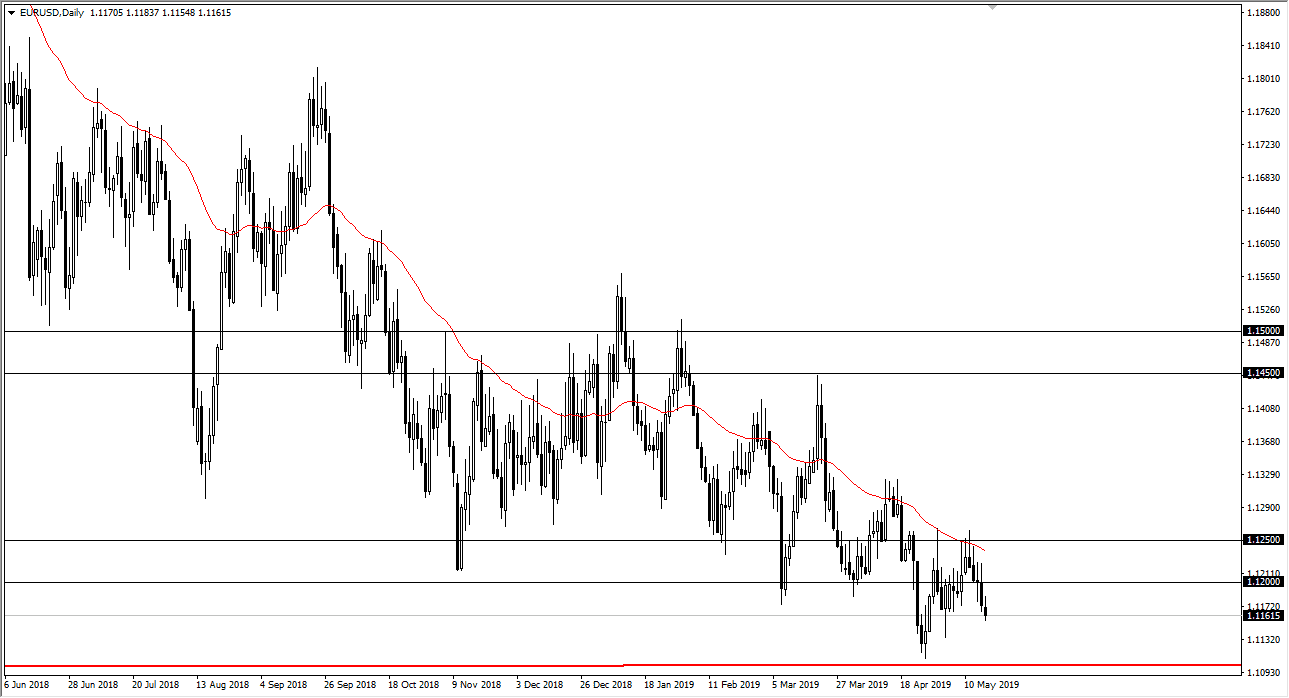

EUR/USD

The Euro initially tried to rally during the trading session on Friday, but gave back the gains later in the day, reaching down towards the 1.1150 level. This is an area that is rather important, but I do think that we continue to grind lower based upon the recent action. The market looks very likely to test the 1.11 handle, and then perhaps break down below there to reach towards the 1.10 level. That’s an area that will be crucial, and as a result I think that the market participants will continue to sell these short-term rallies on signs of exhaustion. The 1.12 level above is resistance, so if we break above there then we could possibly go to the 1.1250 level.

The Euro is being beaten down, mainly because of lack of economic growth, and of course the interest in the US stock markets. That drives up demand for US dollars, thereby driving this pair lower.

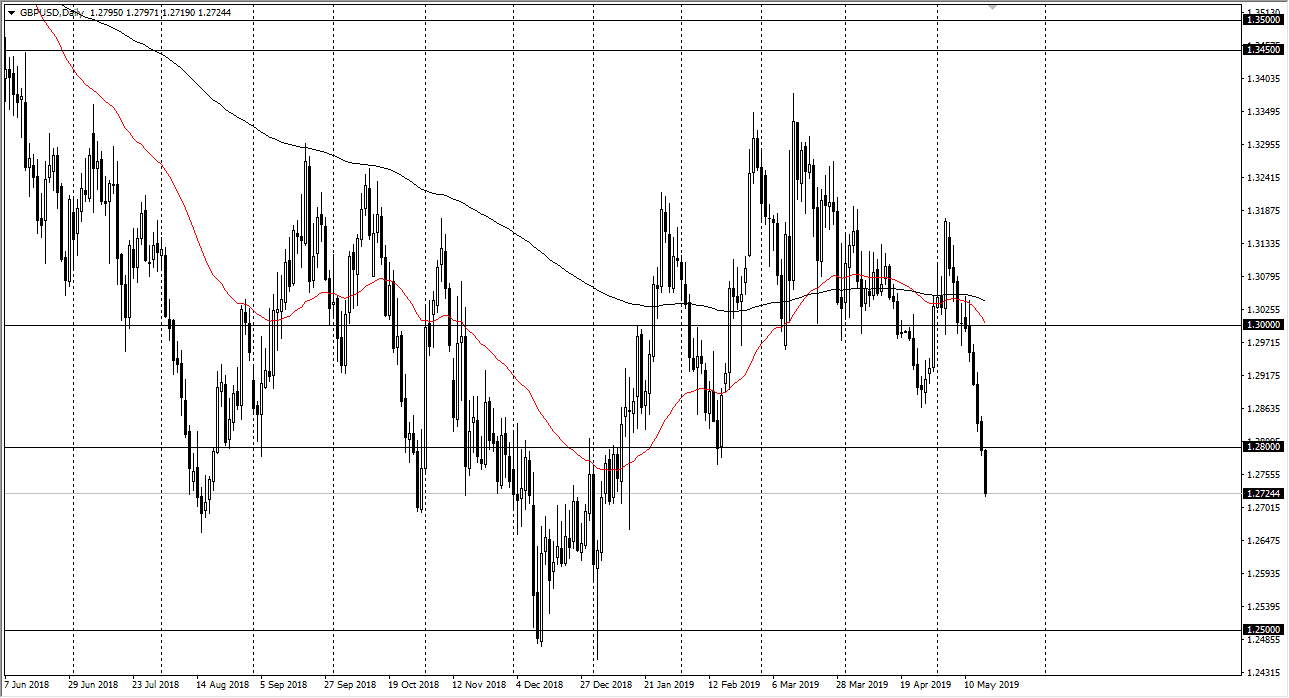

GBP/USD

The British pound broke down during the trading session on Friday, breaking below the 1.28 handle. By doing so, we reached towards the 1.27 level, and as a result it’s very likely that we could continue to see a lot of noise. At this point, I think it’s only a matter of time before we do find buyers though, because there should be plenty of interest in this oversold market. However, I would wait for some type of supportive daily candle stick to start trading, because quite frankly you should have plenty of time to make that decision. If we break down below the 1.27 handle, it’s very likely that we then go down to the 1.25 handle underneath which is even more important. Lots of headline risk still remains with the British pound.