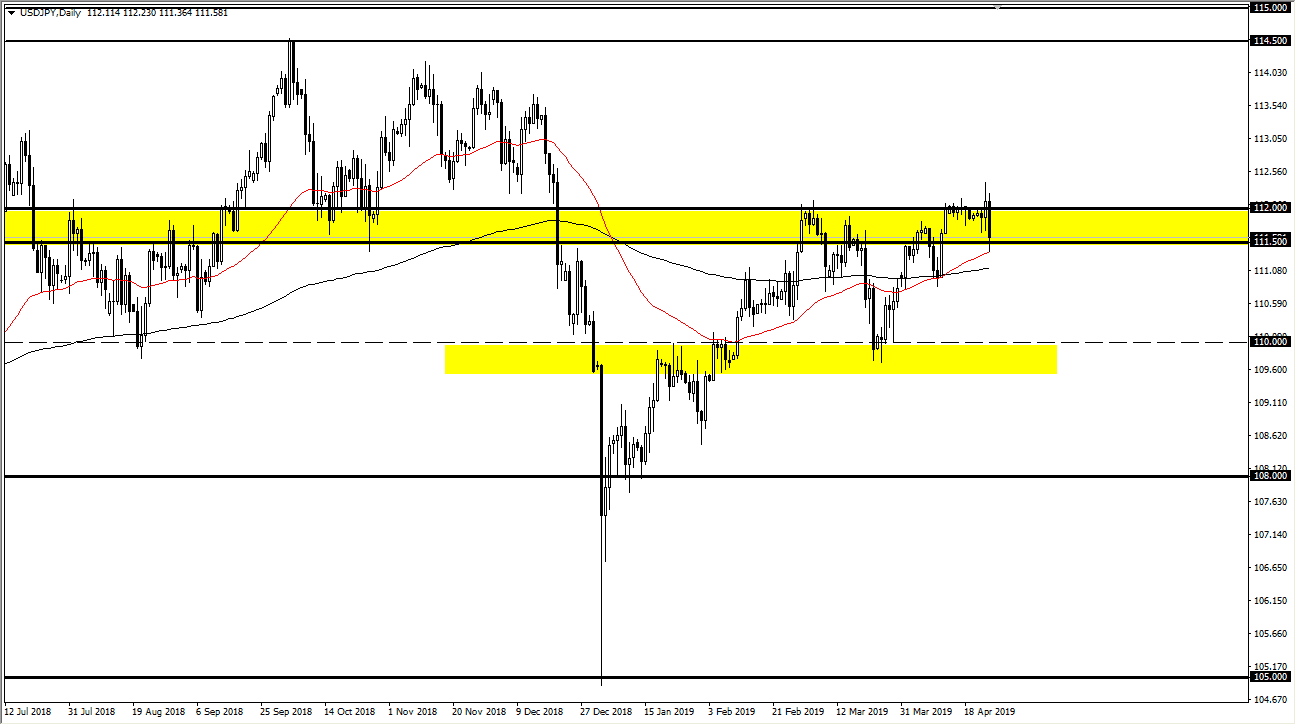

USD/JPY

The US dollar has pulled back a bit during trading on Thursday, reaching down towards the 50 day EMA, an area that should be rather significant support. The ¥111.50 level of course is an area that I’ve been talking about at support as well, so at this point it’s not a huge surprise that we got a bit of a bounce. With that being said, the daily candle stick is rather negative, and at this point we are at an inflection point. All things being equal though, the US dollar is starting to rally a bit against the Japanese yen, so it’s not until we break down below the black 200 day EMA that I would be a seller. Otherwise, if we break above the top of the candle stick from the Wednesday session, that opens the door to the ¥113.50 level. In general, this is a market that has been banging on the door to higher levels, but we need to take a bit of momentum gathering to go higher.

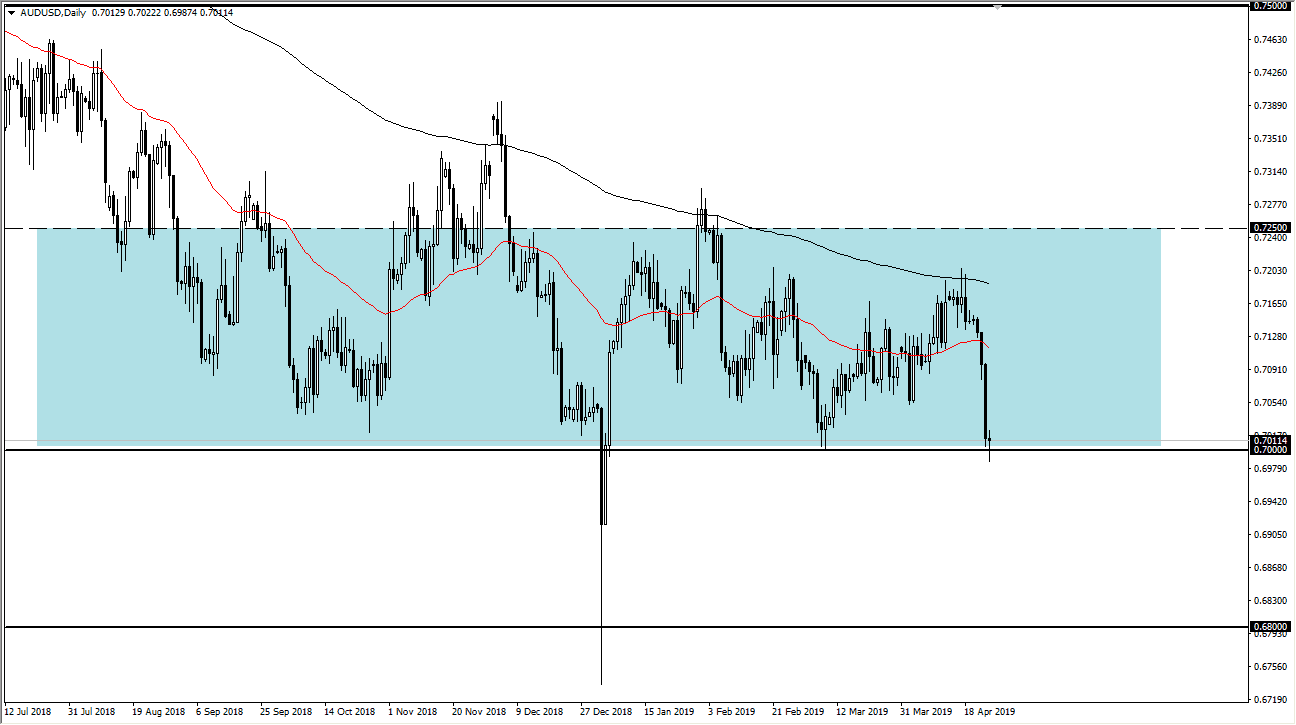

AUD/USD

The Australian dollar fell rather hard during the trading session on Thursday, slicing through the 0.70 level before bouncing significantly. We are forming a bit of a hammer, and that of course is a very bullish sign. If we can break above the top of the candle stick for the day on Thursday, that’s the classic buying signal. The 0.71 level above is the initial target, but I think we could go even higher than that. Alternately, if we break down below the hammer, that would be a very negative sign but at this point there is a major support level that extends down to the 0.68 handle. That’s 200 points worth of buying pressure underneath, so quite frankly I do not want to short this market regardless. Quite frankly, if the US dollar starts to strengthen against other currencies, it’s probably better to trade them, not the Aussie as this is so well supported underneath.