The USD / CAD path is still bullish, and despite the rise in crude oil prices supporting the CAD, investors' flight from risk appetite has stopped the Canadian market from achieving strong gains. Concern over US-China trade talks has increased and will continue this week as Chinese negotiators arrive in Washington with a Friday deadline set to raise US tariffs on Chinese goods. If there is no significant progress in resolving their dispute, the United States will raise tariffs to 25 percent on goods imported from China worth 200 billion dollars. The latest US move is aimed at pressuring China to agree to what the United States wants. But it is unclear whether they can do so quickly enough to avoid the deadline on Friday.

Canadian housing starts jumped 22.6 per cent in April, easing fears about the performance of the Canadian economy. Oil prices rebounded after a sharp drop in US crude inventories. The housing data supported the Bank of Canada's view of the temporary adverse winds that pushed the Canadian dollar higher but not enough to keep away from the developments of the trade war.

The pair will be watching today the release of the Canadian trade balance. From the US, there will be announcements of unemployment Claims, the trade balance, the PPI and comments by Federal Reserve Governor Jerome Powell.

Oil prices rose after the sudden drop in US crude inventories. Where it was announced of a drop of 4 million barrels against expectations of an increase by 1.1 million barrels. Oil price gains are under pressure from increased trade concerns between the United States and China and rising inventories in the United States. The sudden drop in oil stocks has boosted prices despite continued concern over a possible trade war. Chinese negotiators will be in Washington to start another round of negotiations as the United States prepares to increase tariffs on Friday. US sanctions against Iran and Venezuela, along with the Opec + cut agreement, have kept oil prices stable, but expectations for energy demand have been affected by a possible tariff escalation from the world's two largest economies.

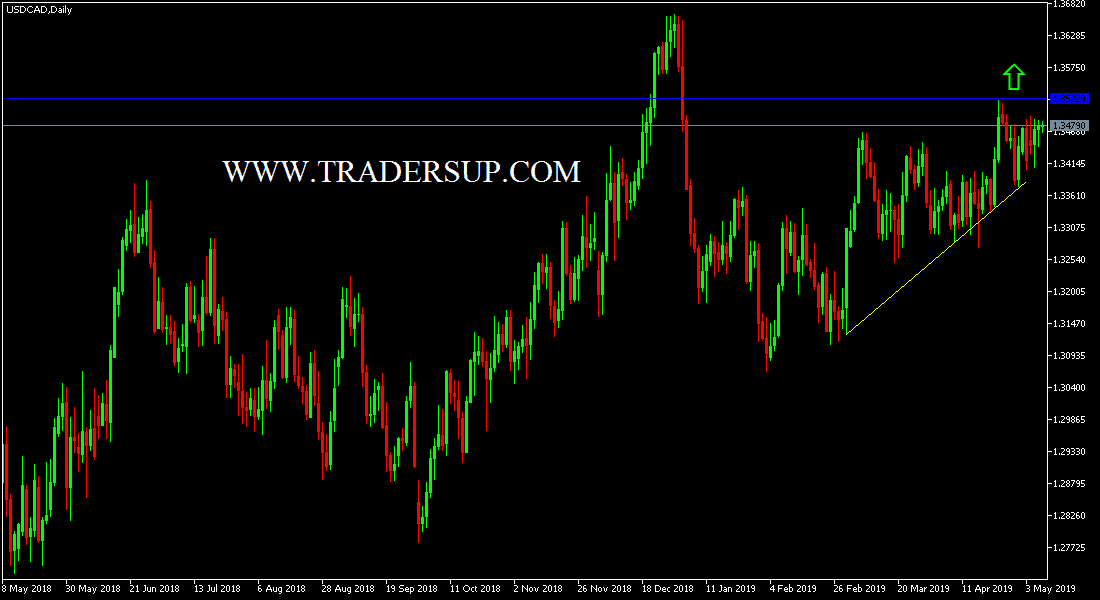

The most important support levels for USD/CAD today are: 1.3430, 1.3365 and 1.3280, respectively.

The major resistance levels against the USD/CAD today are: 1.3520, 1.3600 and 1.3685, respectively.