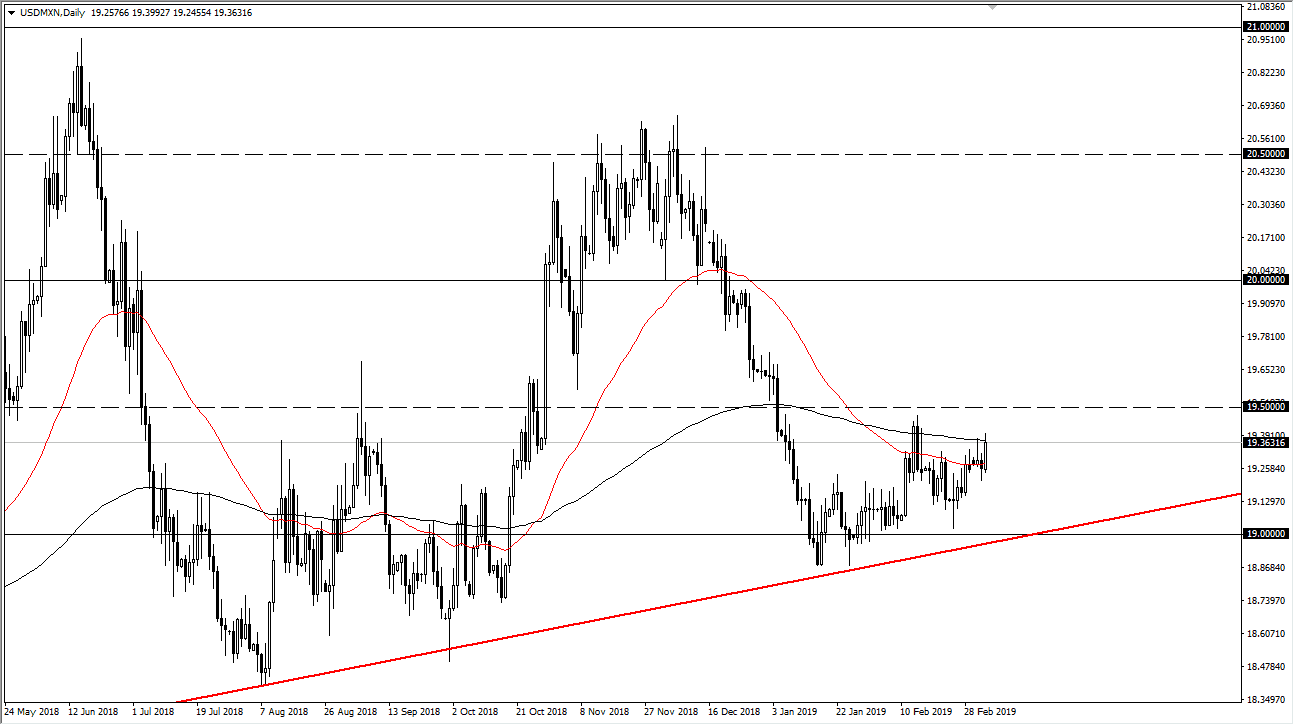

The US dollar rallied against the Mexican peso during trading on Wednesday, reaching towards the vital 200 day EMA. This is an area that coincides with a bit of resistance as of late, so it makes sense that we would run into a little bit of trouble towards the end of the day. Now we have a lot of questions ask, because this is obviously an area where we had seen selling pressure recently. That being said, the next couple of days could be crucial as to where the value of the Mexican peso goes.

Above current levels at the 19.50 peso level, I believe that we have a lot of selling pressure. If we can break above the area, it’s very likely that the US dollar will continue to climb significantly against the peso. Keep in mind that there is a major trendline just below that coincides nicely with the 15 level, so it makes sense that we would see a bit of a pushback overall. That being said, if we rollover I think that we are looking at major support closer to that region. With all of these things going on at the same time, there are two distinct possible scenarios starting to show themselves.

The first one is that we simply break out above the 19.50 pesos level. If we do, the initial move will be to the 19.65 pesos handle, and then to the area just shy of 20 pesos. This of course would probably coincide with some type of concern when it comes to the global economy slowing down, or other such “fear.” Keep in mind that the Mexican peso represents the emerging markets, so if the world start to get a bit nervous about growth, it makes sense that money will go flowing into the US bond market, naturally driving up the value of the greenback.

The second scenario is that we break out to the upside, and that would probably be a rush to find yield and growth in a “risk on” environment. Remember, the interest rate differential between these two currencies is still pretty wide. We have been grinding to the upside, and this is only shown the 19.50 pesos level to be crucial. There may not be a trade right this second, but clearly there are a couple of levels worth paying attention to.