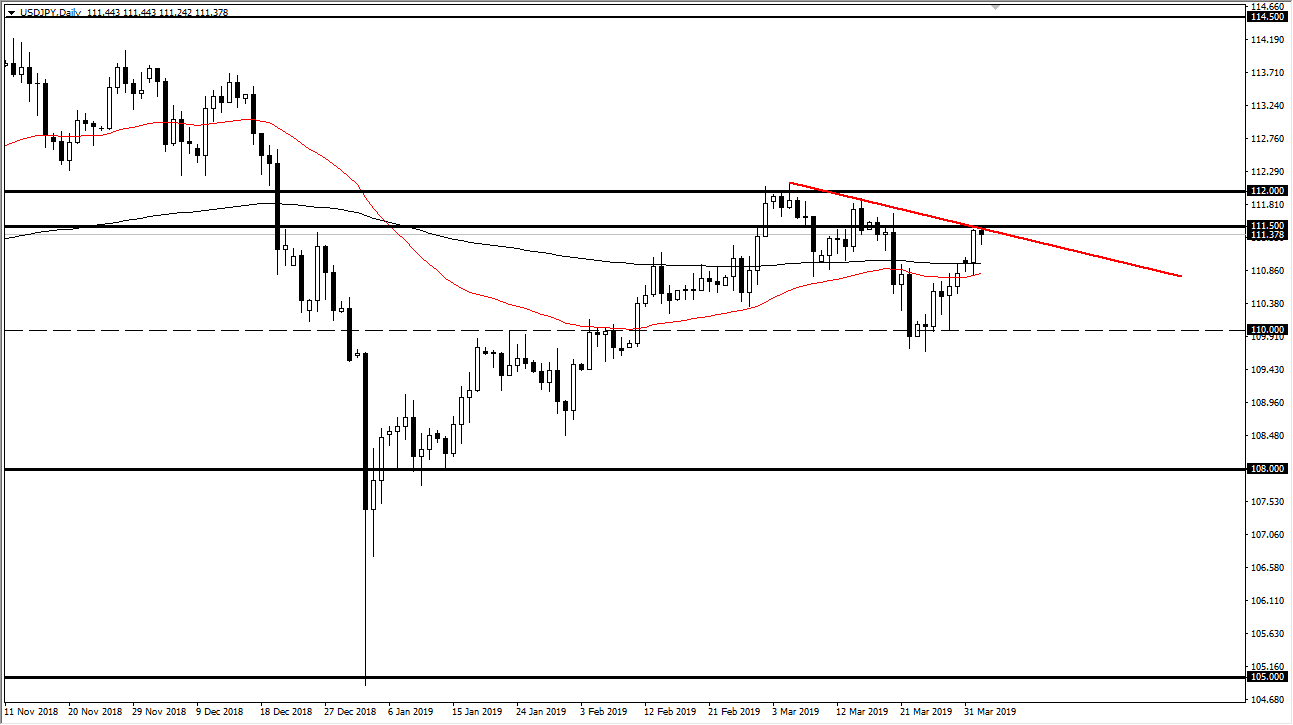

USD/JPY

The US dollar has pulled back slightly against the Japanese yen during trading on Tuesday, as we have seen massive amounts of US dollar strength against most currencies. That being said, there is a significant resistance barrier just above that extends all the way to the ¥112 level. We have a minor downtrend line that the market also seems to be paying attention to as well.

If we break down below the bottom of the candle stick for the Tuesday session, it suddenly turns into a “hanging man.” However, if we break higher then above the ¥112 level I believe that the buyers will come in and try to push as high as the ¥113.50 level. That being said, the downside move could go to ¥110.50.

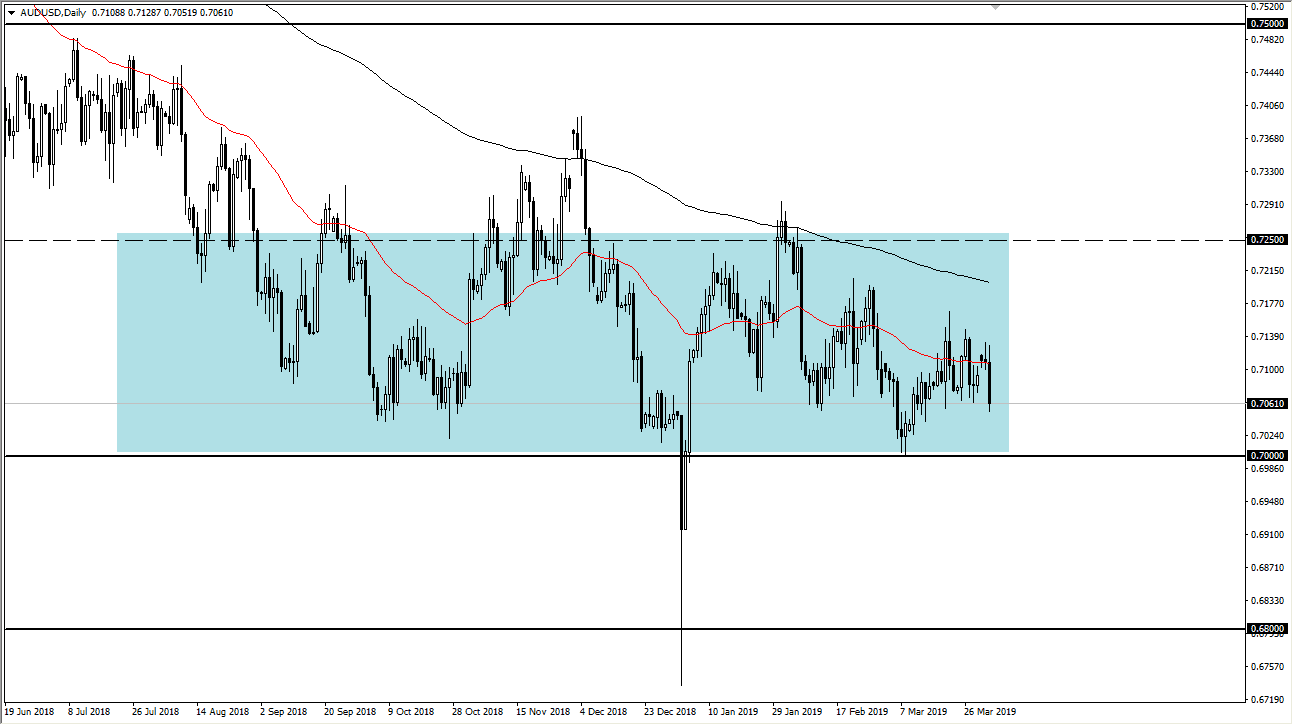

AUD/USD

The Aussie fell a bit during the trading session during the day on Tuesday, as we continue to see a lot of noise when it comes to the US/China trade situation. Beyond that, the Australian housing market is in trouble, so with a soft RBA, that is a formula for a week Australian dollar. However, the 0.70 level underneath is massive support, so would of course makes sense that the Aussie may go back to test it again. That level appears on the monthly charts, so everybody in the world knows it’s there.

Recently, this is a market that’s been one you should be buying on short-term dips and taking small prices. Frankly, I haven’t shorted the Australian dollar in ages, but I haven’t gotten overly excited about owning it either. I simply take what the market gives me, and at this point it’s roughly 20 or 30 pips. Expect choppy volatility, but so far the area below has been extraordinarily reliable.