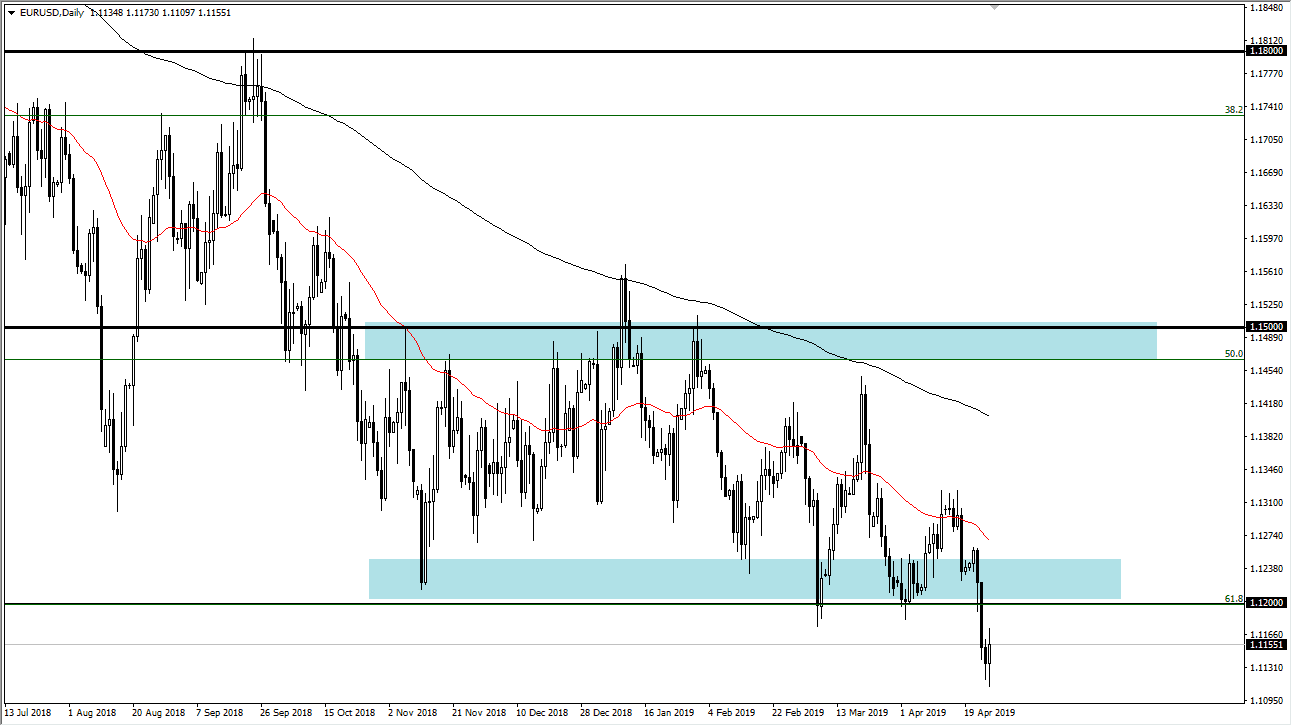

EUR/USD

The Euro broke down initially during the trading session on Friday but found support underneath the turn around and have a relatively decent day. The last couple of candles do look supportive, so it’s very likely that we will probably try to continue to rally from here. However, there is a significant amount of noise to be found near the 1.12 level so I think at the first signs of trouble sellers will jump back into this market place and start shorting again. Keep in mind that the market has recently made a significant break down, so it makes sense that we need to retest that area.

Both central banks are soft right now, but the ECB much more so than the Federal Reserve. There is still the argument to be made for the Federal Reserve to raise interest rates in the future, although nowhere nearby. As opposed to the ECB, which has many issues.

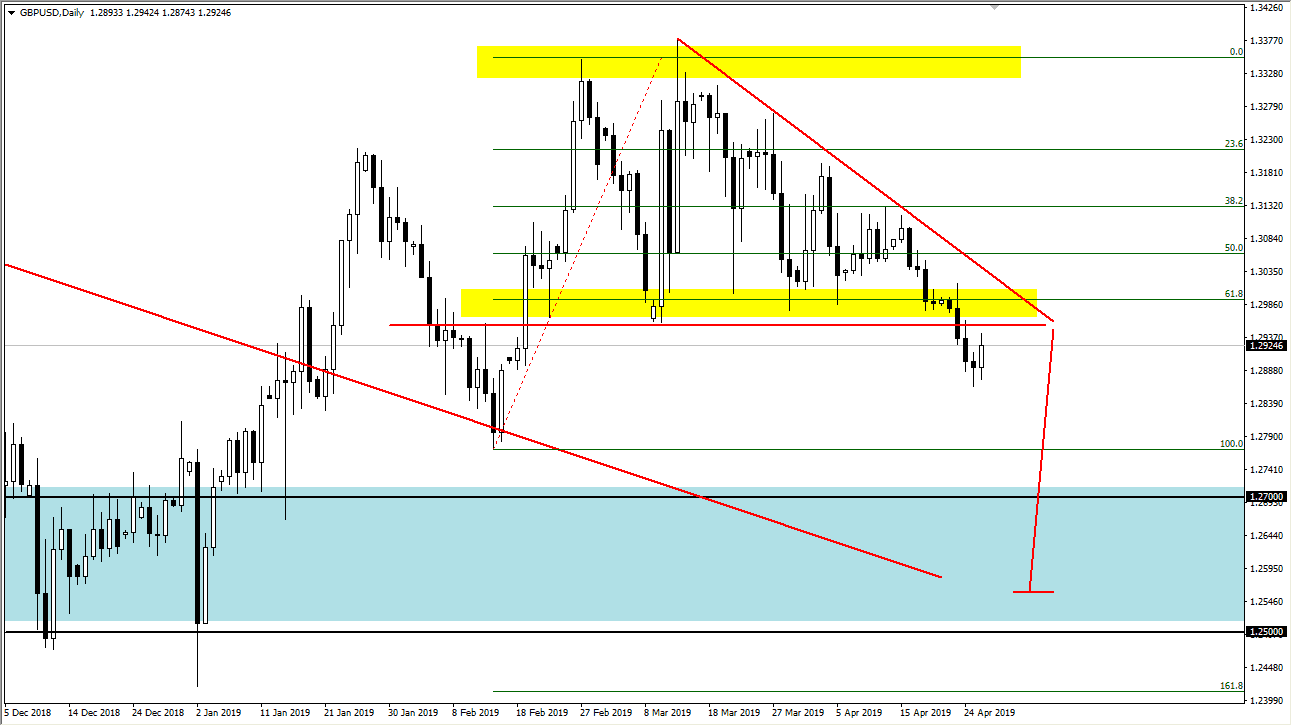

GBP/USD

The British pound initially fell during the trading session on Friday, but then turned around to break above the top of the hammer from the Thursday session. That suggests that we would go higher to reach towards the support level at the 1.30 level, and we did so quite rapidly. While we did not reach quite that high, we did make a serious attempt, and the sellers have come back confirm the descending triangle been broken that I have marked on this chart. Based upon the triangle, we could go down to the 1.26 level, but I also believe that the 1.28 level, which is substantively the 100% Fibonacci retracement level from the move higher. Overall, it looks as if the British pound is going to continue to suffer at the hands of a market that simply doesn’t want to be bothered with the Brexit headlines while we wait for some type of clarity.