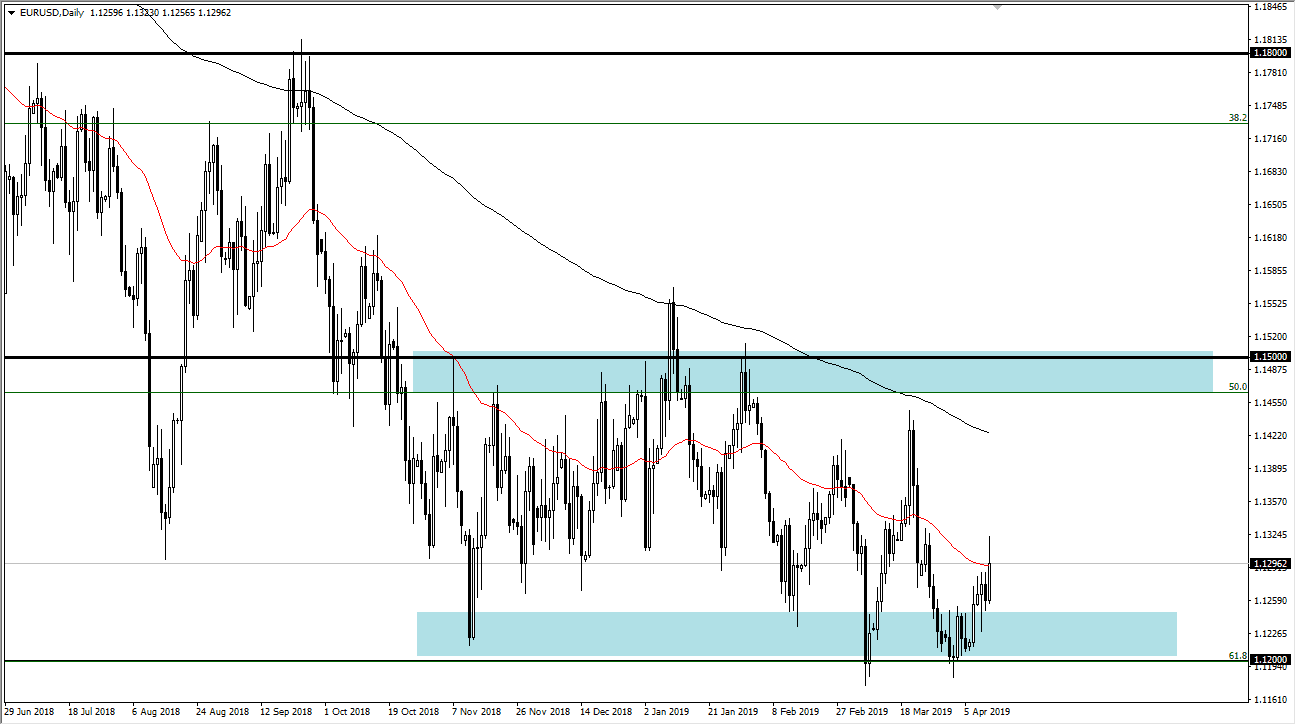

EUR/USD

The Euro rallied significantly during the trading session on Friday, breaking above the 50 day EMA. However, we did pull back just a bit during the later part of the day as it looks like the 50 day EMA is causing a bit of technical selling. Beyond that, of course we would have a lot of risk off trading going into the weekend. However, it’s obvious that we have plenty of demand underneath, especially near the 1.12 level. The market has been consolidating between that area and the 1.15 level, so this is simply a continuation of the overall range that we have been trading through. As we are closer to the bottom of the market range, it makes sense that the risk is to the upside rather than the down. If we break down below the 1.1150 level, then double things break apart

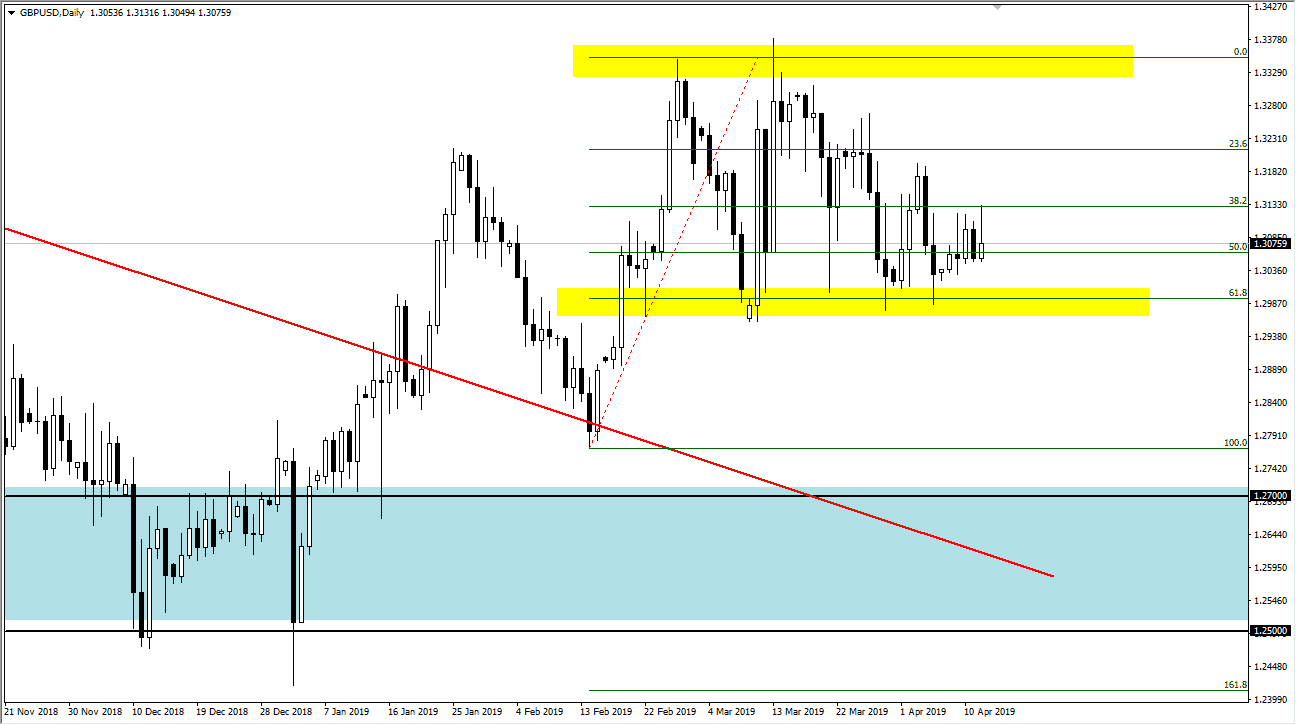

GBP/USD

The British pound rallied during the trading session on Friday, but then gave back quite a bit of the gains. The 1.3133 level caused a bit of resistance just as we had seen over the last several days, so giving back the gains tells you just how choppy and sideways this market is overall. Currently, the market looks as if it is stuck just above the bottom of the range that we have been trading in, between the 1.30 level, and the 1.3350 level above. With all that being said, this is a market that has been making lower highs, so we could very well break down from here and “reset” at the 1.28 level. All things being equal I would probably prefer to stay on the sidelines when it comes to trading this pair.