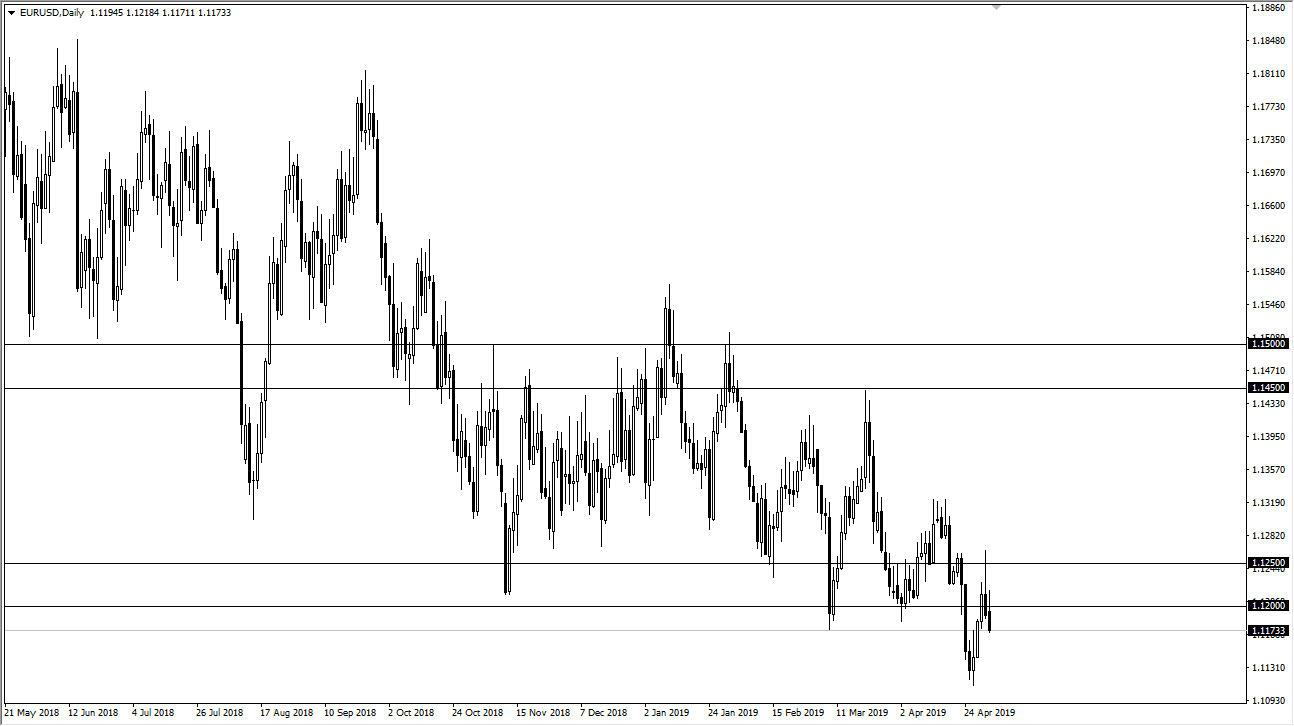

EUR/USD

The Euro initially tried to rally during the trading session on Thursday but gave back the gains as we continue to see a lot of selling pressure right around the 1.12 level. The market had recently been in consolidation with the 1.12 level offering a significant amount of support, so now it makes sense that we are seeing a lot of resistance in that same area. The shape of the candle stick is very negative, just as the one before it is. With that being the case, it’s very likely that we continue to see a bearish pressure, as the market may try to grind down to the 1.1150 level underneath. The alternate scenario is that we break the top of the shooting star from the Wednesday session, which would be an extraordinarily bullish sign. With Friday offering the jobs number in the United States, we could get a significant amount of volatility.

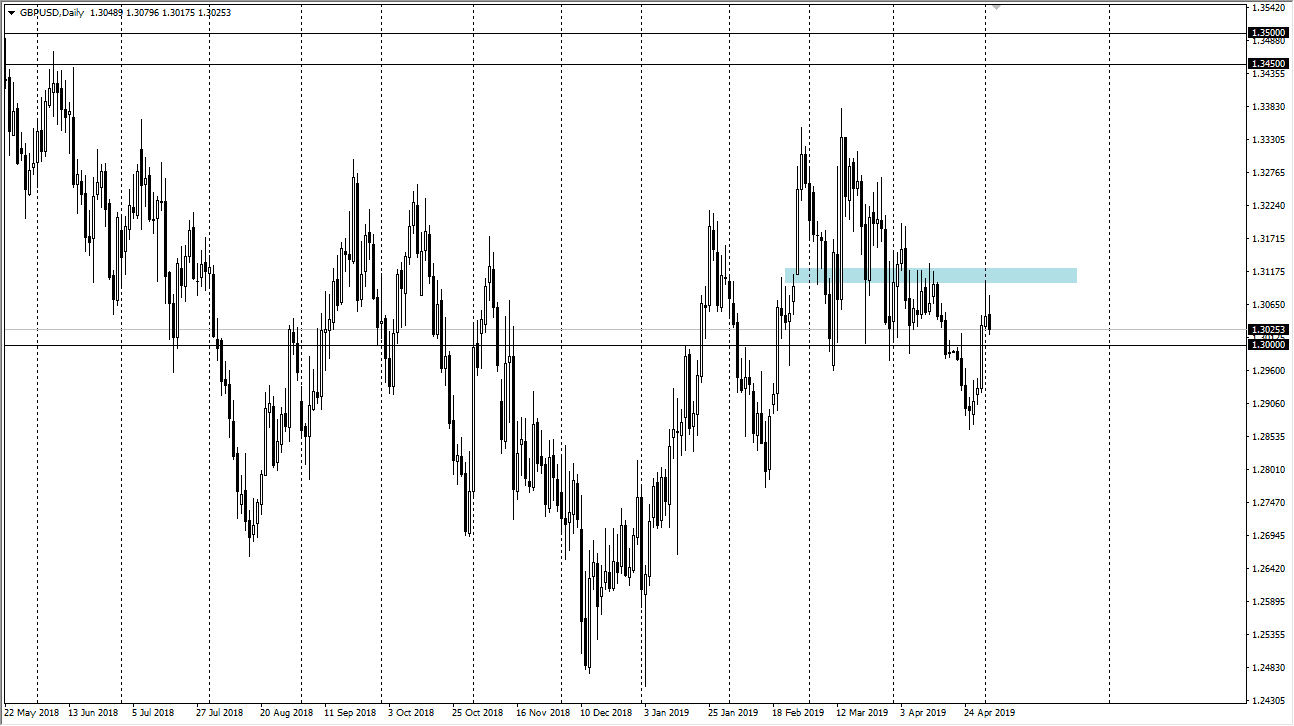

GBP/USD

The British pound initially tried to rally during the day as well, but also gave back quite a bit of the gains to turn around of form a bit of a shooting star. With this being the case, it’s obvious that we are struggling to get above the 1.31 level. At this point in time it’s a situation where we are selling any type of strength in the British pound, as the US dollar continues to be very bullish. With the Federal Reserve lacking any type of dovish nest when it comes to the recent press conference, it’s very likely will start to pay attention to the Brexit again, which has offered nothing in the way of good news other than the delay that the parties involved had recently signed.