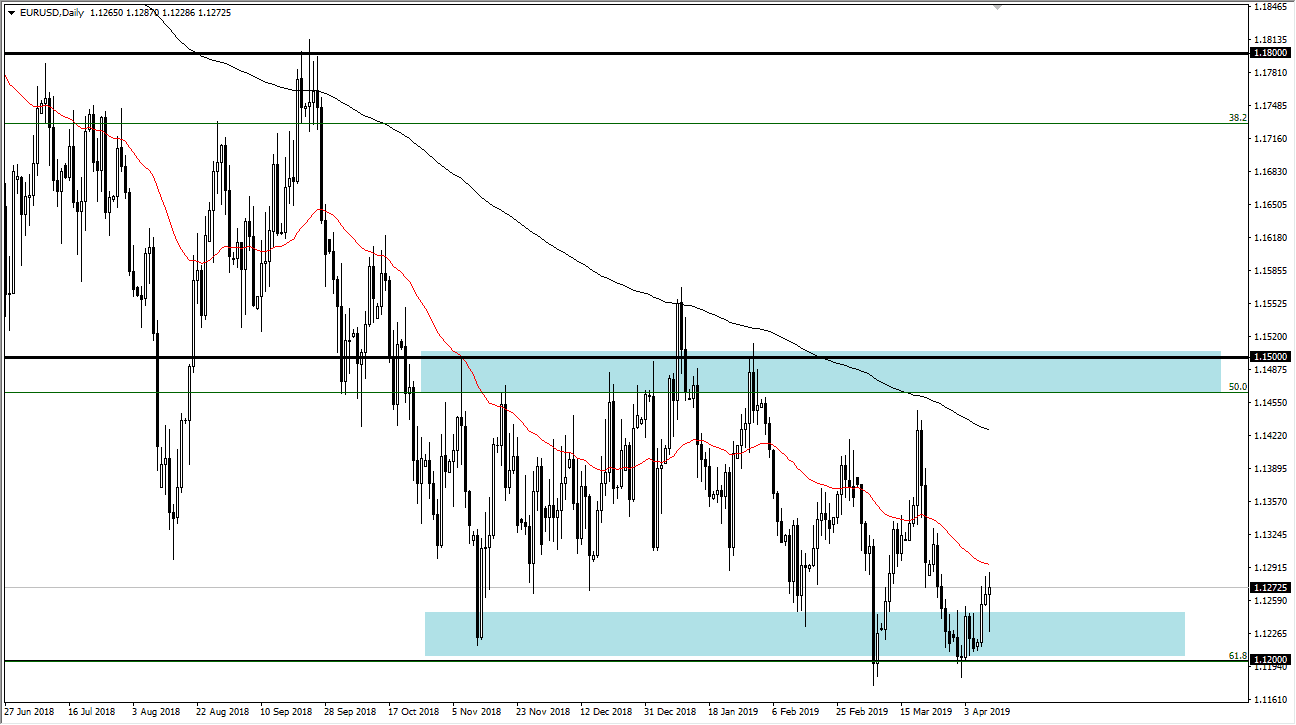

EUR/USD

The Euro initially fell during trading after the ECB press conference, but at the end of the day we started to see technical buying at lower levels just as we have in the past. That being the case, it makes sense that we bounced significantly to form a massive hammer. I believe it’s only a matter time before we break out to the upside in go towards the 1.14 level above. The 200 day EMA is sitting at the same general area, so I would anticipate that we will run into a little bit of trouble at that level.

Just below icy massive support at the 1.12 level still, so it’s not until we break down below the 1.1150 level that I would be concerned about the range. The range looks very significant between the 1.12 level and the 1.15 level above. A simple return to consolidation is what we are looking at.

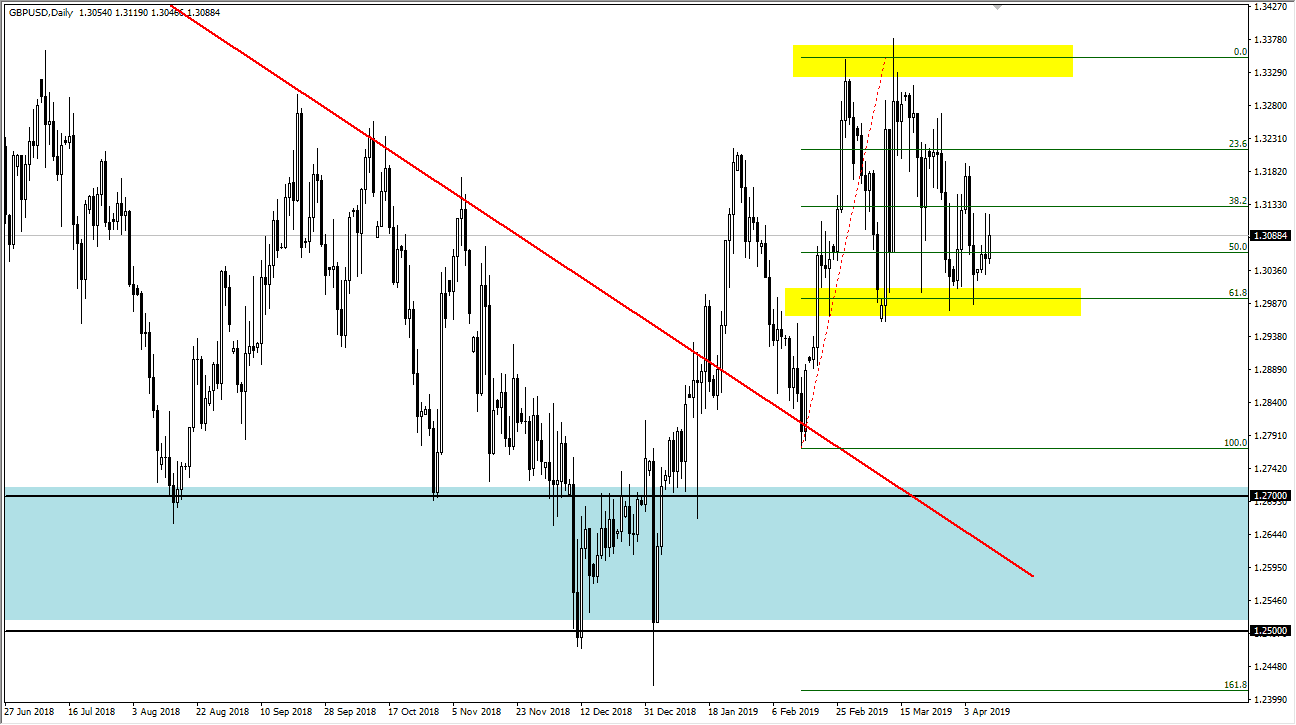

GBP/USD

The British pound rallied significantly during the trading session as the Federal Reserve Meeting Minutes continued the dovish tone for the United States, and therefore it gave a little bit of a lift to other currencies around the world. I don’t think that the British pound is clear yet though, and it is simply a reiteration of the support underneath. The 1.30 level underneath is the beginning of a 50 point range that has held quite nicely. If we were to break down below that level, then we could go down to the 1.28 level where I think we will essentially “reset.” To the upside, I suspect we are going to continue to see a lot of choppy resistance, as we continue to have a lot of Brexit headlines out there to throw things around.