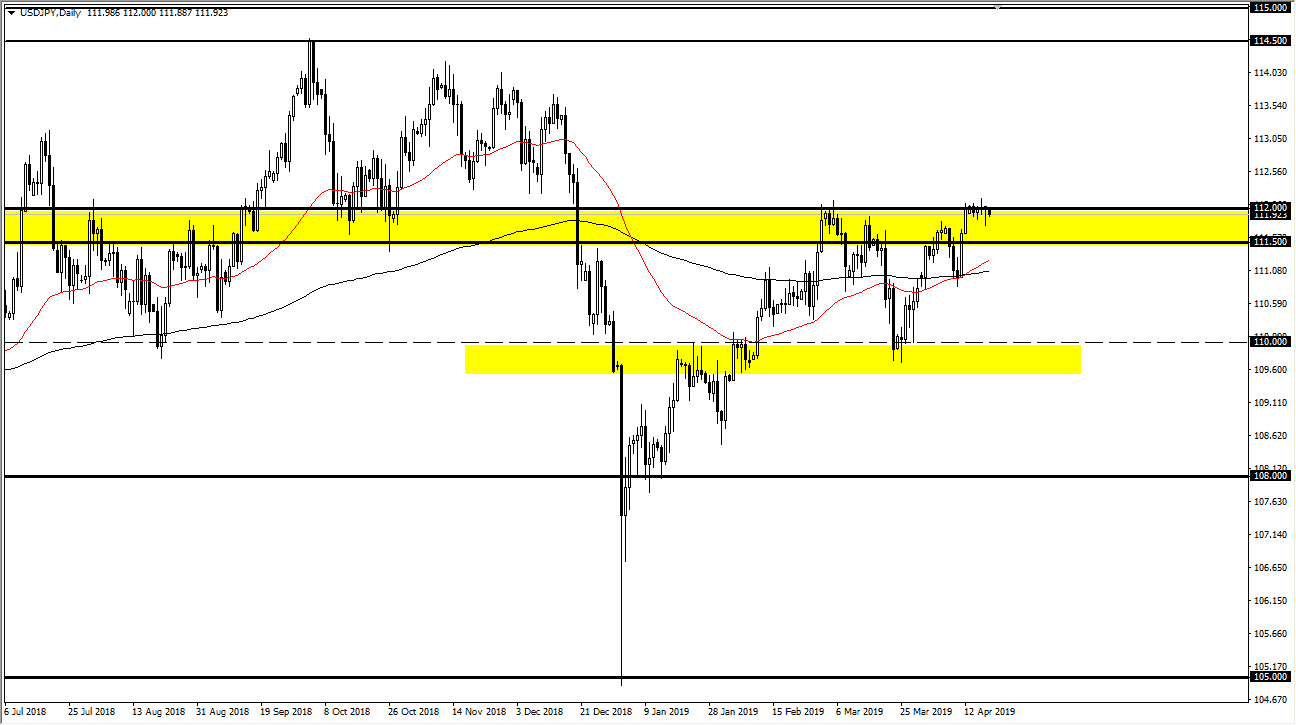

USD/JPY

The US dollar fell a bit against the Japanese yen and then Good Friday trading, but more than that you need to pay attention to the fact that the ¥112 level is crucial. If we can break above the ¥112.25 level on a daily close, then I think the market continues to go much higher, perhaps reaching towards ¥113.50 level. To the downside, I think there is plenty of support down at the 100 level ¥0.50 level, and then perhaps down to the moving averages that I have marked on the chart which are extensively the ¥111 level. Below there, we probably also have an area around the ¥110 level that could offer support and could be another area where the market runs two and then finds buyers. One thing worth paying attention to is that the S&P 500 is banging up against resistance as well, so ultimately this pair is mimicking that. One should lead the other.

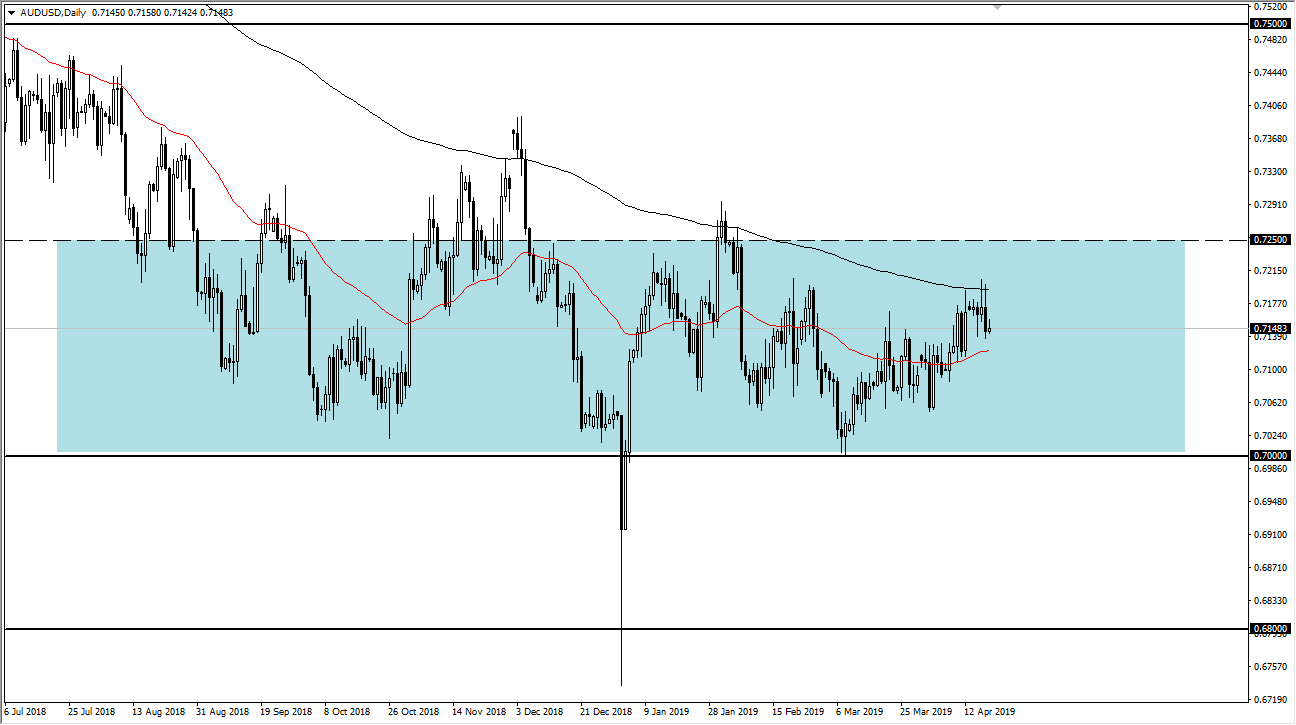

AUD/USD

The Australian dollar tried to rally during the day on Friday, but then pulled back a bit. At this point, it looks very likely that the market will continue to bounce around and perhaps even grind a bit lower, but I think there are plenty of buyers underneath that will continue to pick up the Aussie based upon value, as the massive support and perhaps floor in the market is at the 0.70 level. I like the idea of buying value as it occurs, and it makes sense that the 200 day EMA, pictured in black on the chart, has caused a bit of a pullback. This is short term though, and I think that longer-term traders are starting to accumulate the Aussie for a play on what should be a rebound in Chinese economic conditions.