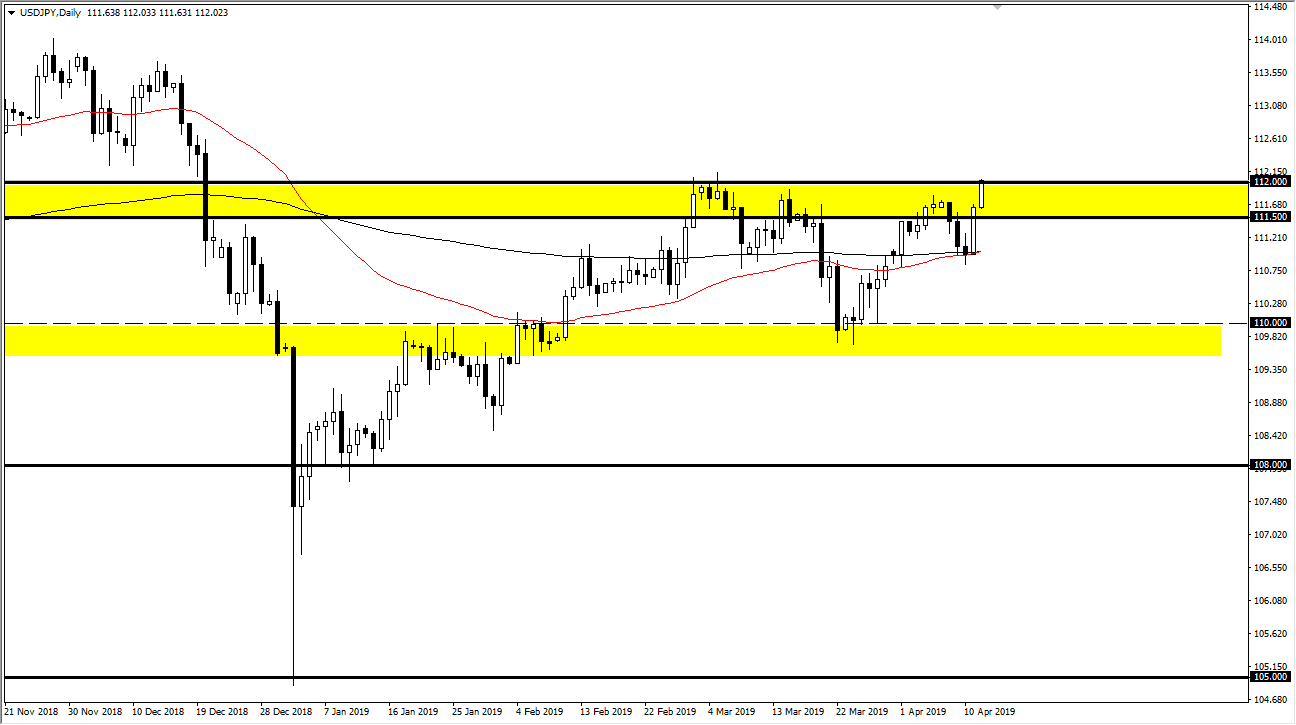

USD/JPY

The US dollar has rallied quite nicely against the Japanese yen during trading on Friday, breaking above the ¥112 level. We are on the verge of a major break out, which makes sense as we have seen the S&P 500 finally cracked the 2900 level in the futures market. That is a good sign that risk appetite will continue to go higher, and typically that will work in the favor of this market. That being said, we could get a short-term pullback but if we can clear the ¥112.15 level, we will have busted through the last vestiges of resistance and should continue to go higher, perhaps looking towards the ¥113.50 level. To the downside, we could drop towards the moving averages but at this point that looks less likely.

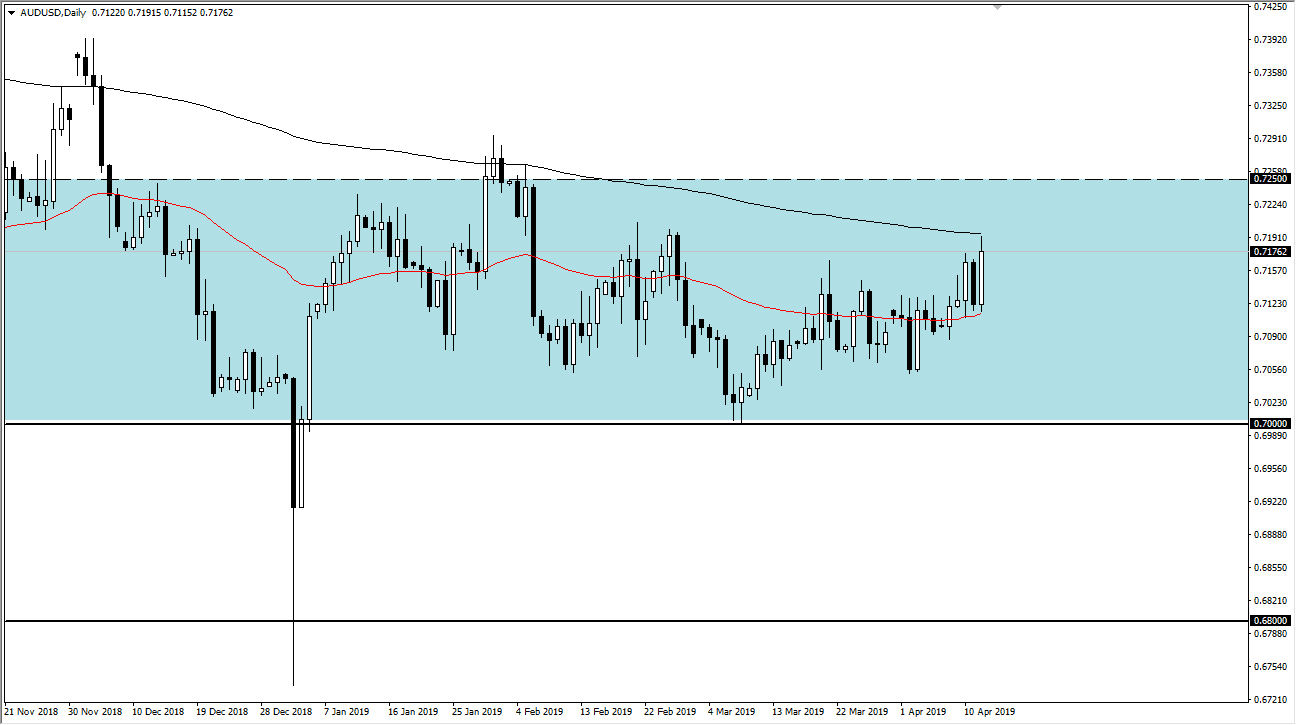

AUD/USD

The Australian dollar had a good trading session on Friday, reaching towards the 200 day EMA. We did pull back a bit from there though, so it makes sense that we would continue to see a lot of choppiness. The 50 day EMA underneath is support, so at this junction I think that we simply go back and forth as we try to figure out where we go next. Overall though, I like buying dips for the longer-term move, as the 0.7050 level is very supportive, assuming we even dropped down through there. Underneath there, we have the 0.70 level, which is massive support on longer-term charts, extending all the way down to the 0.68 level. This is a market that is highly sensitive to the risk appetite around the world and of course the Chinese economic situation. This not until we break down below there that I would be interested in shorting. Short-term pullbacks continue to be opportunities to pick up value.