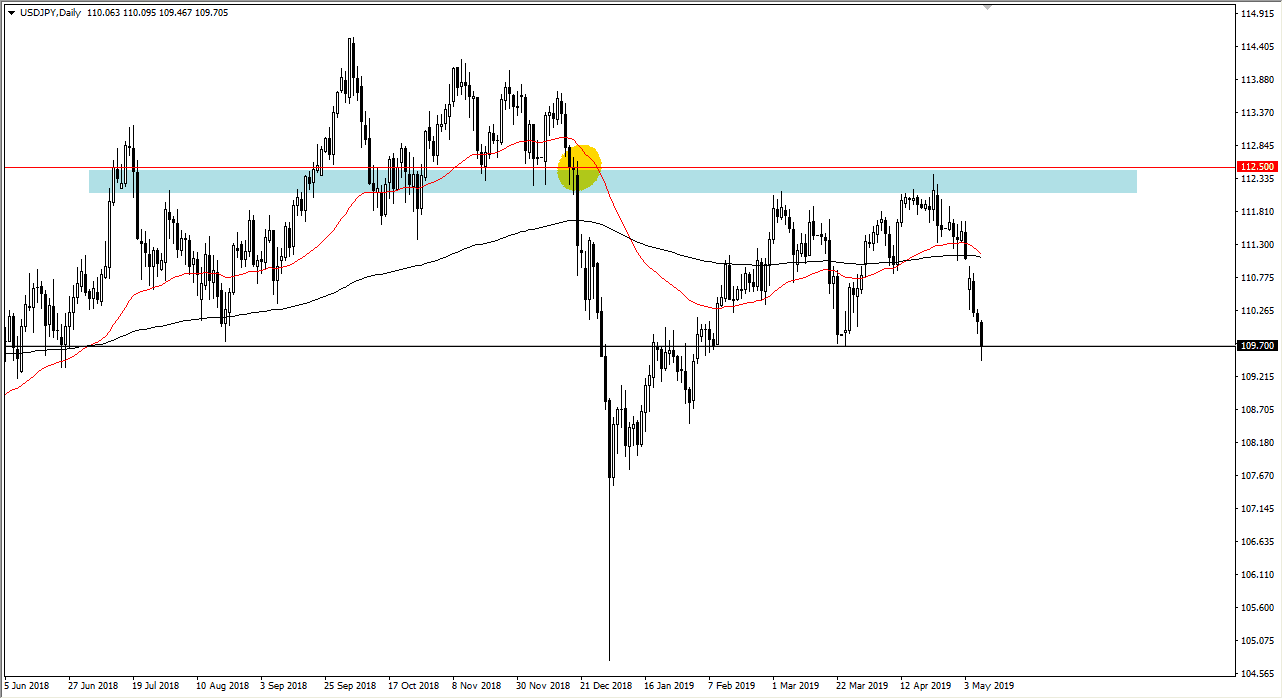

USD/JPY

The US dollar initially fell against the Japanese yen as the S&P 500 got hammered. However, we did see a bit of a recovery later in the day due to a couple of tweets, so the ¥109.70 level seems to be holding at support. The ¥109.50 level seems to be rather significant as well. The fact that we have found a bit of support here suggests that we could very well reenter the consolidation area above. Quite frankly, there’s a gap from several days ago at the beginning of the week that has yet to be filled as well, so I think there is the possibility that we go to the ¥111 level. If we break down below the ¥109.50 level, then we could open up the door down to the ¥109 level.

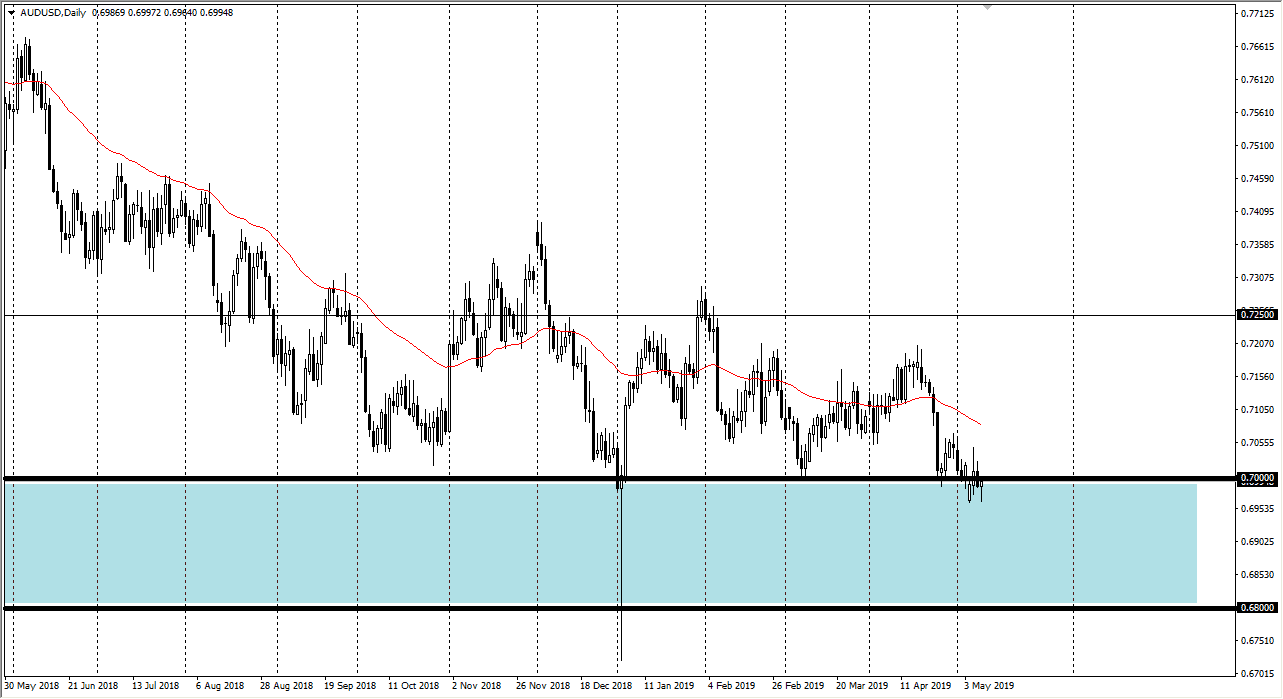

AUD/USD

The Australian dollar initially fell during trading on Thursday but recovered just as the USD/JPY pair did, showing signs of life again. This of course is a good sign because we are sitting right on top of major support. The support extends all the way down to the .68 level so it’s likely we could get a bit of a bounce from here. That being said, it’s probably best to be very cautious about this pair because it is going to be extraordinarily sensitive to the US/China trade talks that are going on during Friday.

I still maintain that the only thing you can do is buy the Australian dollar, because of the huge support barrier that extends 200 point. With that, I pay attention to what’s going on with the US dollar. If the US dollar starts to fall in strength overall, then I’m a buyer here. Otherwise I am on the sidelines and waiting for a trade.