With the US jobs numbers coming out on Friday, this will obviously be highly influential on where we go next. The Thursday session was obviously very strong as the US dollar got a boost from a softer than expected ECB press conference, which drove the EUR/USD pair lower, and as that is the biggest measure of US dollar strength or weakness, we have course seen the US dollar strength transfer over here against the Mexican peso.

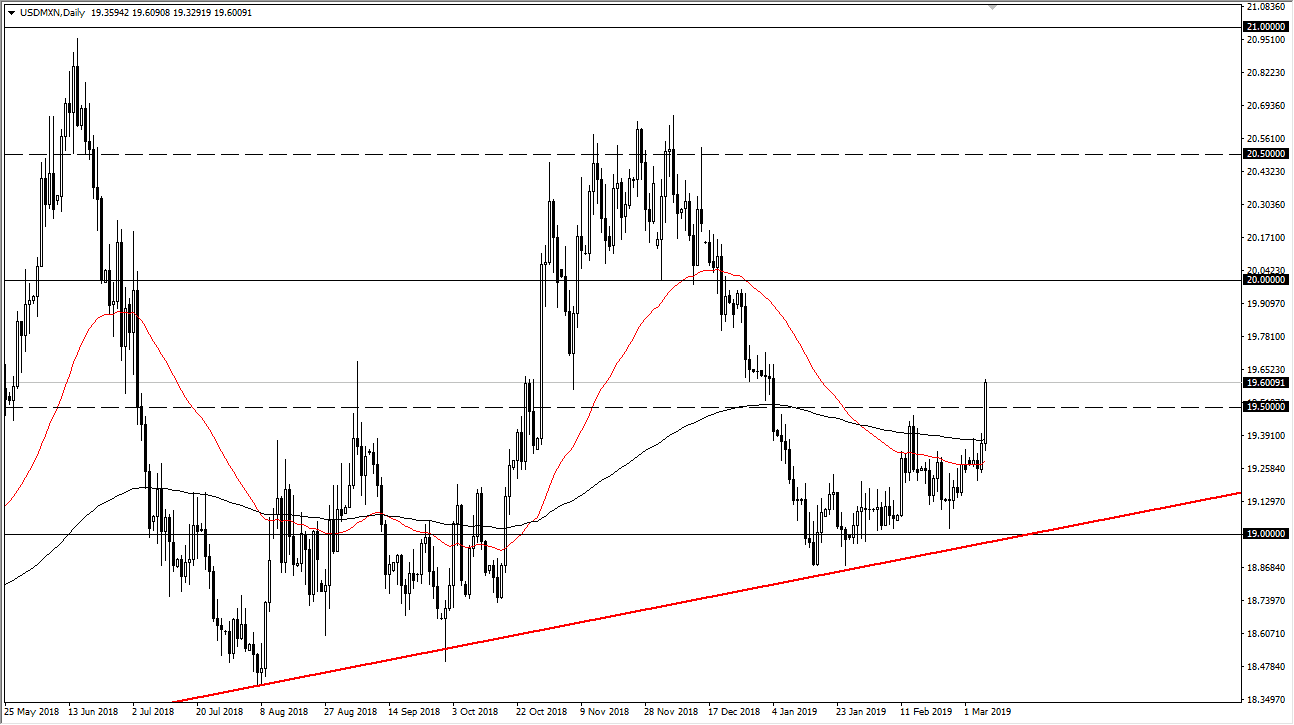

Remember my analysis yesterday, I suggested that the 19.50 pesos level would be crucial and could open the door to the 19.65 level. That’s the next major cluster to overcome, but clearly after this type of move it’s well within reach. With the jobs number coming out on Friday, there’s a really good chance that we will get enough volatility to finally break through there. If we do clear that area, it opens up the door to the 20 pesos level above which is the next major resistance barrier.

Another thing that should be pointed out is that the 200 day EMA was sliced through rather handily during the day, so longer-term traders are going to be looking at this as an opportunity to take a “buy-and-hold” type of situation, so fresh money could be coming soon. You should also keep in mind that the uptrend line underneath has held quite nicely, and now it looks as if the market has made up its mind to go higher.

Keep in mind that the jobs report will throw things around, or more specifically the greenback. If we can stay above the 200 day moving average, it’s very likely that the uptrend will continue even if we do have to pull back slightly to build up the necessary momentum.