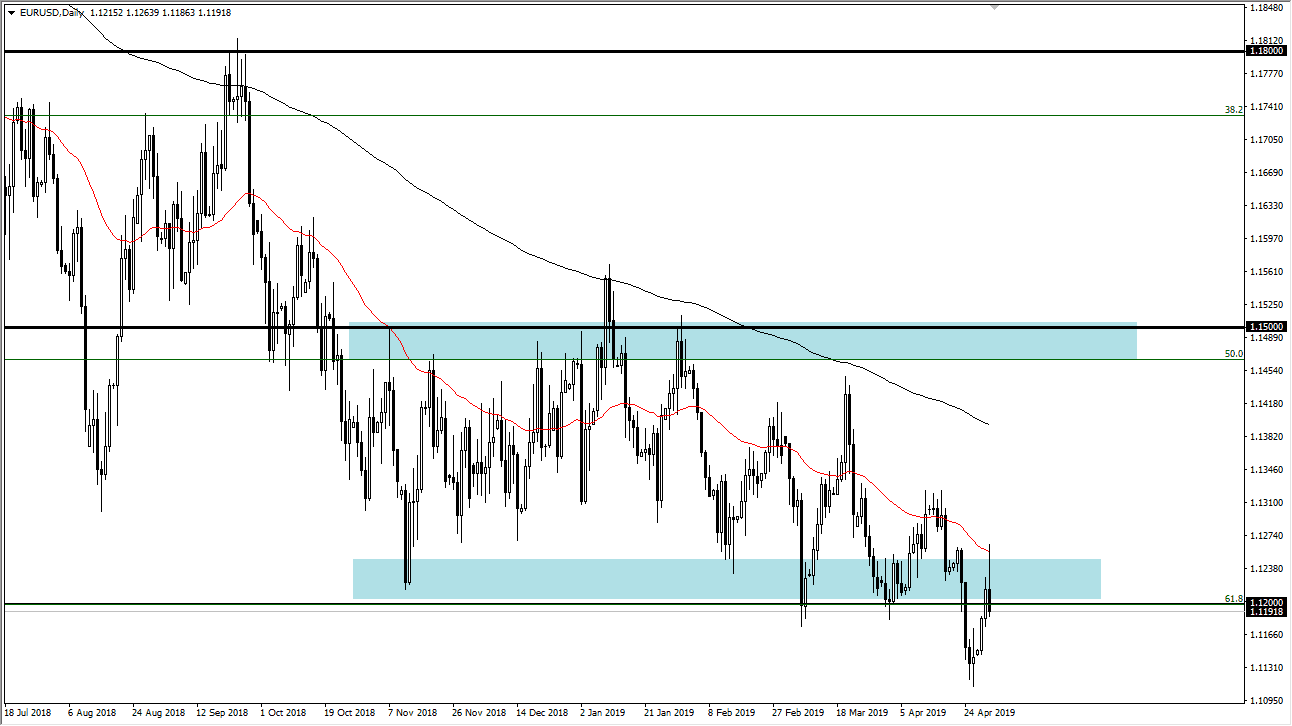

EUR/USD

The Euro initially rallied significantly enough during the trading session on Wednesday but struggled at the 50 day EMA. There was a huge move and volatile timeframe during the Federal Reserve press conference. With that being the case, we suddenly turned around as Jerome Powell did not suggest that a rate cut with anywhere close. There had been a lot of thought in that direction as of late, but if it certainly isn’t going to happen then the US dollar should continue to cause a lot of strength. That strength is going to be difficult to overcome, but I do believe that the greenback will continue to strengthen because of this. Looking at this chart, it’s obvious to see that we got turned around at the previous support level, which is now acting as resistance. This is textbook technical analysis. If we continue lower, the 1.11 level will be targeted, followed by the 1.10 level.

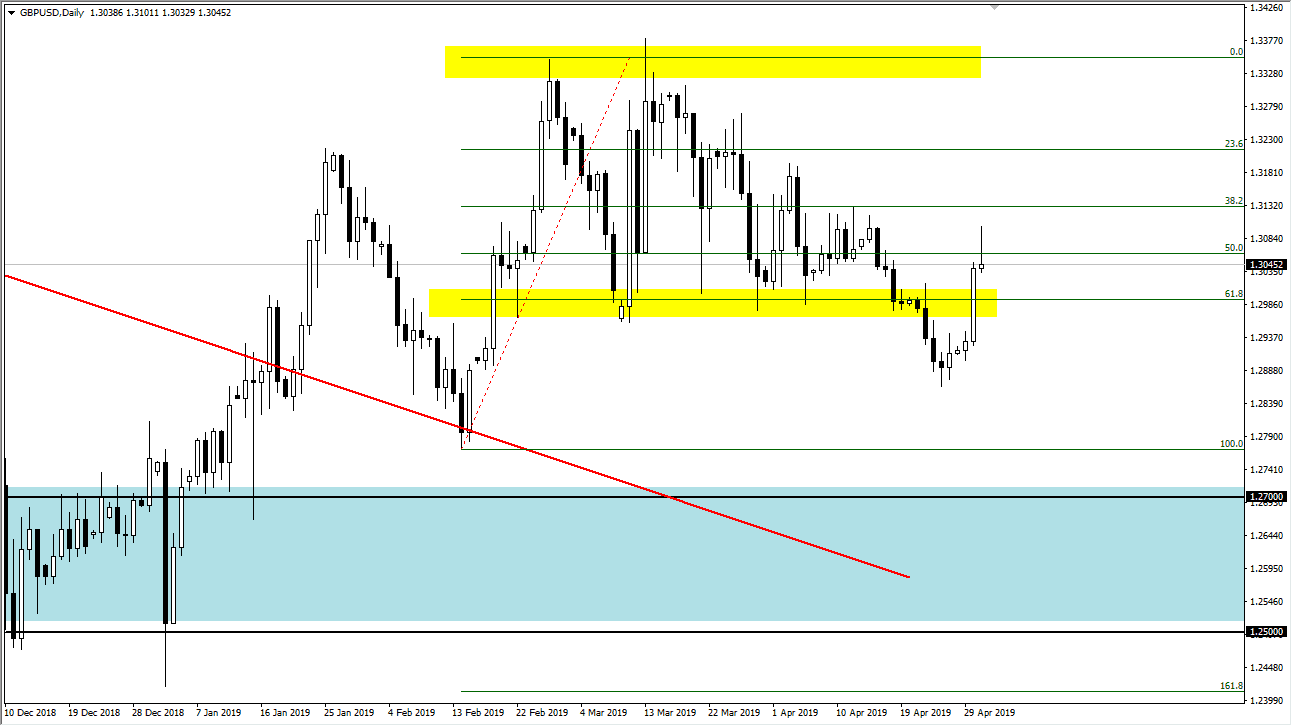

GBP/USD

The British pound initially shot higher during the trading session on Wednesday as well but found the 1.31 level to be a bit resistive. Now that we have done that, I believe that the market is going to roll over from here and continue to go lower. It makes sense, because a lot of what we have seen in the British pound over the last 48 hours has been due to the idea of a potential second referendum. However, with the Federal Reserve looking likely to stay on the sidelines, that means there’s no rate cut coming. That should strength in the greenback and therefore send this market back down to the lows again. If we break above the 1.31 handle on a daily close, then it’s a very bullish sign.