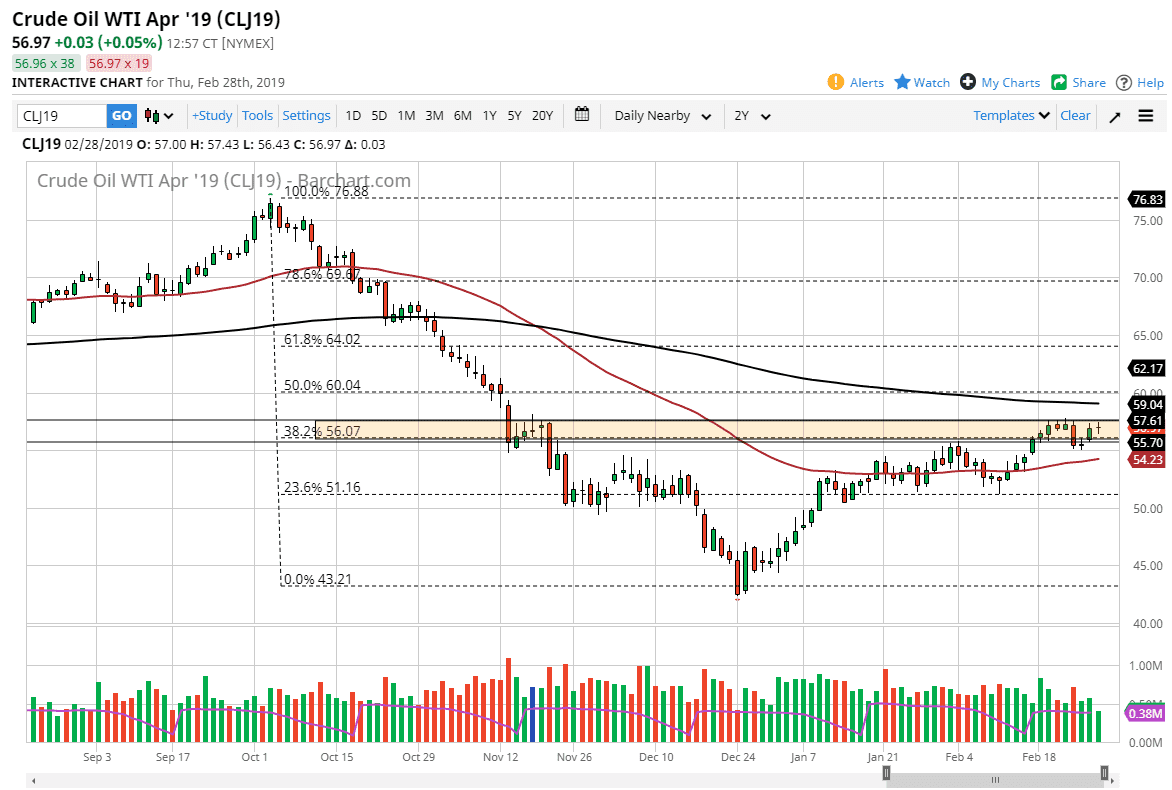

WTI Crude Oil

The crude oil markets continue to look a bit lost, as we are simply bouncing around in a relatively tight range. The $57.75 region seems to be offering significant resistance, just as the $55.50 level seems offer support. As we continue to go back and forth, I think this offers a lot of short-term back and forth range bound type of trading, for those who are willing to trade short-term charts. As for a longer-term move, we need to see some type of impulsive daily candle that breaks out of this range significantly to feel a bit more comfortable about putting serious money to work. The 200 day EMA is just above causing bearish pressure, but at the same time we have the 50 day EMA underneath turning higher to bring buyers into the market.

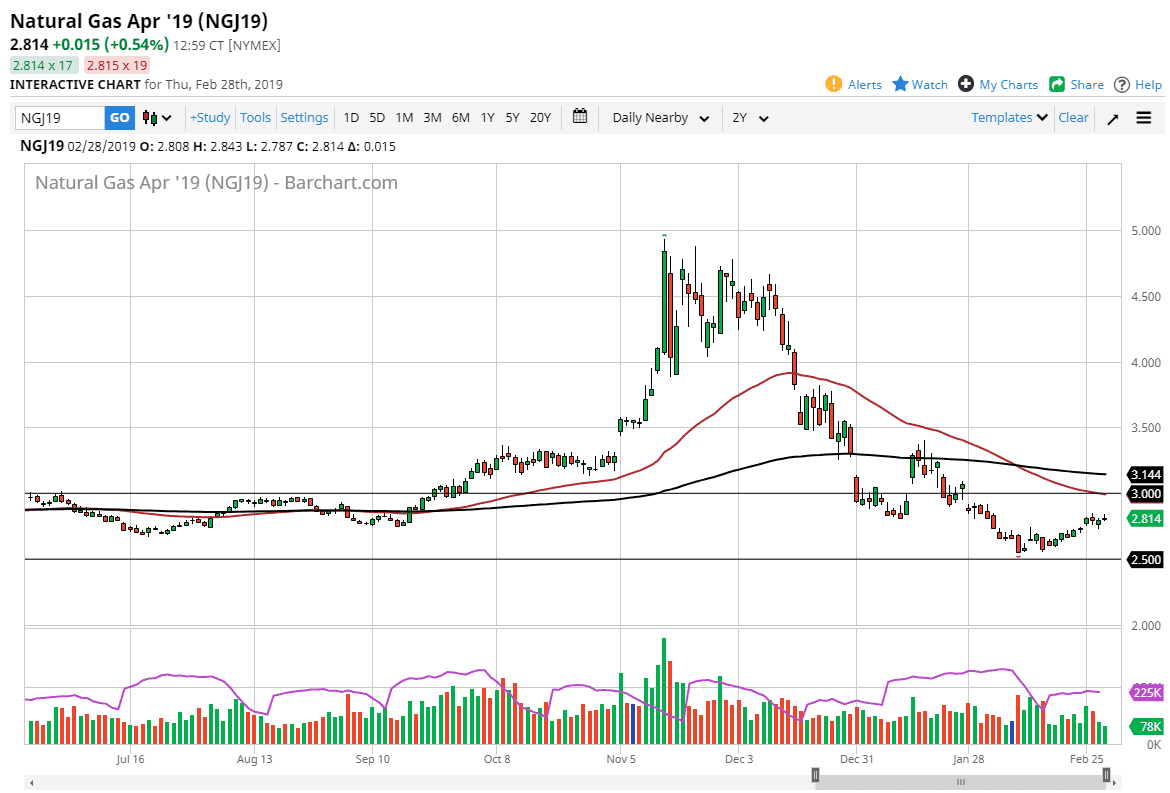

Natural Gas

Natural gas markets initially shot higher during the trading session on Thursday, but the inventory number wasn’t exactly hot. Because of this, we turned around of form a bit of a shooting star but I still don’t want to short this market at this point. We are essentially between two major areas, with the $3.00 level above being massive resistance. There is a gap there that could offer a selling opportunity as well, so as soon as we get to that area I am looking for a reason to start selling. That would simply be some signs of exhaustion that I can take advantage of.

We have the 50 day EMA just above there as well, so that of course helps. Between that and the gap, I would expect to see sellers come back into this market and try to push lower. The $2.50 level underneath is massive support, and therefore I think it’s going to be difficult to break through it.