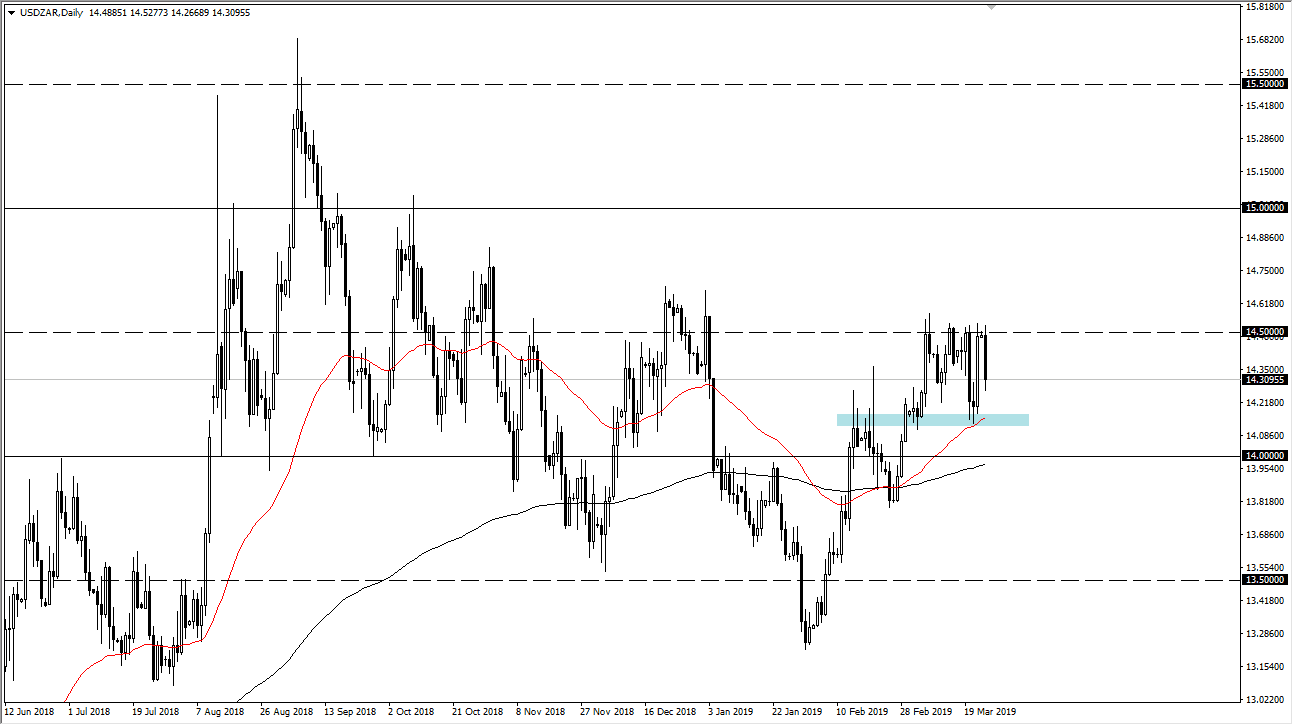

The US dollar fell during trading on Monday as we go back to work from the weekend. The 14.50 Rand area has offered a significant barrier more than once, so the fact that we pull back from here on Monday should not have been much of a surprise. In fact, as we closed there at the end of the Friday session, it suggests that we continue to see massive selling pressure. That’s an area that has proven itself to be important more than once, so therefore we should continue to pay attention to it.

Obviously, if we can break above there it’s likely that we will continue to go much higher, perhaps the 14.75 Rand area, or even the 15.00 Rand area after that. To the downside, I see a significant amount of support near the 14.15 Rand level, an area that is marked by a blue box on the chart and features the 50 day EMA. With all of that going on, it looks as if we continue to consolidate overall, so I’m looking to pick up a dip here for a short-term trade.

If we were to break down below the 50 day EMA, then it’s possible that the 14.00 Rand level would be tested next, but so far the buyers have been very resistant to give up that area. I think at this point what it looks like is a simple consolidation with the idea of building up enough pressure to break out to the upside. This is a major level, in the form of 14.50 Rand, so it may be very difficult to finally break through. If that’s going to be the case, then obviously it’s going to take several attempts. Until we break out of this area, I simply trade the South African Rand back and forth.