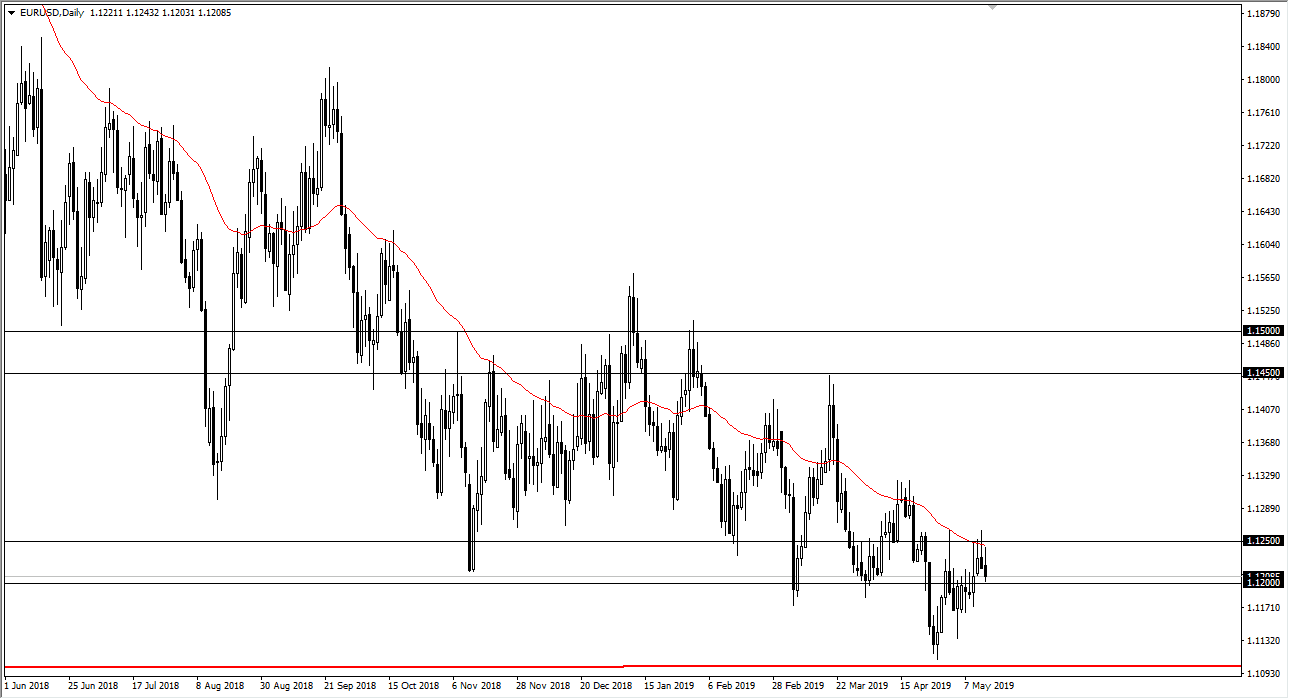

EUR/USD

The Euro tried to rally again during the trading session on Tuesday, but then broke down significantly to form a bit of a shooting star again. This is a market that continues to show massive resistance near the 1.1250 level, which is also accompanied by the 50 day EMA. With that being the case, it’s very likely that we will try to slice through the 1.12 level, and then perhaps down to the 1.11 handle after that. We certainly have enough reasons out there to think that money may flow back into the US dollar, and perhaps even more specifically the US treasury markets. As we have formed three shooting stars in a row, it tells me that the Euro may be in a bit of trouble. Having said that, if we were to break above the middle shooting star, the Monday candle stick, that would be an extraordinarily bullish sign.

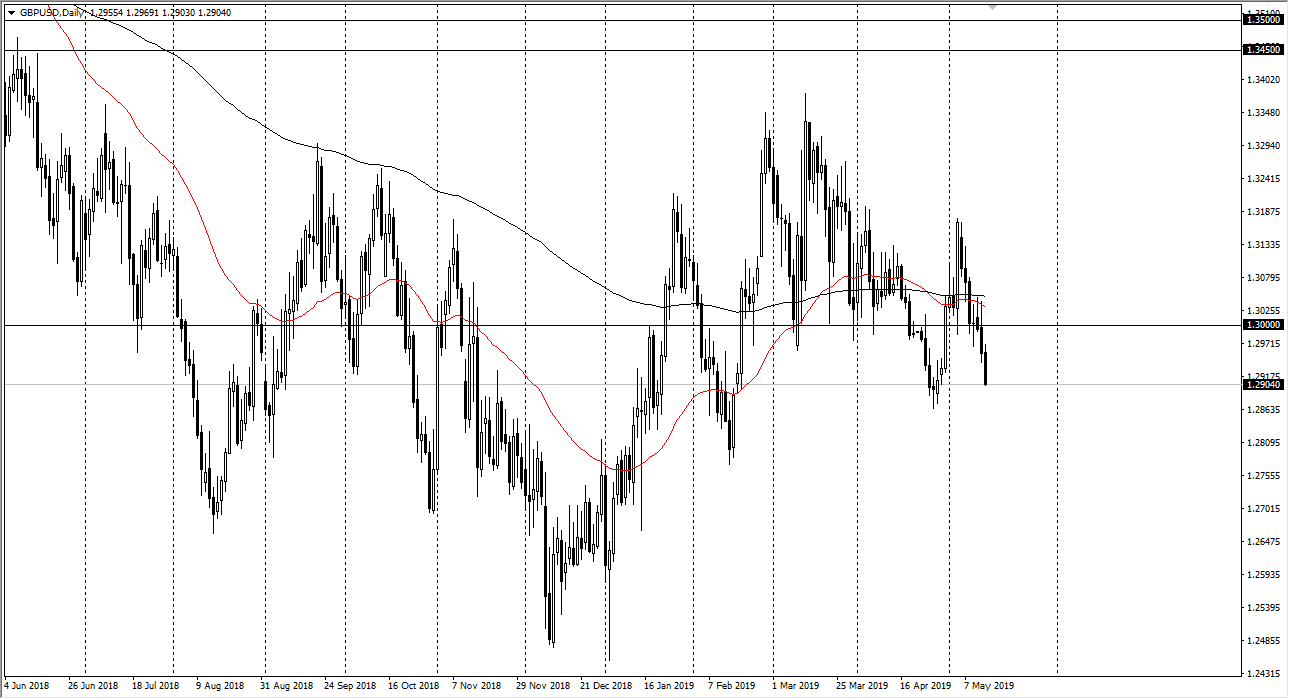

GBP/USD

The British pound of course fell also, as we continue to see a lot of volatility in Sterling. This is a market that is testing the 1.29 level, an area where we could see a bit of support. However, if we break down below the 1.2850 level, then we could go down to the 1.28 handle after that. Otherwise, if we bounce from here we could try to go towards the 1.30 level above, but it’s going to take some good news coming out of either the United Kingdom or perhaps the risk appetite of markets around the world to make that happen. I suspect at best were going to see a consolidating marketplace but I do recognize that we are at historically cheap levels so longer-term traders are probably picking up the British pound at these lower levels.