The US dollar pulled back initially during trading on Tuesday but turned around of form a nice-looking hammer. We have been grinding higher for some time, which makes sense considering that the world is a bit concerned about global growth, which of course favors the US dollar over emerging market currencies. In fact, the South African Rand has struggled even though gold has taken off to the upside, which perhaps has something to do with fear more than gold markets, because as most of you will know South Africa is a huge exporter of the yellow metal.

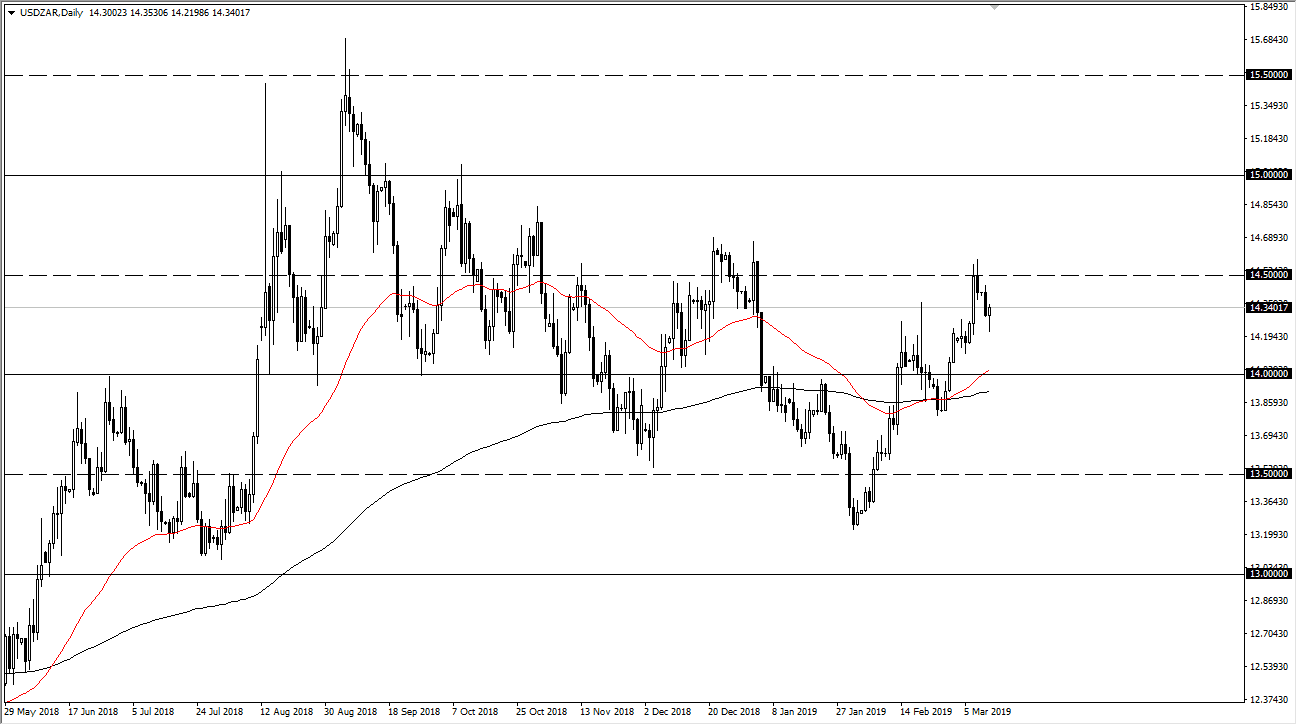

However, the political situation in South Africa isn’t exactly stable, and that has been expressed in this chart. You can see that I have a grid laid out in equal distance, something that this pair tends to follow quite well. We have recently pulled back from the 14.50 Rand level, only to find buyers again. I think at this point we are trying to build up the necessary momentum to break out and reach towards 15 Rand.

Pullbacks at this point should be supported at the 50 day EMA, which is pictured in red on this chart. The 14 Rand level looks to be rather supportive, and therefore I would look at that as the potential “floor” in the market for the short term. However, I do not think that we can reach down towards that area unless we break down below the bottom of the hammer for Tuesday. I suspect that we are more likely to reach towards the 14.50 Rand level, reaching maybe even towards the 14.60 Rand area. Once we clear the 14.65 Rand level, then we should be looking at that previously mentioned move to the 15 handle above. Unless we get some type of serious negativity in the United States, this market is very likely to continue to try to break out.